Answered step by step

Verified Expert Solution

Question

1 Approved Answer

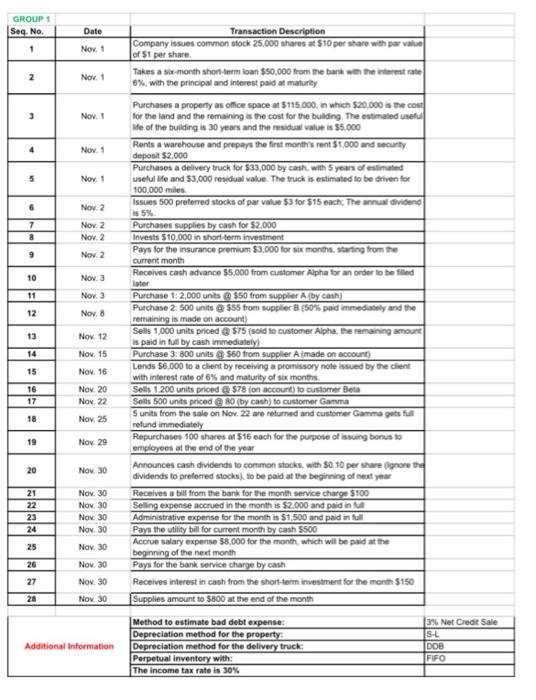

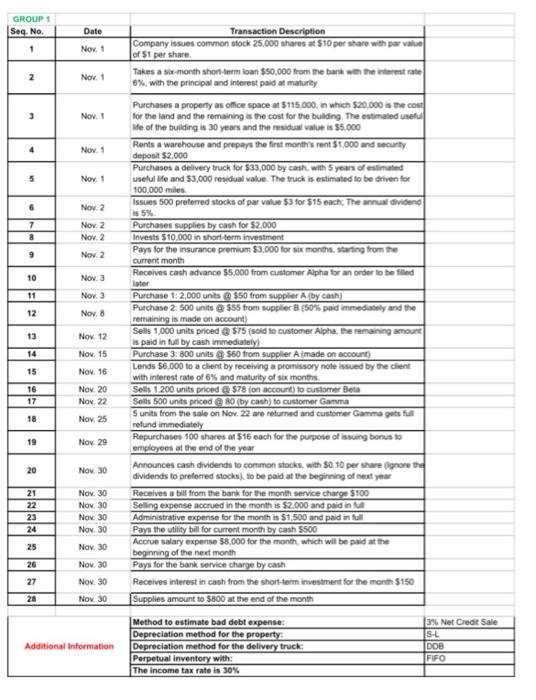

Help with questions 10-18, please Account | Debit | Credit begin{tabular}{|c|c|c|c|} hline multicolumn{4}{|l|}{ GROUP 1} hline Seq. No. & Date & Transaction Description &

