Help with t accounts only

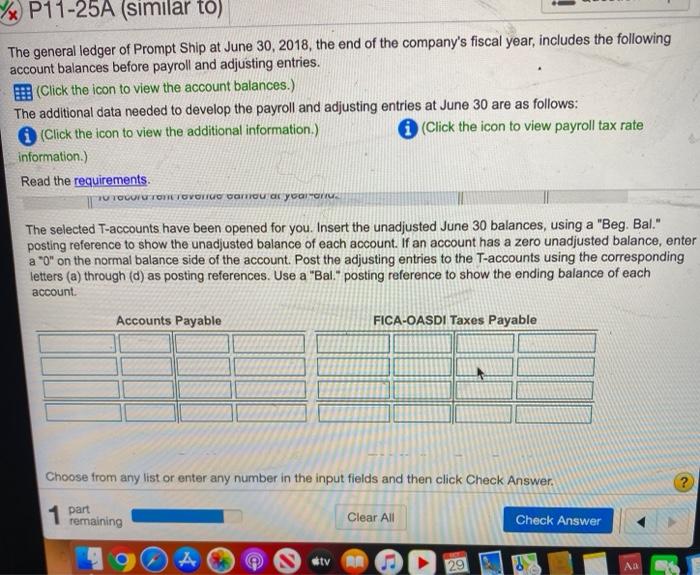

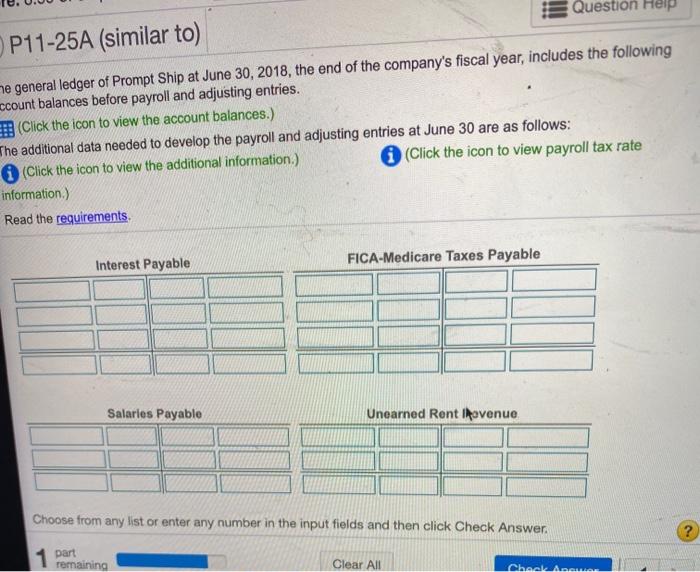

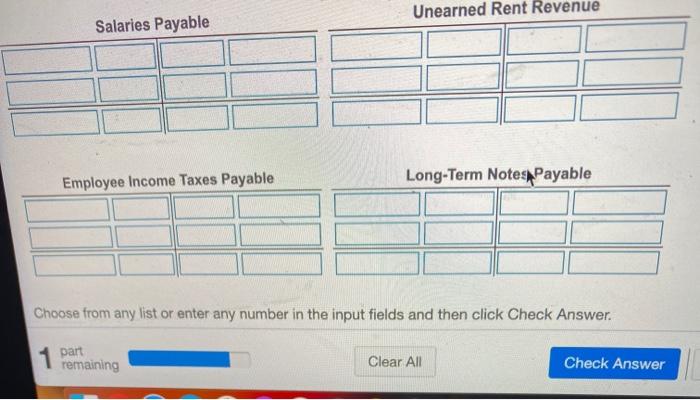

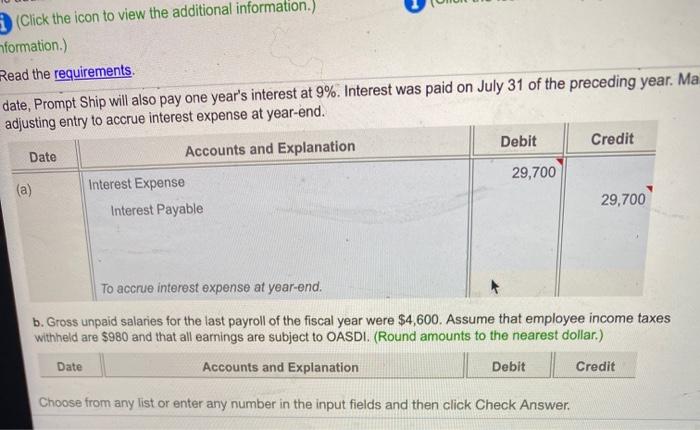

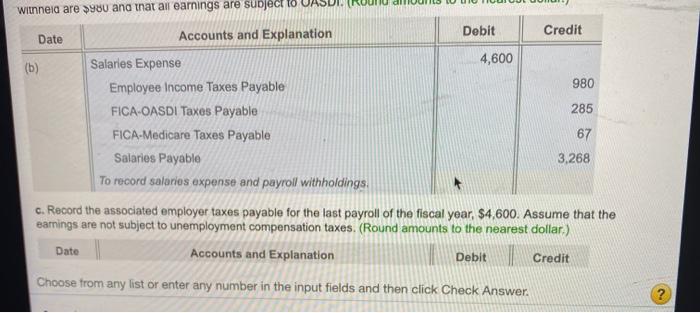

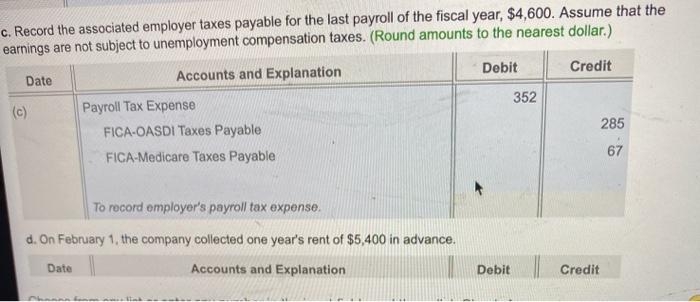

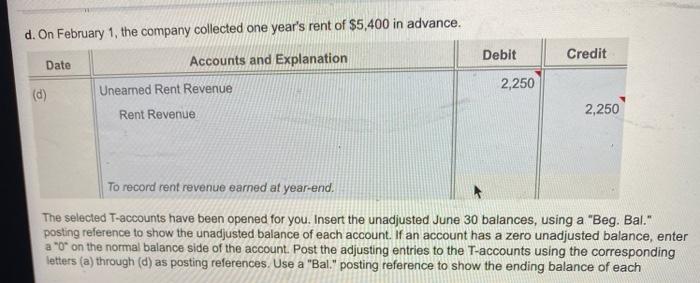

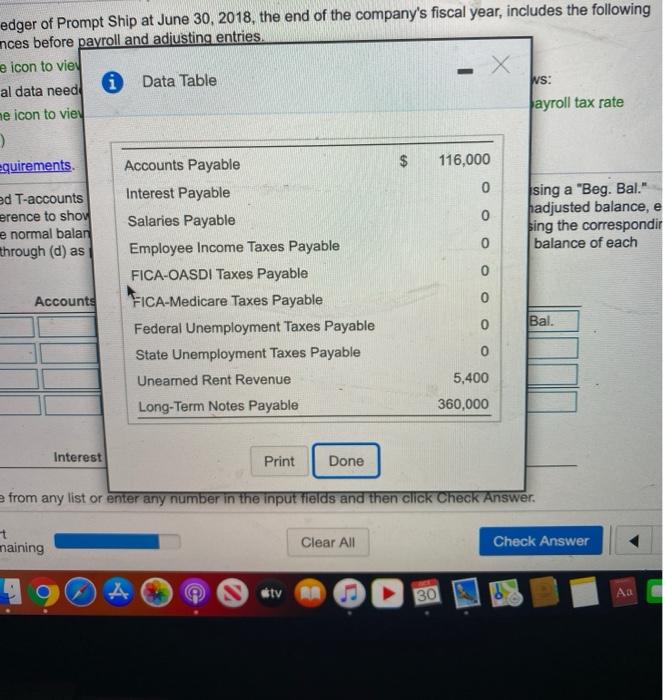

7x P11-25A (similar to) The general ledger of Prompt Ship at June 30, 2018, the end of the company's fiscal year, includes the following account balances before payroll and adjusting entries. (Click the icon to view the account balances.) The additional data needed to develop the payroll and adjusting entries at June 30 are as follows: Click the icon to view the additional information.) (Click the icon to view payroll tax rate information.) Read the requirements. TOTUOTU TOHOTOVOHUO Camou ac yaran The selected T-accounts have been opened for you. Insert the unadjusted June 30 balances, using a "Beg. Bal." posting reference to show the unadjusted balance of each account. If an account has a zero unadjusted balance, enter a "0" on the normal balance side of the account. Post the adjusting entries to the T-accounts using the corresponding letters (a) through (d) as posting references. Use a "Bal." posting reference to show the ending balance of each account Accounts Payable FICA-OASDI Taxes Payable Choose from any list or enter any number in the input fields and then click Check Answer. ? 1 part remaining Clear All Check Answer #tv O29 AD Ques Help P11-25A (similar to) me general ledger of Prompt Ship at June 30, 2018, the end of the company's fiscal year, includes the following ccount balances before payroll and adjusting entries. (Click the icon to view the account balances.) The additional data needed to develop the payroll and adjusting entries at June 30 are as follows: (Click the icon to view the additional information.) (Click the icon to view payroll tax rate information) Read the requirements Interest Payable FICA-Medicare Taxes Payable Salarles Payablo Unearned Rent avenue Choose from any list or enter any number in the input fields and then click Check Answer. ? 