Help with Statistics

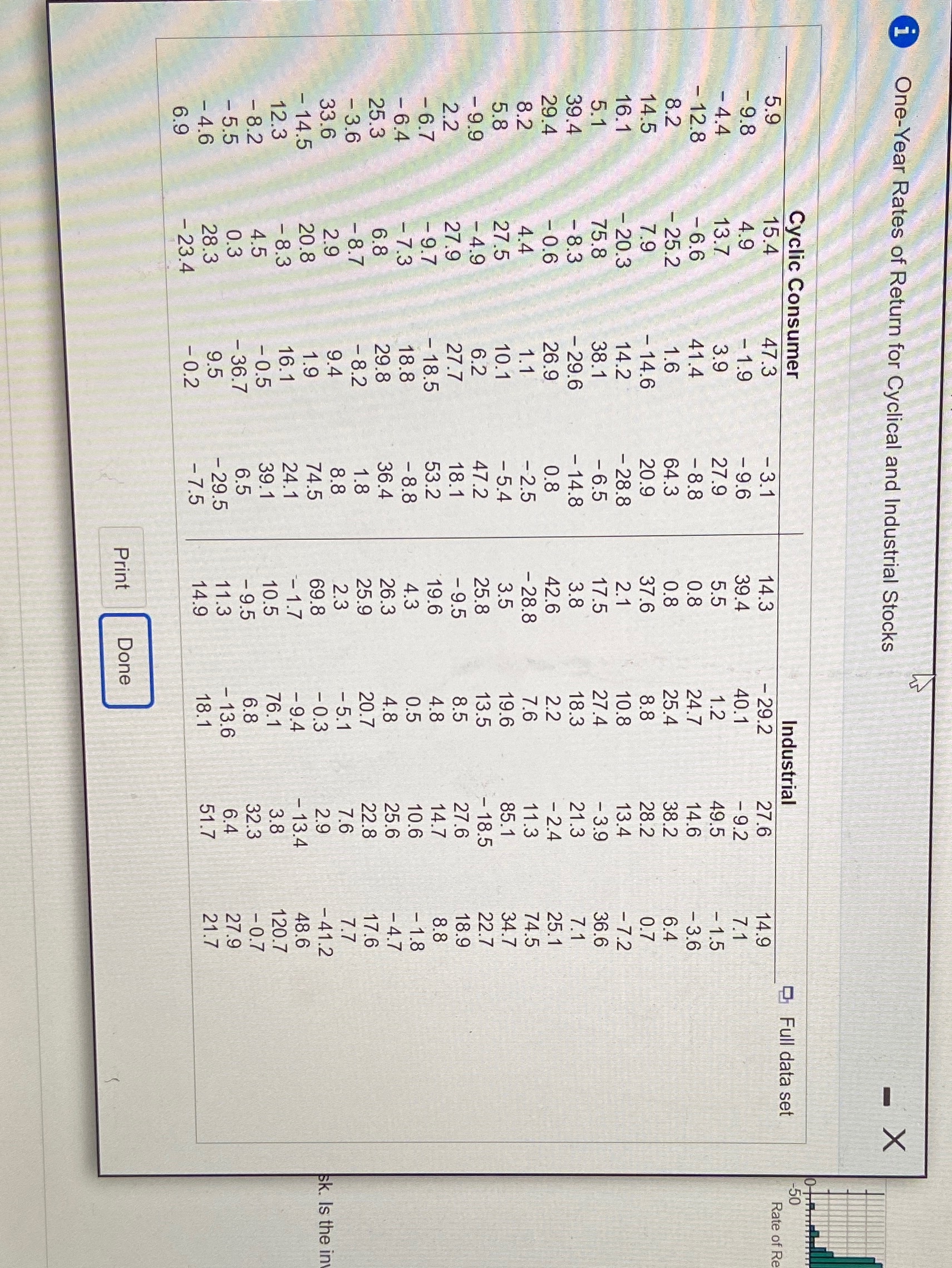

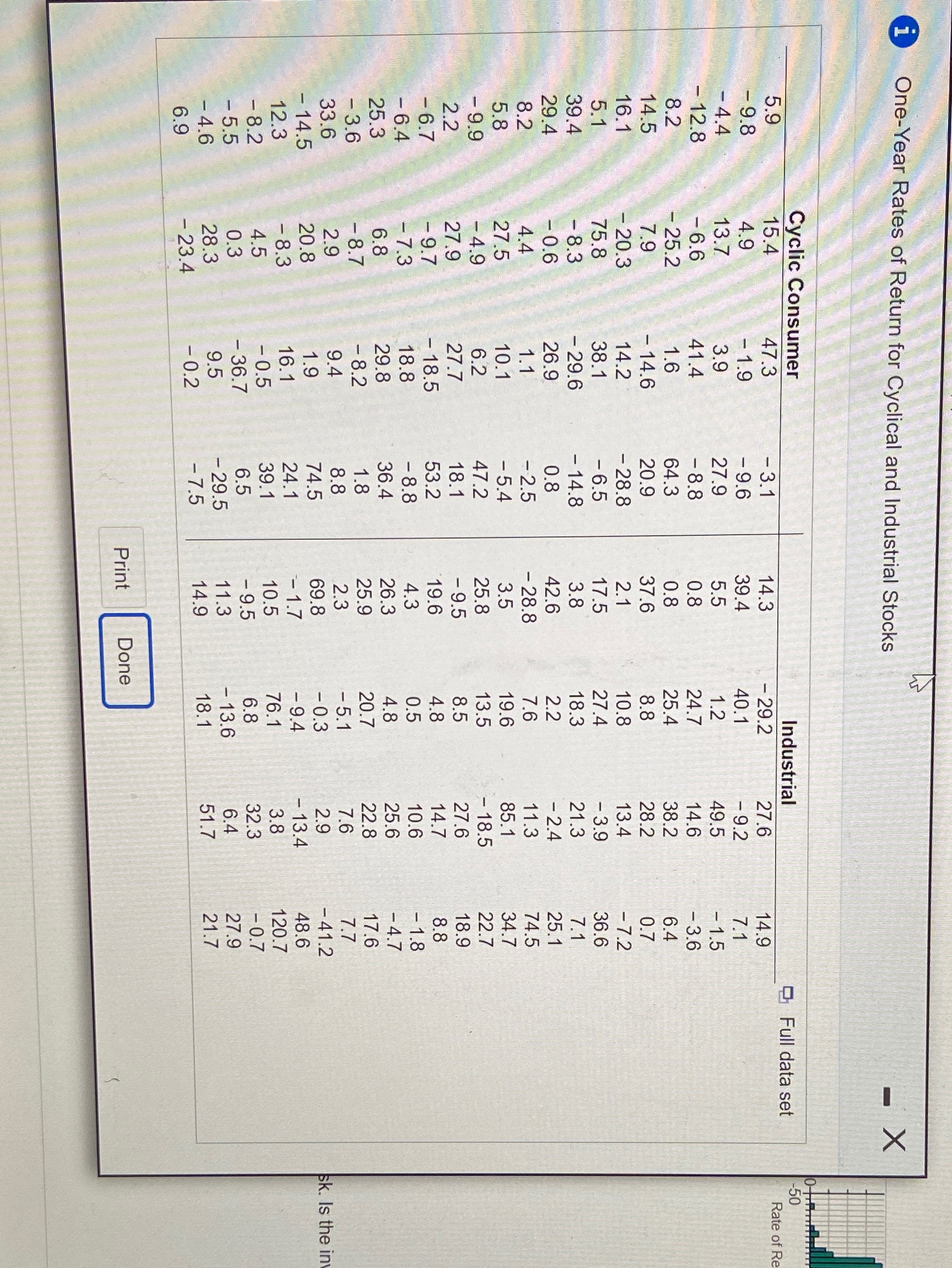

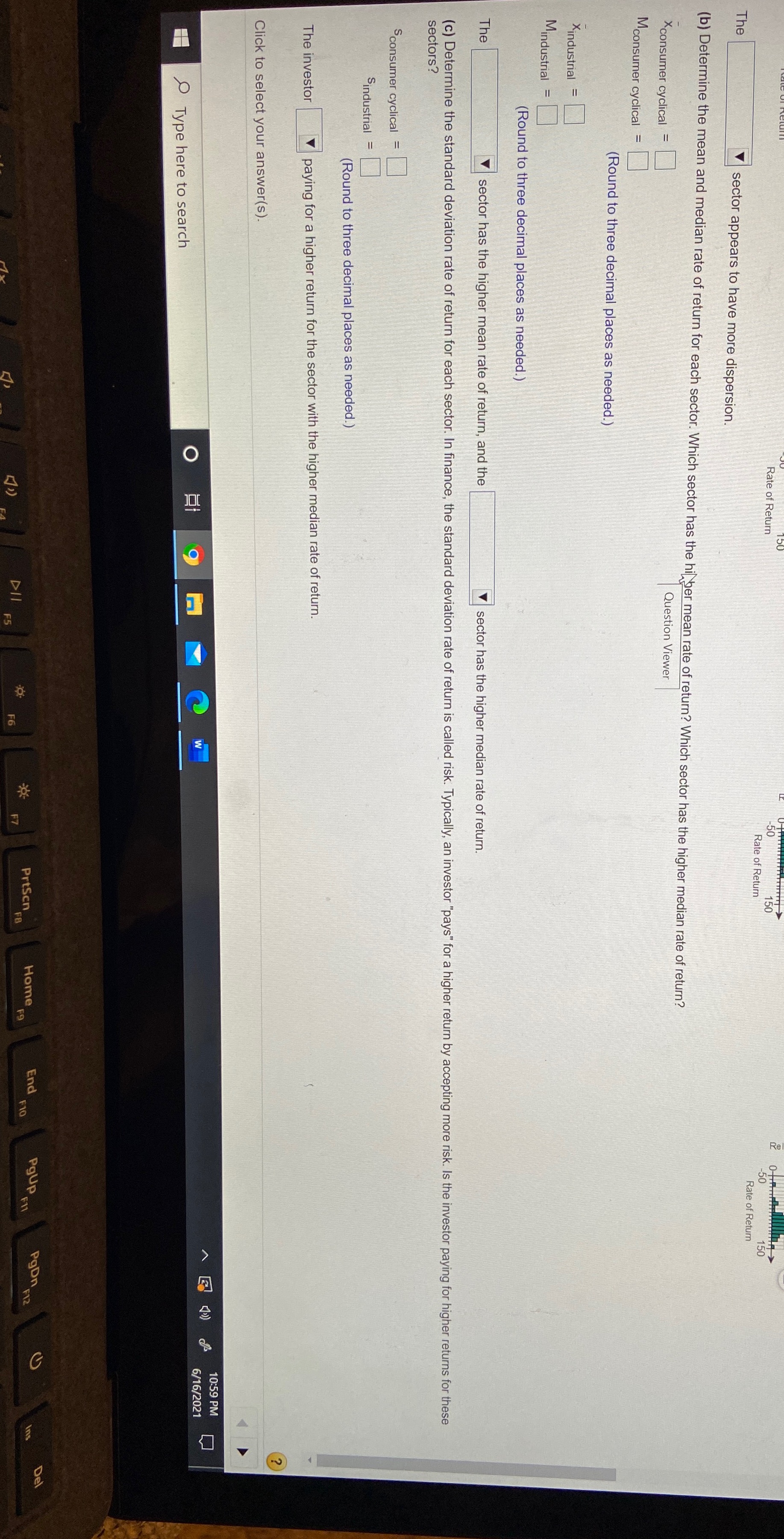

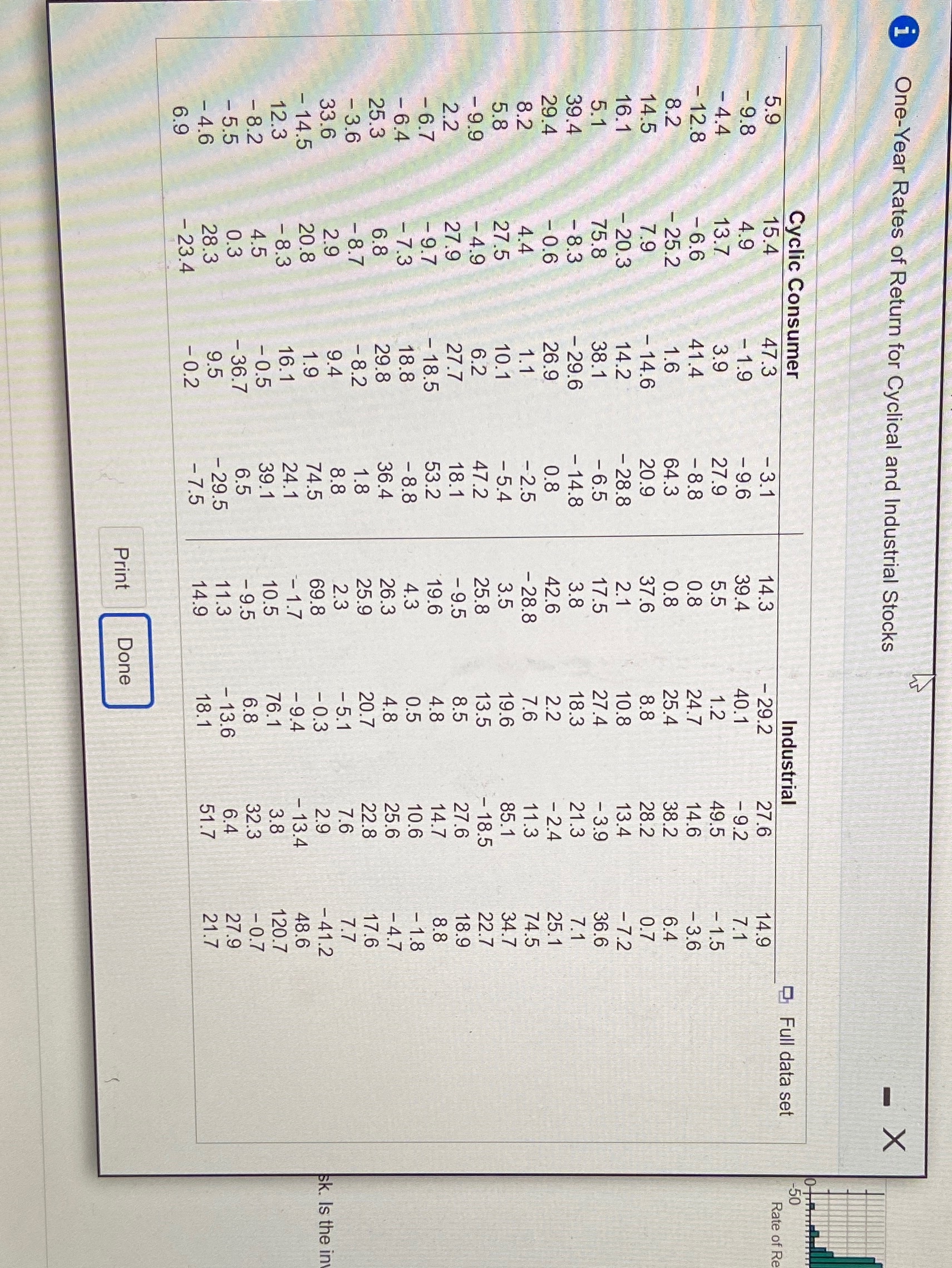

This Question: 1 pt Submit Quiz 1 of 17 (9 complete ) A This Quiz: 17 pts possible Stocks may be categorized by sectors. The accompanying data represent the one-year rate of return (in percent) for a sample of consumer cyclical stocks and industrial stocks for a 12-month period. Note: Consumer cyclical stocks include restaurants and retailers. Industrial stocks include manufacturers and shipping companies. Complete parts (a) through (c) below. Click the icon to view the data. stocks (a) Draw a relative frequency histogram for each sector using a lower class limit for the first class of - 50 and a class width