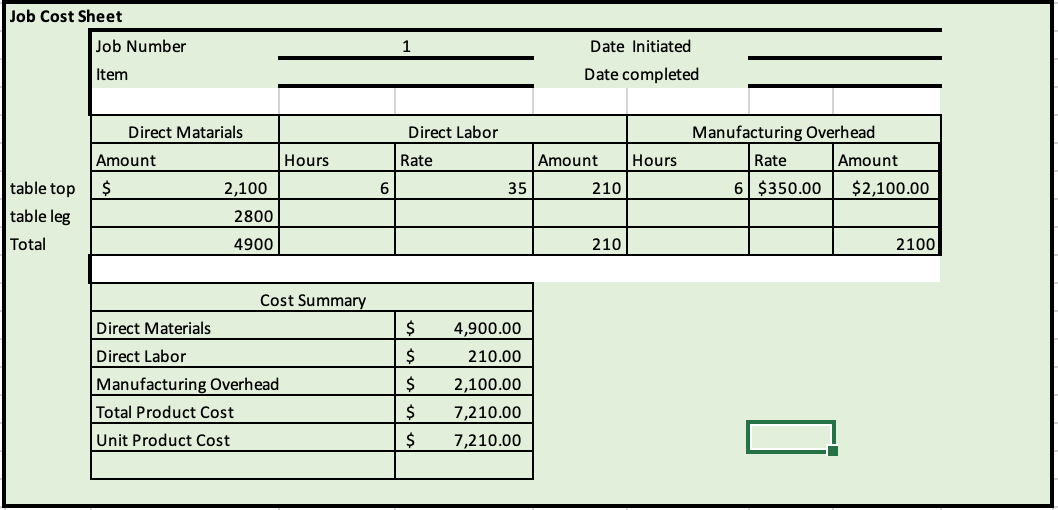

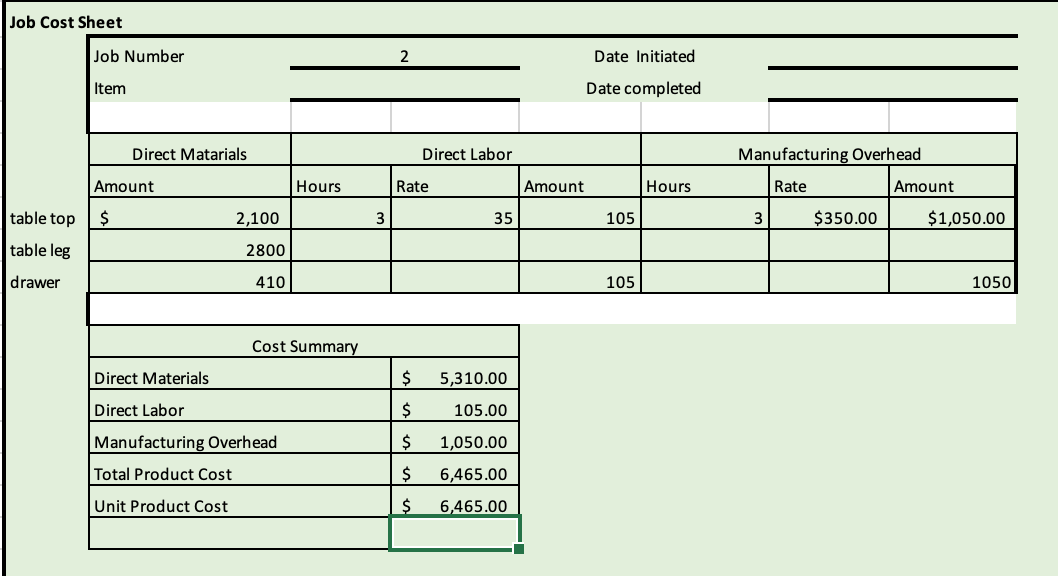

Help with step #6, please?