Help with questions 10-18, please

\begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|l|}{ GROUP 1} \\ \hline Seq. No. & Date & Transaction Description & \\ \hline 1 & Nov, 1 & \begin{tabular}{l} Company issues common stock 25,000 shares at $10 per share with par value \\ of $1 per share. \end{tabular} & \\ \hline 2 & Nov. 1 & \begin{tabular}{l} Takes a sicmonth shon-termi ban $50,000 from the bark whe the interest rate \\ 6%, with the principal and interest paid at maturity \end{tabular} & \\ \hline 3 & Now 1 & \begin{tabular}{l} Purchases a property as office space at $115,000, in which $20,000 is the cost \\ for the land and the remaining as the cost for the bulding. The estimated usetu- \\ We of the building is 30 years and the residual value is $5,000 \end{tabular} & \\ \hline 4 & Nov, 1 & \begin{tabular}{l} Rents a warehouse and prepays the first monthrs rent $1,000 and securty \\ deposit $2,000 \end{tabular} & \\ \hline 5 & Nov. 1 & \begin{tabular}{l} Purchases a delivery fruck for $33,000 by casich, with 5 years of estifinated \\ useful life and $3,000 residual value. The truck is estimated to be ativen for \\ 100,000 miles. \end{tabular} & \\ \hline 6 & Nov. 2 & \begin{tabular}{l} Issues 500 preferred stocks of par value $3 for $15 each, The annual dividend \\ is 5%. \end{tabular} & \\ \hline 7 & Nov. 2 & Purchases supplies by cash for $2.000 & \\ \hline 8 & Nov. 2 & Invests 510,000 in shorlterm investment & \\ \hline 9 & Nov 2 & \begin{tabular}{l} Pays for the insurance premium $3.000 for six months, starting from the \\ current month \end{tabular} & \\ \hline 10 & Nov: 3 & \begin{tabular}{l} Receives cash advance $5,000 from customer Nipha for an order to be filled \\ later \end{tabular} & \\ \hline 11 & Nor. 3 & Purchase 1:2,000 units a $50 from suppler A. (by cash) & \\ \hline 12 & Nov, 8 & \begin{tabular}{l} Purchase 2: 500 units 8555 from supplier 8 ( 50% paid immediatily and the \\ remaining is made on account) \end{tabular} & \\ \hline 13 & Nov. 12 & \begin{tabular}{l} Sells 1,000 units priced 8575 (sold ib customer Alpha, the remaining amount \\ is paid in ful by cash immediately). \end{tabular} & \\ \hline 14 & Nov. 15 & Purchase 3: 800 units a $60 from suppler A (made on scoourn) & \\ \hline 15 & Nov. 16 & \begin{tabular}{l} Lends $6.000 to a client by receiving a promissory nole isuved by the client \\ with interest rate of 6% and maturity of six months. \end{tabular} & \\ \hline 16 & Nov. 20 & Sells 1.200 units priced a 578 ion account) to customer Beda & \\ \hline 17 & Nov 22 & Sells 500 units priced 280 (by cash) to customer Ganma & \\ \hline 18 & Nov. 25 & \begin{tabular}{l} 5 units from the sale on Nov. 22 are retumed and customer Gamma geta fill \\ refund immediately \end{tabular} & \\ \hline 19 & Nov 29 & \begin{tabular}{l} Repurchases 100 shares at $16 each for the purpose of issuing bonus is \\ employees at the end of the year \end{tabular} & \\ \hline 20 & Nov, 30 & \begin{tabular}{l} Announces cash dividends to common stocks, with $0.10 per share (0onore the \\ dividends to preforred stocks), to be paid at the beginning of next yeur \end{tabular} & \\ \hline 21 & Nov. 30 & Receives a bill from the bark for the month service charge $500 & \\ \hline 22 & Nov. 30 & Selling expense accrued in the month is $2.000 and paid in Mal & \\ \hline 23 & Nov. 30 & Administrative expense for the month is $1,500 and paid in full & \\ \hline 24 & Nov. 30 & Pays the utility bill for current month by cash $500 & \\ \hline 25 & Nov 30 & \begin{tabular}{l} Accrue salary expense $8,000 for the month. which wil be paid at the \\ beginning of the next month \end{tabular} & \\ \hline 26 & Nov 30 & Pays for the bank service charge by cash & \\ \hline 27 & Nov. 30 & Receives interest in cash from the shonttem investment for the month $150 & \\ \hline 28 & Nov 30 & Supplies amount to $800 at the end of the month & \\ \hline \multirow{5}{*}{\multicolumn{2}{|c|}{ Additional information }} & Method to estimate bad debt expense: & 336 Net Credit Sale \\ \hline & & Depreciation method for the property: & Sh- \\ \hline & & Depreciation method for the delivery truck: & DOE \\ \hline & & Perpetual inventory with: & FIFO \\ \hline & & The income tax rate is 30% & \\ \hline \end{tabular} Account | Debit | Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started