of 10. Which sector appears to have more dispersion? Choose the correct relative frequency histogram for consumer cyclical O A. O B. O C. OD. 0.3- 5 0.3- 0.3- 03- O o Relative Frequency Relative Frequency Relative Frequency Relative Frequency -50 150 50 150 Question Viewer 50 150 50 150 Rate of Return Rate of Return Rate of Return Rate of Return Choose the correct relative frequency histogram for industrial stocks. O A O B. O C. OD. 034 0.3- 0.3- 0 3- O Relative Frequency Relative Frequency Relative Frequency Relative Frequency OHH 150 -50 150 50 150 -50 -50 150 Rate of Return Rate of Return Rate of Return Rate of Return The sector appears to have more dispersion. (b) Determine the mean and median rate of return for each sector. Which sector has the higher mean rate of return? Which sector has the higher median rate of return? *consumer cyclical Mconsumer cyclical = Click to select your answer ( s ) . 10:58 PM W 6/16/2021 O Type here to search-50 Rate of Return 150 -50 150 Rate of Return Rate of Return The sector appears to have more dispersion. (b) Determine the mean and median rate of return for each sector. Which sector has the hilber mean rate of return? Which sector has the higher median rate of return? Question Viewer Xconsumer cyclical = Mconsumer cyclical = (Round to three decimal places as needed.) Xindustrial = Mindustrial = (Round to three decimal places as needed.) The `sector has the higher mean rate of return, and the sector has the higher median rate of return. (c) Determine the standard deviation rate of return for each sector. In finance, the standard deviation rate of