1 part remaining Clear All Cback AWAR Unearned Rent Revenue Salaries Payable Employee Income Taxes Payable Long-Term Notes Payable Choose from any list or enter any number in the input fields and then click Check Answer. 1 part remaining Clear All Check Answer (Click the icon to view the additional information.) nformation.) Read the requirements date, Prompt Ship will also pay one year's interest at 9%. Interest was paid on July 31 of the preceding year. Ma adjusting entry to accrue interest expense at year-end. Debit Credit Date Accounts and Explanation 29,700 (a) Interest Expense Interest Payable 29,700 To accrue interest expense at year-end. b. Gross unpaid salaries for the last payroll of the fiscal year were $4,600. Assume that employee income taxes withheld are $980 and that all earnings are subject to OASDI. (Round amounts to the nearest dollar.) Accounts and Explanation Debit Credit Date Choose from any list or enter any number in the input fields and then click Check Answer. withneid are $980 and that all earnings are subject to Debit Accounts and Explanation Date Credit (b) Salaries Expense 4,600 Employee Income Taxes Payable 980 FICA OASDI Taxos Payable 285 FICA-Medicare Taxes Payable 67 Salaries Payable 3,268 To record salaries expense and payroll withholdings c. Record the associated employer taxes payable for the last payroll of the fiscal year, $4,600. Assume that the earnings are not subject to unemployment compensation taxes. (Round amounts to the nearest dollar.) Date Accounts and Explanation Debit Credit Choose from any list or enter any number in the input fields and then click Check Answer 2 c. Record the associated employer taxes payable for the last