Answered step by step

Verified Expert Solution

Question

1 Approved Answer

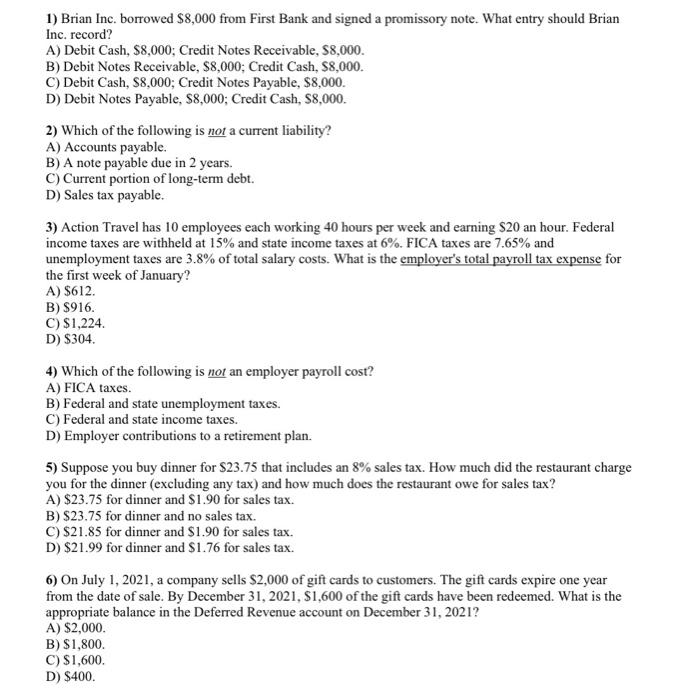

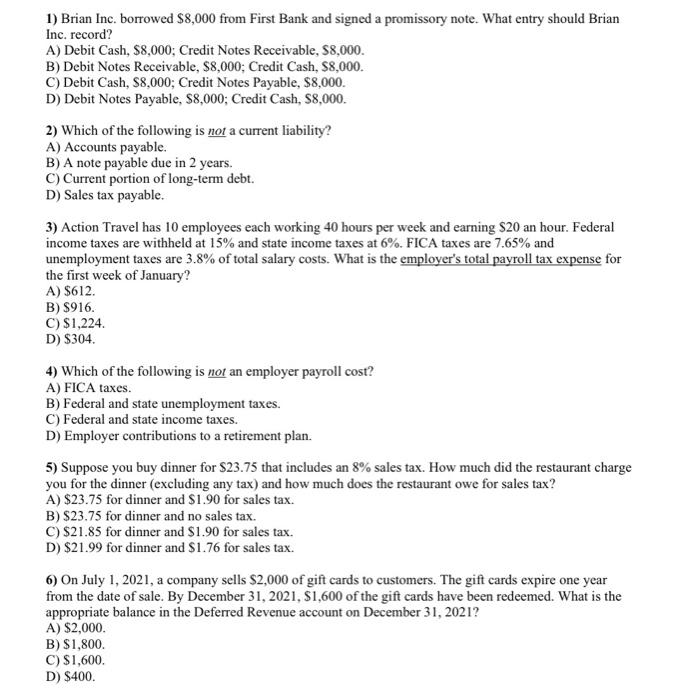

help with numbers 1-6 please 1) Brian Inc. borrowed $8,000 from First Bank and signed a promissory note. What entry should Brian Inc. record? A)

help with numbers 1-6 please

1) Brian Inc. borrowed $8,000 from First Bank and signed a promissory note. What entry should Brian Inc. record? A) Debit Cash, $8,000; Credit Notes Receivable, $8,000. B) Debit Notes Receivable, $8,000; Credit Cash, $8,000. C) Debit Cash, 88,000; Credit Notes Payable, $8,000. D) Debit Notes Payable, $8,000; Credit Cash, 88,000. 2) Which of the following is not a current liability? A) Accounts payable. B) A note payable due in 2 years. C) Current portion of long-term debt. D) Sales tax payable. 3) Action Travel has 10 employees each working 40 hours per week and earning $20 an hour. Federal income taxes are withheld at 15% and state income taxes at 6%. FICA taxes are 7.65% and unemployment taxes are 3.8% of total salary costs. What is the employer's total payroll tax expense for the first week of January? A) $612. B) $916. C) $1,224. D) $304. 4) Which of the following is not an employer payroll cost? A) FICA taxes. B) Federal and state unemployment taxes. C) Federal and state income taxes. D) Employer contributions to a retirement plan. 5) Suppose you buy dinner for $23.75 that includes an 8% sales tax. How much did the restaurant charge you for the dinner (excluding any tax) and how much does the restaurant owe for sales tax? A) $23.75 for dinner and $1.90 for sales tax. B) $23.75 for dinner and no sales tax. C) $21.85 for dinner and $1.90 for sales tax. D) $21.99 for dinner and $1.76 for sales tax. 6) On July 1, 2021, a company sells $2,000 of gift cards to customers. The gift cards expire one year from the date of sale. By December 31, 2021, S1,600 of the gift cards have been redeemed. What is the appropriate balance in the Deferred Revenue account on December 31, 2021? A) $2,000. B) $1,800 C) $1,600 D) $400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started