help with question #13 part 3

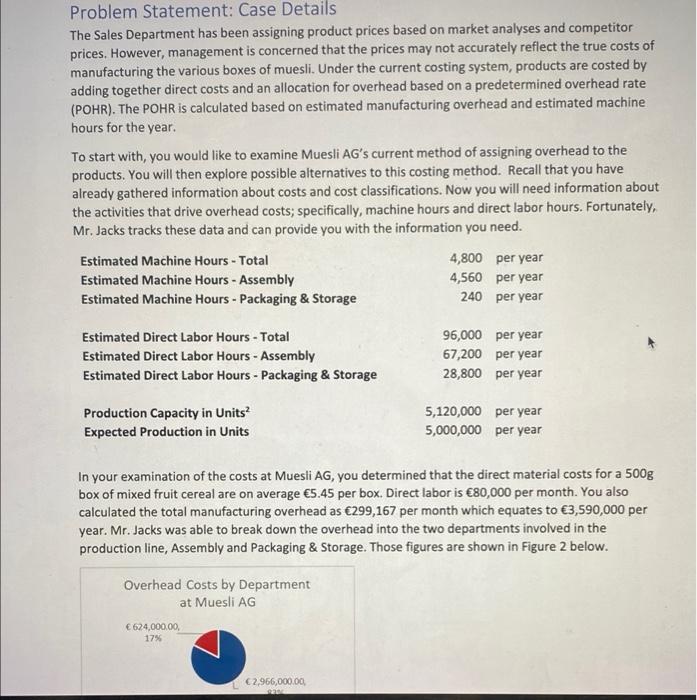

Introduction As you continue to learn about your new company, Muesli AG, you decide that a visit to the production line will be the best way to understand how it operates. Mr. Jacks, the production manager volunteers to take you on a tour of the facilities. "Muesli AG produces muesli on a single production line and can only make one product at a time. This line can operate 24 hours a day, and the number of boxes that can be made per hour depends on how many machines and which models are installed. The staff working the assembly line will process production orders in the sequence that they were released by the production controller. Whenever a new production order is started for a different product than the one before, the machines must be reconfigured and an allergen cleanup is required, which takes several hours. GOODS MANUFACTURING Figure 1: The Production Line at Muesli AG "I understand that one of the mandates you have been given is to evaluate our installed machinery and equipment" says Mr. Jack. "We can purchase extra processing units or upgrade existing ones to increase our throughput. The machines are very expensive though. We can also hire consultants to evaluate our workflow and factory layout. They can make recommendations for our work practices and machine place- ment that can improve our efficiency, reducing the number of hours it takes to change over production runs. Before that however, you should consider the length of our production runs. If we don't make too many products and run the production lines for several days each time we produce a product, then we will only do changeovers once or twice a week. I've been trying to get the sales team to understand this, but they fear losing sales if we don't have the right products available for sale at any given moment." A critical strategic decision is how long to make production campaigns. A campaign corresponds to a series of consecutive production orders of the same product. Long production campaigns will reduce the average setup time (there is no setup time between production orders of the same product). On the other hand, producing in small campaigns will allow a wider offering to the customer but reduce total output because of the capacity lost to machine setup. Finding the right balance between small production campaigns that allow you to respond to changing markets and long production campaigns that increase productivity is a key element of the game." 1 Problem Statement: Case Details The Sales Department has been assigning product prices based on market analyses and competitor prices. However, management is concerned that the prices may not accurately reflect the true costs of manufacturing the various boxes of muesli. Under the current costing system, products are costed by adding together direct costs and an allocation for overhead based on a predetermined overhead rate (POHR). The POHR is calculated based on estimated manufacturing overhead and estimated machine hours for the year. To start with, you would like to examine Muesli AG's current method of assigning overhead to the products. You will then explore possible alternatives to this costing method. Recall that you have already gathered information about costs and cost classifications. Now you will need information about the activities that drive overhead costs; specifically, machine hours and direct labor hours. Fortunately, Mr. Jacks tracks these data and can provide you with the information you need. Estimated Machine Hours - Total 4,800 per year per year Estimated Machine Hours - Assembly 4,560 Estimated Machine Hours - Packaging & Storage 240 per year Estimated Direct Labor Hours - Total 96,000 per year Estimated Direct Labor Hours - Assembly 67,200 per year Estimated Direct Labor Hours - Packaging & Storage 28,800 per year Production Capacity in Units 5,120,000 per year Expected Production in Units 5,000,000 per year In your examination of the costs at Muesli AG, you determined that the direct material costs for a 500g box of mixed fruit cereal are on average 5.45 per box. Direct labor is 80,000 per month. You also calculated the total manufacturing overhead as 299,167 per month which equates to 3,590,000 per year. Mr. Jacks was able to break down the overhead into the two departments involved in the production line, Assembly and Packaging & Storage. Those figures are shown in Figure 2 below. Overhead Costs by Department at Muesli AG 624,000.00, 17% 2,966,000.00, 935 There are 240 production days in the year. Full capacity at Muesli AG means that the company will produce 24,000 units each day for two days and then shut down for 8 hours to clean the machines and