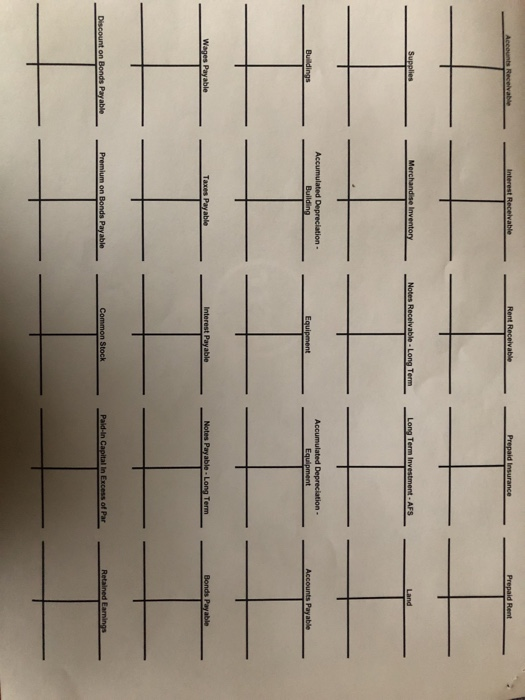

help with statement of cash flows. any help with each areas T accounts

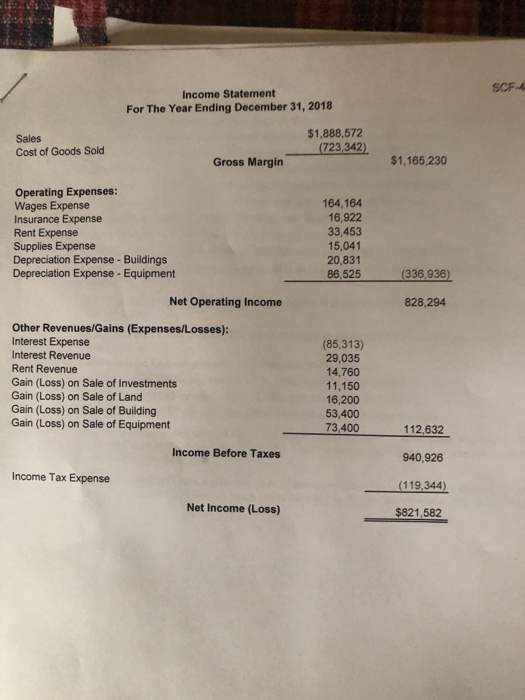

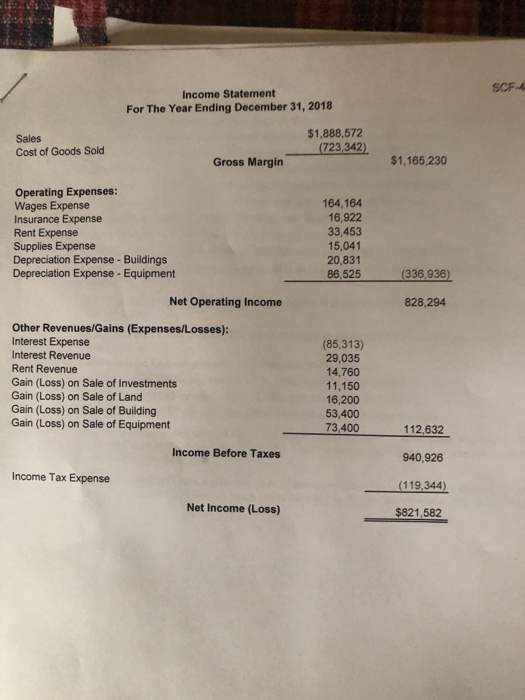

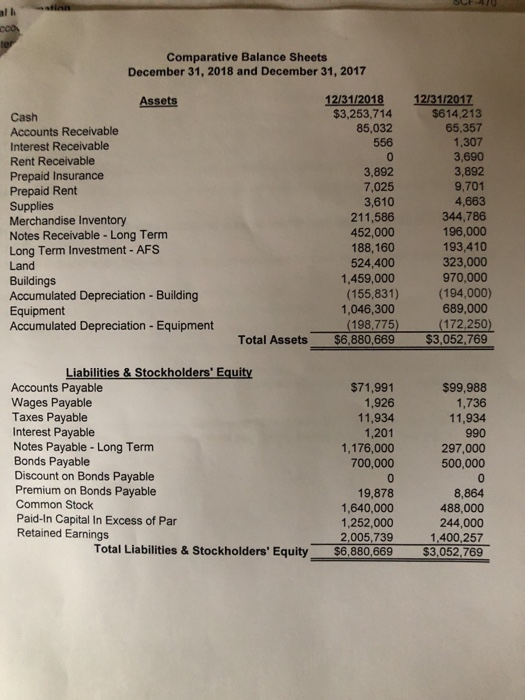

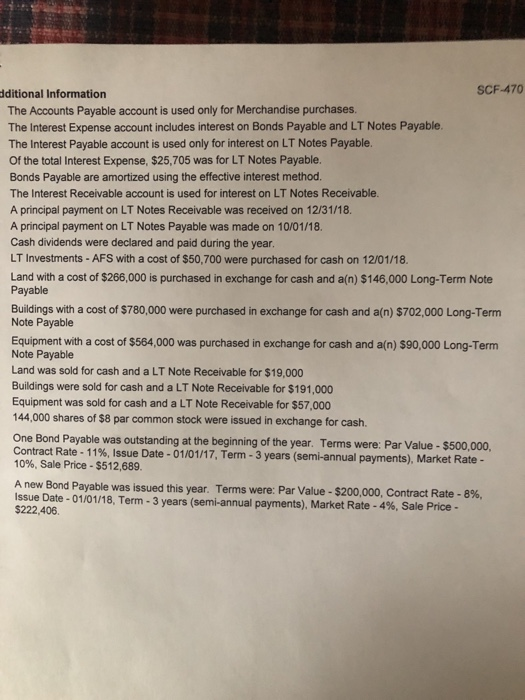

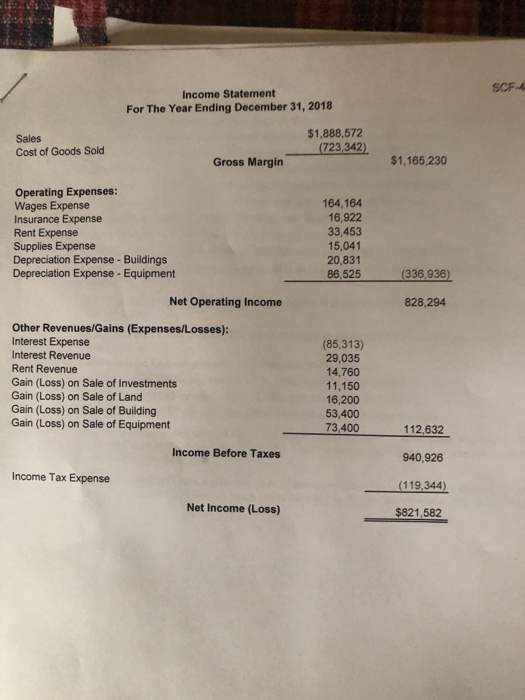

SCF-4 Income Statement For The Year Ending December 31, 2018 $1,888,572 723.844 $1,185,230 Sales Cost of Goods Sold (723,342) Gross Margin 164,164 16,922 33,453 15,041 20,831 86,525 Wages Expense Insurance Expense Rent Expense Supplies Expense Depreciation Expense- Buildings Depreciation Expense-Equipment (336,936) Net Operating Income 828,294 Other Revenues/Gains (Expenses/Losses) Interest Expense nterest Revenue Rent Revenue Gain (Loss) on Sale of Investments Gain (Loss) on Sale of Land Gain (Loss) on Sale of Building Gain (Loss) on Sale of Equipment (85,313) 29,035 14,760 11,150 16,200 53,400 112,632 940,926 119,344 $821,582 Income Before Taxes Income Tax Expense Net Income (Loss) Comparative Balance Sheets December 31, 2018 and December 31, 2017 12/31/2018 12/31/2017 Assets $614,213 65,357 1,307 $3,253,714 85,032 Accounts Receivable Interest Receivable Rent Receivable Prepaid Insurance Prepaid Rent 3,892 7,025 3,610 211,586 452,000 188,160 524,400 1,459,000 (155,831) 1,046,300 198,775 Total Assets $6,880,669 9,701 344,786 196,000 193,410 323,000 970,000 (194,000) 689,000 Merchandise Inventory Notes Receivable -Long Term Long Term Investment -AFS Land Buildings Accumulated Depreciation - Building Equipment Accumulated Depreciation -Equipment $3,052,769 Liabilities & Stockholders' Equity $71,991 1,926 11,934 1,201 1,176,000 700,000 Accounts Payable Wages Payable Taxes Payable Interest Payable Notes Payable - Long Term Bonds Payable Discount on Bonds Payable Premium on Bonds Payable Common Stock Paid-In Capital In Excess of Par Retained Earnings $99,988 1,736 11,934 297,000 500,000 19,878 1,640,000 1,252,000 2,005,739 8,864 488,000 244,000 1,400,257 Total Liabities & Stockholders' Equity $6.,880,669 $3,052,769 SCF-470 ditional Information The Accounts Payable account is used only for Merchandise purchases The Interest Expense account includes interest on Bonds Payable and LT Notes Payable. The Interest Payable account is used only for interest on LT Notes Payable. Of the total Interest Expense, $25,705 was for LT Notes Payable. Bonds Payable are amortized using the effective interest method. The Interest Receivable