return is called risk. Typically, an investor "pays" for a higher return by accepting more risk. Is the investor paying for higher returns for these sectors? $consumer cyclical = Sindustrial = (Round to three decimal places as needed. ) The investor paying for a higher return for the sector with the higher median rate of return. Click to select your answer (s ) . 10:59 PM 6/16/2021 3 O O Type here to search Del PgDn Ins PrtSen Home End PgUp F12 F10 DII F7 FB F9 F5i One-Year Rates of Return for Cyclical and Industrial Stocks X Cyclic Consumer 5.9 15.4 47.3 Industrial -50 190 0 -9.8 - 3.1 4.9 14.3 Full data set - 1.9 - 29.2 27.6 14.9 Rate of Re - 9.6 13.7 39.4 3.9 40.1 -9.2 7.1 - 12.8 27.9 5.5 - 6.6 41.4 1.2 49.5 - 8.8 0.8 - 1.5 8.2 -25.2 24.7 1.6 14.6 - 3.6 14.5 64.3 0.8 7.9 25.4 38.2 - 14.6 6.4 16.1 20.9 37.6 20.3 8.8 14.2 28.2 - 28.8 0.7 5.1 2.1 75.8 10.8 13.4 38.1 -6.5 -7.2 17.5 39.4 27.4 - 8.3 - 3.9 -29.6 36.6 - 14.8 3.8 29.4 18.3 -0.6 21.3 26.9 7.1 0.8 42.6 8.2 2.2 4.4 -2.4 25.1 1.1 - 2.5 - 28.8 7.6 5.8 11.3 27.5 74.5 10.1 - 5.4 3.5 19.6 85.1 -9.9 34.7 - 4.9 6.2 47.2 25.8 13.5 - 18.5 22.7 2.2 27.9 27.7 18.1 - 9.5 8.5 27.6 18.9 -6.7 -9.7 - 18.5 53.2 19.6 4.8 14.7 8.8 - 6.4 -7.3 18.8 - 8.8 4.3 0.5 10.6 -1.8 25.3 6.8 29.8 36.4 26.3 4.8 25.6 -4.7 - 3.6 - 8.7 - 8.2 1.8 25.9 20.7 22.8 17.6 33.6 2.9 9.4 8.8 2.3 -5.1 7.6 7.7 - 14.5 20.8 1.9 74.5 69.8 - 0.3 2.9 -41.2 sk. Is the in 12.3 - 8.3 16.1 24.1 - 1.7 -9.4 - 13.4 48.6 - 8.2 4.5 -0.5 39.1 10.5 76.1 3.8 120.7 - 5.5 0.3 - 36.7 6.5 -9.5 6.8 32.3 -0.7 -4.6 28.3 9.5 -29.5 11.3 - 13.6 6.4 27.9 6.9 - 23.4 - 0.2 -7.5 14.9 18.1 51.7 21.7 Print Done