set them up for the next batch of muesli. The management at Muesli AG recognizes that they have not been able to operate at full capacity in prior time periods and have adjusted the estimated production numbers accordingly. The expected production is 5,000,000 boxes of muesli. Instructions: Using the information from the case study and the details above, explore overhead allocation by completing the following calculations. An Excel worksheet is provided for you to complete your analysis. Use formulas and link to cells in the worksheet. Other information: All currency amounts are in euros. A "production campaign" is Muesli AG's equivalent to a job order. Part 1 1. Muesli AG allocates manufacturing overhead costs based on machine hours (MH) and a single plantwide POHR. Calculate the predetermined overhead rate per MH. 2. Calculate the total cost of each production campaign (job): Q1-210308, Q2-210401, and Q2- 210402, using the plantwide POHR per MH. 3. Using this allocation method, calculate the average cost per unit for each production campaign. In other words, how much did it cost to manufacture one box of muesli for each of these production campaigns if Muesli AG uses machine hours as an allocation base? 4. If Muesli AG were to allocate manufacturing overhead costs based on direct labor hours (DLH), what would be the plantwide POHR? 5. Calculate the total cost of each production campaign (job): Q1-210308, Q2-210401, and Q2- 210402, using the plantwide POHR per DLH. 6. Using this allocation method, calculate the average cost per unit for each production campaign. In other words, how much did it cost to manufacture one box of muesli for each of these production campaigns if Muesli AG uses direct labor hours as an allocation base? Part 2 Assume now that Muesli AG will use departmental overhead rates. 7. Calculate the POHR based on MH for the assembly department. 8. Calculate the POHR based on DLH for the packaging department. 9. Calculate the total cost of each production campaign (job): Q1-210308, Q2-210401, and Q2- 210402, using the departmental overhead rates. 10. Using this allocation method, calculate the average cost per unit for each production campaign. In other words, how much did it cost to manufacture one box of muesli for each of these Using the information from the case study and the details above, explore overhead allocation by completing the following calculations. An Excel worksheet is provided for you to complete your analysis. Use formulas and link to cells in the worksheet. Other information: All currency amounts are in euros. A "production campaign" is Muesli AG's equivalent to a job order. Part 1 1. Muesli AG allocates manufacturing overhead costs based on machine hours (MH) and a single plantwide POHR. Calculate the predetermined overhead rate per MH. 2. Calculate the total cost of each production campaign (job): Q1-210308, Q2-210401, and Q2- 210402, using the plantwide POHR per MH. 3. Using this allocation method, calculate the average cost per unit for each production campaign. In other words, how much did it cost to manufacture one box of muesli for each of these production campaigns if Muesli AG uses machine hours as an allocation base? 4. If Muesli AG were to allocate manufacturing overhead costs based on direct labor hours (DLH), what would be the plantwide POHR? 5. Calculate the total cost of each production campaign (job): Q1-210308, Q2-210401, and Q2- 210402, using the plantwide POHR per DLH. 6. Using this allocation method, calculate the average cost per unit for each production campaign. In other words, how much did it cost to manufacture one box of muesli for each of these production campaigns if Muesli AG uses direct labor hours as an allocation base? Part 2 Assume now that Muesli AG will use departmental overhead rates. 7. Calculate the POHR based on MH for the assembly department. 8. Calculate the POHR based on DLH for the packaging department. 9. Calculate the total cost of each production campaign (job): Q1-210308, Q2-210401, and Q2- 210402, using the departmental overhead rates. 10. Using this allocation method, calculate the average cost per unit for each production campaign. In other words, how much did it cost to manufacture one box of muesli for each of these production campaigns if Muesli AG uses machine hours per department as an allocation base? Part 3 11. Margins on food products can be quite slim. Assume that the Sales Department wishes to mark up boxes of cereal by 5%. What price per unit should they charge for each of the jobs if the company uses a plantwide POHR per MH? 12. What should they charge if they use departmental POHR per MH? 13. How would you recommend that Muesli AG apply overhead to production campaigns? Why