Answered step by step

Verified Expert Solution

Question

1 Approved Answer

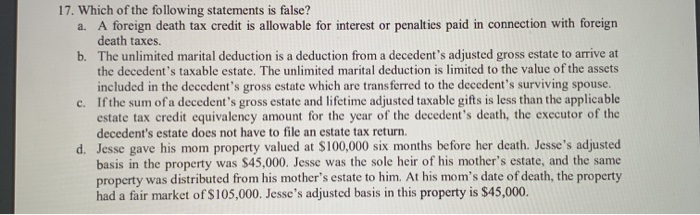

help with one or all would be greatly appreciated!! 17. Which of the following statements is false? a. A foreign death tax credit is allowable

help with one or all would be greatly appreciated!!

17. Which of the following statements is false? a. A foreign death tax credit is allowable for interest or penalties paid in connection with foreign death taxes. b. The unlimited marital deduction is a deduction from a decedent's adjusted gross estate to arrive at the decedent's taxable estate. The unlimited marital deduction is limited to the value of the assets included in the decedent's gross estate which are transferred to the decedent's surviving spouse. c. If the sum of a decedent's gross estate and lifetime adjusted taxable gifts is less than the applicable estate tax credit equivalency amount for the year of the decedent's death, the executor of the decedent's estate does not have to file an estate tax return d. Jesse gave his mom property valued at $100,000 six months before her death. Jesse's adjusted basis in the property was $45,000. Jesse was the sole heir of his mother's estate, and the same property was distributed from his mother's estate to him. At his mom's date of death, the property had a fair market of $105,000. Jesse's adjusted basis in this property is $45,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started