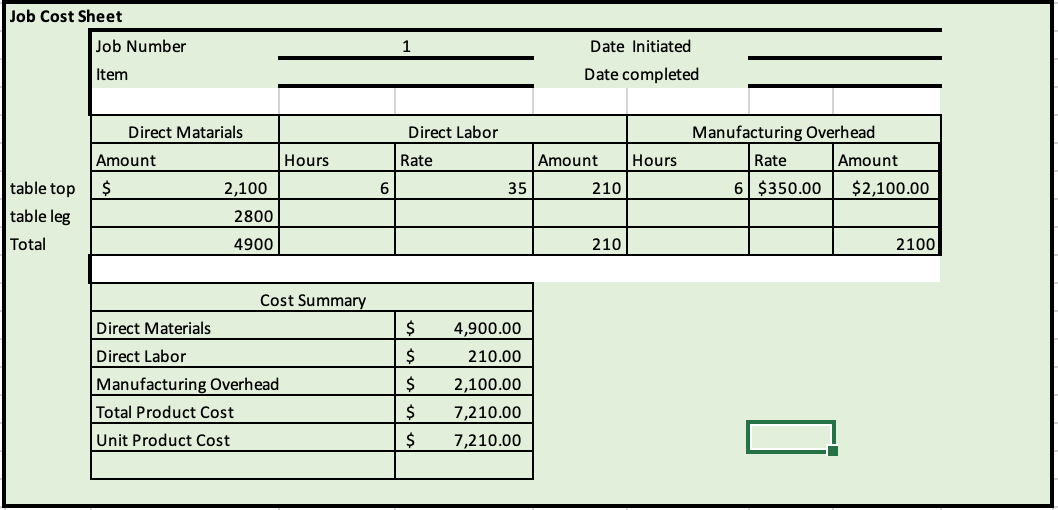

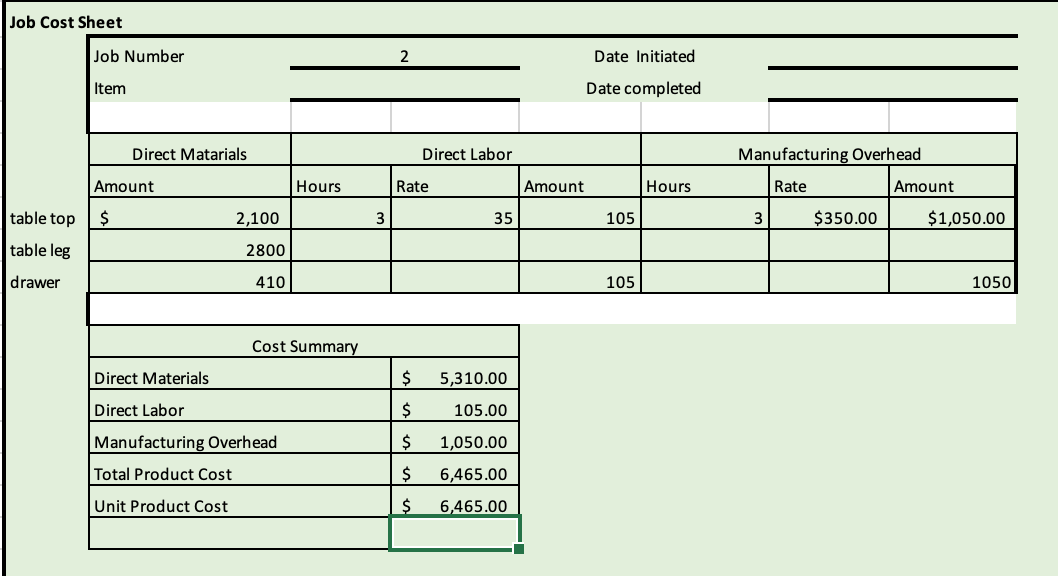

Step 5 Post the journal entries that you recorded on the "General Journal" tab to the "T-accounts" tab. This is the company's first month of business, so there will not be any beginning balances. Compute the balance for each T-account after all of the entries have been posted. Step 6 Prepare a Schedule of Cost of Goods Manufactured and a Schedule of Cost of Goods Sold on the "Schedule of COGM and COGS" tab for Job #1 and Job #2 that were worked on during the month by the company. Ivoke sure to follow the format 150 th a t more the Step 7 Prepare an Income Statement for the month using the Traditional Format on the "Income Statement" tab. Job Cost Sheet Job Number Item Date Initiated Date completed Direct Labor Rate 3 Hours Direct Matarials Amount Hours $ 2,100 6 2800 4900 Amount 210 Manufacturing Overhead Rate Amount 6 $350.00 $2,100.00 table top table leg Total 5 210 2100| vaterials Cost Summary Direct Materials Direct Labor Manufacturing Overhead Total Product Cost Unit Product Cost $ $ $ $ $ 4,900.00 210.00 2,100.00 7,210.00 7,210.00 Job Cost Sheet Job Number Date Initiated Date completed Item natarials Direct Matarials Amount Hours Hou Direct Labor Rate 35 Amount Hours 105| Manufacturing Overhead Rate Amount 3 $350.00 $1,050.00 | $ 2.100 3 35 table top table leg drawer 2800 410 410 _11051 1050 Cost Summary Direct Materials Direct Labor Manufacturing Overhead Total Product Cost $ $ $ $ $ 5,310.00 105.00 1,050.00 6,465.00 6,465.00 Unit Product Cost Step 5 Post the journal entries that you recorded on the "General Journal" tab to the "T-accounts" tab. This is the company's first month of business, so there will not be any beginning balances. Compute the balance for each T-account after all of the entries have been posted. Step 6 Prepare a Schedule of Cost of Goods Manufactured and a Schedule of Cost of Goods Sold on the "Schedule of COGM and COGS" tab for Job #1 and Job #2 that were worked on during the month by the company. Ivoke sure to follow the format 150 th a t more the Step 7 Prepare an Income Statement for the month using the Traditional Format on the "Income Statement" tab. Job Cost Sheet Job Number Item Date Initiated Date completed Direct Labor Rate 3 Hours Direct Matarials Amount Hours $ 2,100 6 2800 4900 Amount 210 Manufacturing Overhead Rate Amount 6 $350.00 $2,100.00 table top table leg Total 5 210 2100| vaterials Cost Summary Direct Materials Direct Labor Manufacturing Overhead Total Product Cost Unit Product Cost $ $ $ $ $ 4,900.00 210.00 2,100.00 7,210.00 7,210.00 Job Cost Sheet Job Number Date Initiated Date completed Item natarials Direct Matarials Amount Hours Hou Direct Labor Rate 35 Amount Hours 105| Manufacturing Overhead Rate Amount 3 $350.00 $1,050.00 | $ 2.100 3 35 table top table leg drawer 2800 410 410 _11051 1050 Cost Summary Direct Materials Direct Labor Manufacturing Overhead Total Product Cost $ $ $ $ $ 5,310.00 105.00 1,050.00 6,465.00 6,465.00 Unit Product Cost