payroll of the fiscal year, $4,600. Assume that the earnings are not subject to unemployment compensation taxes. (Round amounts to the nearest dollar.) Debit Credit Date Accounts and Explanation 352 (c) 285 Payroll Tax Expense FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable 67 To record employer's payroll tax expense. d. On February 1, the company collected one year's rent of $5,400 in advance. Date Accounts and Explanation Debit Credit d. On February 1, the company collected one year's rent of $5,400 in advance. Debit Credit Date Accounts and Explanation 2,250 Uneamed Rent Revenue (d) Rent Revenue 2,250 To record rent revenue earned at year-end. The selected T-accounts have been opened for you. Insert the unadjusted June 30 balances, using a "Beg. Bal." posting reference to show the unadjusted balance of each account. If an account has a zero unadjusted balance, enter a "O on the normal balance side of the account. Post the adjusting entries to the T-accounts using the corresponding letters (a) through (d) as posting references. Use a "Bal" posting reference to show the ending balance of each edger of Prompt Ship at June 30, 2018, the end of the company's fiscal year, includes the following nces before payroll and adjusting entries e icon to vie i Data Table al data need VS: me icon to vie Jayroll tax rate ) equirements Accounts Payable $ 116,000 0 ed T-accounts Interest Payable sing a "Beg. Bal." erence to show Salaries Payable 0 padjusted balance, e e normal balan sing the correspondir through (d) as Employee Income Taxes Payable 0 balance of each FICA-OASDI Taxes Payable 0 Accounts FICA-Medicare Taxes Payable 0 Federal Unemployment Taxes Payable 0 Bal. State Unemployment Taxes Payable 0 Unearned Rent Revenue 5,400 Long-Term Notes Payable 360,000 Interest Print Done e from any list or enter any number in the input fields and then click Check Answer. + naining Clear All Check Answer 0 30 Aa