Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 2 Assume the same facts as in part 1 for Carl and Renee Simpson except Carl received $12,000 from an income replacement insurance

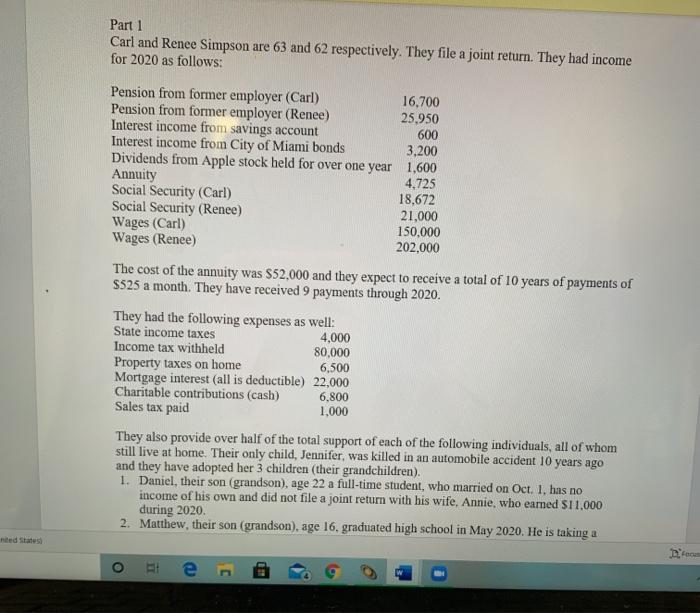

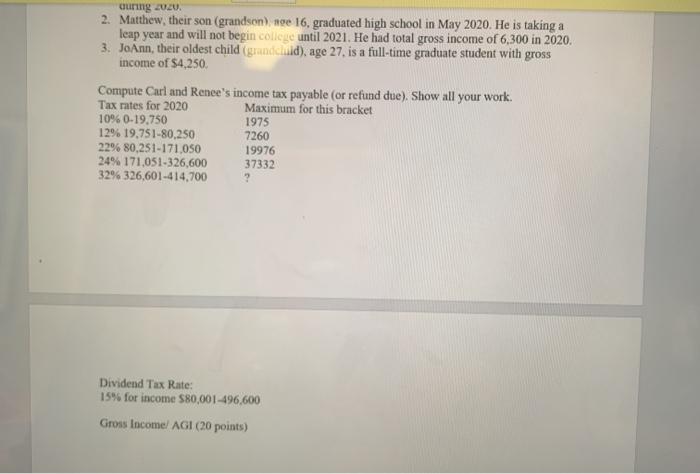

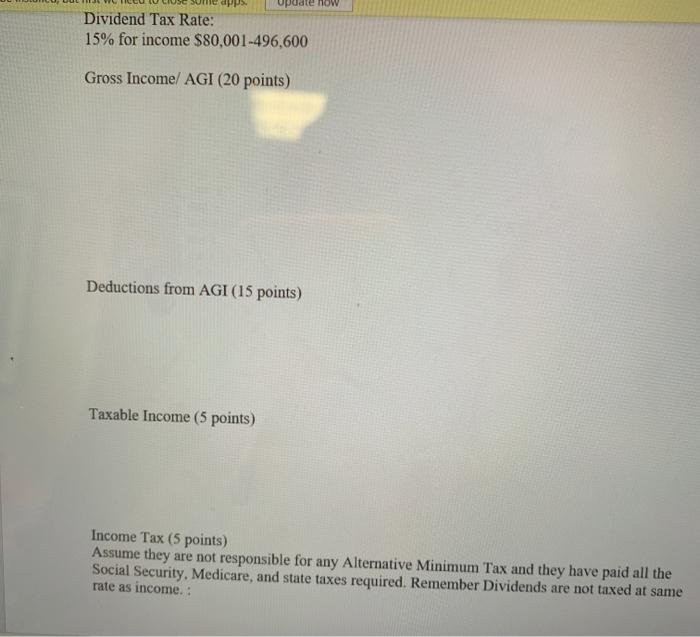

Part 2 Assume the same facts as in part 1 for Carl and Renee Simpson except Carl received $12,000 from an income replacement insurance policy he purchased and 10,000 from an income replacement insurance policy purchased by his employer while he was unable to work because of shoulder surgery. Daniel received a scholarship from State University (gifted student). They still provide over half of Daniel's support. The scholarship provided the following: Tuition and fees 5,000 Housing and meals 4,500. Books and supplies 1,000 Starting in 2010, Carl and Renee have been purchasing Series EE bonds in their name to use for the higher education of their children (grandchildren). During the year they cash in $20,000 of the bonds for Daniel and JoAnn to use for college expenses. Of the amount, $7,500 represents interest. Of the $20,000, $3,000 is used for tuition and fees, 5,500 is used for dormitory fees and the rest is used for meal plans. 1. Determine the effect of the income replacement insurance policies on their gross income. 2. Determine the effect of the scholarship on Daniel's gross income and Renee and Carl's tax return. 3. Determine the tax consequences for Carl and Renee of the Series EE bonds. Show all your work. You just have to tell me this affects the results in Part 1(do not redo that tax return).[ nited States) Part 1 Carl and Renee Simpson are 63 and 62 respectively. They file a joint return. They had income for 2020 as follows: Pension from former employer (Carl) Pension from former employer (Renee) Interest income from savings account Interest income from City of Miami bonds 600 3,200 Dividends from Apple stock held for over one year 1,600 4,725 18,672 21,000 Annuity Social Security (Carl) Social Security (Renee) Wages (Carl) Wages (Renee) They had the following expenses as well: State income taxes The cost of the annuity was $52,000 and they expect to receive a total of 10 