account is used for interest on LT Notes Receivable. A principal payment on LT Notes Receivable was received on 12/31/18. A principal payment on LT Notes Payable was made on 10/01/18 Cash dividends were declared and paid during the year LT Investments- AFS with a cost of $50,700 were purchased for cash on 12/01/18. Land with a cost of $266,000 is purchased in exchange for cash and a(n) $146,000 Long-Term Note Payable Buildings with a cost of $780,000 were purchased in exchange for cash and a(n) $702,000 Long-Ternm Note Payable Equipment with a cost of $564,000 was purchased in exchange for cash and a(n) $90,000 Long-Term Note Payable Land was sold for cash and a LT Note Receivable for $19,000 Buildings were sold for cash and a LT Note Receivable for $191,000 Equipment was sold for cash and a LT Note Receivable for $57,000 144,000 shares of $8 par common stock were issued in exchange for cash. One Bond Payable was outstanding at the beginning of the year. Terms were: Par Value-$500,000 Contract Rate-1196 Issue Date-01/01/17 Term-3 years (semi-annual payments), Market Rate 10%. Sale Price-$512,689. A new Bond Payable was issued this year. Terms were: Par Value -$200,000, Contract Issue Date-01/01/18, Term-3 years (semi-annual payments). Market Rate-4% Sale Price . $222,406. Rent Receivable Term Long Term AFS Land Equipment Term Taxes Pay able Stock Paid-in Capital In Excess of Par SCF-4 Income Statement For The Year Ending December 31, 2018 $1,888,572 723.844 $1,185,230 Sales Cost of Goods Sold (723,342) Gross Margin 164,164 16,922 33,453 15,041 20,831 86,525 Wages Expense Insurance Expense Rent Expense Supplies Expense Depreciation Expense- Buildings Depreciation Expense-Equipment (336,936) Net Operating Income 828,294 Other Revenues/Gains (Expenses/Losses) Interest Expense nterest Revenue Rent Revenue Gain (Loss) on Sale of Investments Gain (Loss) on Sale of Land Gain (Loss) on Sale of Building Gain (Loss) on Sale of Equipment (85,313) 29,035 14,760 11,150 16,200 53,400 112,632 940,926 119,344 $821,582 Income Before Taxes Income Tax Expense Net Income (Loss) Comparative Balance Sheets December 31, 2018 and December 31, 2017 12/31/2018 12/31/2017 Assets $614,213 65,357 1,307 $3,253,714 85,032 Accounts Receivable Interest Receivable Rent Receivable Prepaid Insurance Prepaid Rent 3,892 7,025 3,610 211,586 452,000 188,160 524,400 1,459,000 (155,831) 1,046,300 198,775 Total Assets $6,880,669 9,701 344,786 196,000 193,410 323,000 970,000 (194,000) 689,000 Merchandise Inventory Notes Receivable -Long Term Long Term Investment -AFS Land Buildings Accumulated Depreciation - Building Equipment Accumulated Depreciation -Equipment $3,052,769 Liabilities & Stockholders' Equity $71,991 1,926 11,934 1,201 1,176,000 700,000 Accounts Payable Wages Payable Taxes Payable Interest Payable Notes Payable - Long Term Bonds Payable Discount on Bonds Payable Premium on Bonds Payable Common Stock Paid-In Capital In Excess of Par Retained Earnings $99,988 1,736 11,934 297,000 500,000 19,878 1,640,000 1,252,000 2,005,739 8,864 488,000 244,000 1,400,257 Total Liabities & Stockholders' Equity $6.,880,669 $3,052,769 SCF-470 ditional Information The Accounts Payable account is used only for Merchandise purchases The Interest Expense account includes interest on Bonds Payable and LT Notes Payable. The Interest Payable account is used only for interest on LT Notes Payable. Of the total Interest Expense, $25,705 was for LT Notes Payable. Bonds Payable are amortized using the effective interest method. The Interest Receivable account is used for interest on LT Notes Receivable. A principal payment on LT Notes Receivable was received on 12/31/18. A principal payment on LT Notes Payable was made on 10/01/18 Cash dividends were declared and paid during the year LT Investments- AFS with a cost of $50,700 were purchased for cash on 12/01/18. Land with a cost of $266,000 is purchased in exchange for cash and a(n) $146,000 Long-Term Note Payable Buildings with a cost of $780,000 were purchased in exchange for cash and a(n) $702,000 Long-Ternm Note Payable Equipment with a cost of $564,000 was purchased in exchange for cash and a(n) $90,000 Long-Term Note Payable Land was sold for cash and a LT Note Receivable for $19,000 Buildings were sold for cash and a LT Note Receivable for $191,000 Equipment was sold for cash and a LT Note Receivable for $57,000 144,000 shares of $8 par common stock were issued in exchange for cash. One Bond Payable was outstanding at the beginning of the year. Terms were: Par Value-$500,000 Contract Rate-1196 Issue Date-01/01/17 Term-3 years (semi-annual payments), Market Rate 10%. Sale Price-$512,689. A new Bond Payable was issued this year. Terms were: Par Value -$200,000, Contract Issue Date-01/01/18, Term-3 years (semi-annual payments). Market Rate-4% Sale Price . $222,406. Rent Receivable Term Long Term AFS Land Equipment Term Taxes Pay able Stock Paid-in Capital In Excess of Par