Help with Q 14

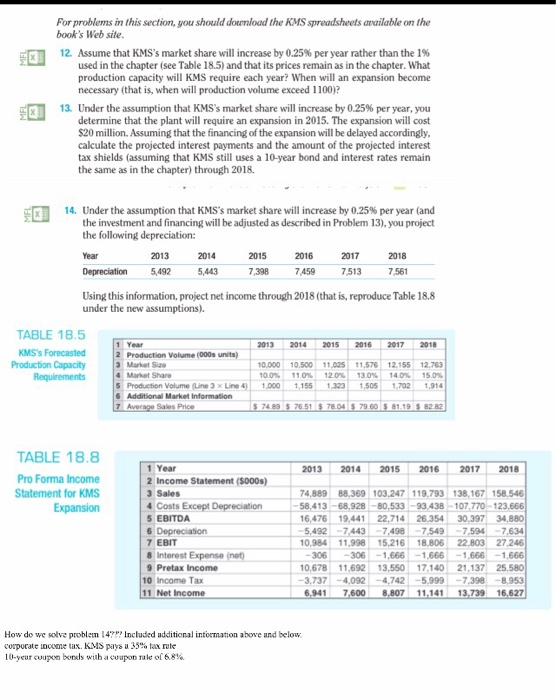

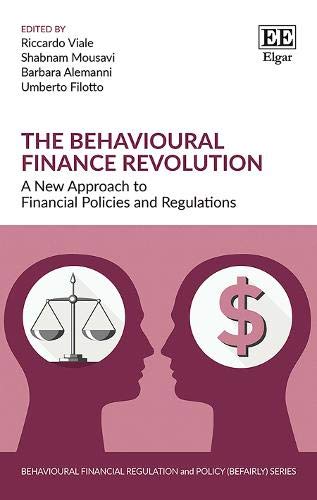

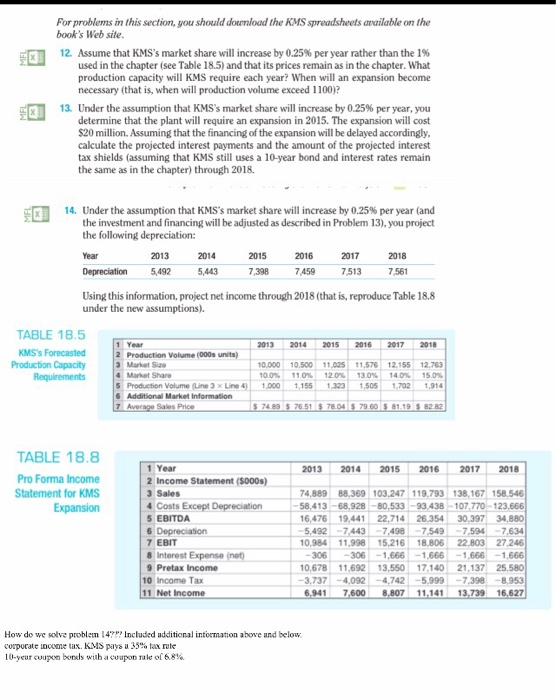

For problems in this section, you should donload the KMS spreadsheets available on the book's Web site 12. Assume that KMS's market share will increase by 0.25% per year rather than the 1% used in the chapter (see Table 18.5) and that its prices remain as in the chapter. What production capacity will KMS require each year? When will an expansion become necessary (that is, when will production volume exceed 1100)? 13. Under the assumption that KMS's market share will increase by 0.25% per year, you determine that the plant will require an expansion in 2015. The expansion will cost $20 million. Assuming that the financing of the expansion will be delayed accordingly calculate the projected interest payments and the amount of the projected interest tax shields (assuming that KMS still uses a 10-year bond and interest rates remain the same as in the chapter) through 2018. 14. Under the assumption that KMS's market share will increase by 0.25% per year (and the investment and financing will be adjusted as described in Problem 13), you project the following depreciation: Year 2013 2014 2015 2017 2018 Depreciation 5,492 5,443 398 7459 7.53 7,561 Using this information, project net income through 2018 (that is, reproduce Table 18.8 under the new assumptions). TABLE 18.5 KMS's Forecasted Production Capacity 2013 2014 2015 2016 2017 2018 2 Production Volume (000s units) 3 Market Size 0000 10.500 11.025 11,576 12.155 12,763 100% 110% 120% 130% 140% 150% 155 ,505 1,702 1.914 Additional Market Information TABLE 18.8 Pro Forma Income Statement for KMS 1 Year 2 Income Statement ($000s) 3 Sales 4 Costs Except Depreciation 5 EBITDA 2013 2014 2015 2016 2017 2018 4,889 88.369 103,247 119.793 138.167 158.546 58,413-68,928-80,533-93438-107,770-123,666 16,476 19,441 22,714 26.34 30,397 34.88 5,492 -7.443 7498 -7549 7,594 7634 0,984 11,998 15,21618.806 22,803 27,246 306-1,666-1,6661,666-1,666 0,678 11,69213,55017.140 21,137 25,580 3,737 -4,092-4,742-5.999-7.398-8.953 627 EBIT 8 Interest Expense( 9 Pretax Income 10 Income Tax Net Income 941 7 11.14113.739 How do we solve problem 14? Included additional intormation above and below corporate income tax. KMS pays 35% tax rate 10-year coupon bonds wub a coupon rule of 68 For problems in this section, you should donload the KMS spreadsheets available on the book's Web site 12. Assume that KMS's market share will increase by 0.25% per year rather than the 1% used in the chapter (see Table 18.5) and that its prices remain as in the chapter. What production capacity will KMS require each year? When will an expansion become necessary (that is, when will production volume exceed 1100)? 13. Under the assumption that KMS's market share will increase by 0.25% per year, you determine that the plant will require an expansion in 2015. The expansion will cost $20 million. Assuming that the financing of the expansion will be delayed accordingly calculate the projected interest payments and the amount of the projected interest tax shields (assuming that KMS still uses a 10-year bond and interest rates remain the same as in the chapter) through 2018. 14. Under the assumption that KMS's market share will increase by 0.25% per year (and the investment and financing will be adjusted as described in Problem 13), you project the following depreciation: Year 2013 2014 2015 2017 2018 Depreciation 5,492 5,443 398 7459 7.53 7,561 Using this information, project net income through 2018 (that is, reproduce Table 18.8 under the new assumptions). TABLE 18.5 KMS's Forecasted Production Capacity 2013 2014 2015 2016 2017 2018 2 Production Volume (000s units) 3 Market Size 0000 10.500 11.025 11,576 12.155 12,763 100% 110% 120% 130% 140% 150% 155 ,505 1,702 1.914 Additional Market Information TABLE 18.8 Pro Forma Income Statement for KMS 1 Year 2 Income Statement ($000s) 3 Sales 4 Costs Except Depreciation 5 EBITDA 2013 2014 2015 2016 2017 2018 4,889 88.369 103,247 119.793 138.167 158.546 58,413-68,928-80,533-93438-107,770-123,666 16,476 19,441 22,714 26.34 30,397 34.88 5,492 -7.443 7498 -7549 7,594 7634 0,984 11,998 15,21618.806 22,803 27,246 306-1,666-1,6661,666-1,666 0,678 11,69213,55017.140 21,137 25,580 3,737 -4,092-4,742-5.999-7.398-8.953 627 EBIT 8 Interest Expense( 9 Pretax Income 10 Income Tax Net Income 941 7 11.14113.739 How do we solve problem 14? Included additional intormation above and below corporate income tax. KMS pays 35% tax rate 10-year coupon bonds wub a coupon rule of 68