years of payments of $525 a month. They have received 9 payments through 2020. Income tax withheld Property taxes on home Mortgage interest (all is deductible) Charitable contributions (cash) Sales tax paid O 16,700 25,950 4,000 80,000 El en 6,500 22,000 6,800 1,000 150,000 202,000 They also provide over half of the total support of each of the following individuals, all of whom still live at home. Their only child, Jennifer, was killed in an automobile accident 10 years ago and they have adopted her 3 children (their grandchildren). 1. Daniel, their son (grandson), age 22 a full-time student, who married on Oct. 1, has no income of his own and did not file a joint return with his wife, Annie, who earned $11,000 during 2020. 2. Matthew, their son (grandson), age 16, graduated high school in May 2020. He is taking a T Focus during 2020. 2. Matthew, their son (grandson), nee 16, graduated high school in May 2020. He is taking a leap year and will not begin college until 2021. He had total gross income of 6,300 in 2020. 3. JoAnn, their oldest child (grandchild), age 27, is a full-time graduate student with gross income of $4,250. Maximum for this bracket Compute Carl and Renee's income tax payable (or refund due). Show all your work. Tax rates for 2020 10% 0-19,750 12% 19,751-80,250 22% 80,251-171,050 24% 171,051-326,600 32% 326,601-414,700 1975 7260 19976 37332 ? Dividend Tax Rate: 15% for income $80,001-496,600 Gross Income! AGI (20 points) Dividend Tax Rate: 15% for income $80,001-496,600 Gross Income/ AGI (20 points) Deductions from AGI (15 points) Taxable Income (5 points) now Income Tax (5 points) Assume they are not responsible for any Alternative Minimum Tax and they have paid all the Social Security, Medicare, and state taxes required. Remember Dividends are not taxed at same rate as income. : Tax Credits (Remember phase-outs for credits.): (5 points) Withholding: Refund or Tax Payable: (5 points)

Step by Step Solution

★★★★★

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To determine the effect of the income replacement insurance policies on Carl and Renee Simpsons gross income Carl received 12000 from an income replac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started