Answered step by step

Verified Expert Solution

Question

1 Approved Answer

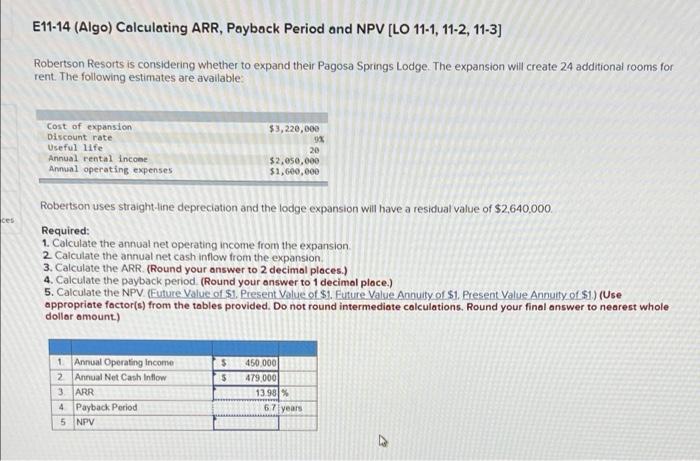

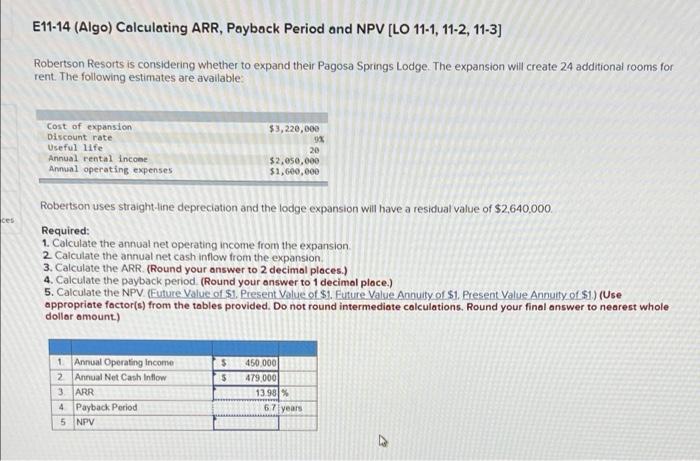

help with the NPV part please! E11-14 (Algo) Calculating ARR, Payback Period and NPV [LO 11-1, 11-2, 11-3) Robertson Resorts is considering whether to expand

help with the NPV part please!

E11-14 (Algo) Calculating ARR, Payback Period and NPV [LO 11-1, 11-2, 11-3) Robertson Resorts is considering whether to expand their Pagosa Springs Lodge. The expansion will create 24 additional rooms for rent. The following estimates are available $3,220,000 Cost of expansion Discount rate Useful life Annual rental income Annual operating expenses $2,050,000 $1,600,000 ces Robertson uses straight-line depreciation and the lodge expansion will have a residual value of $2,640.000 Required: 1. Calculate the annual net operating income from the expansion 2 Calculate the annual net cash inflow from the expansion 3. Calculate the ARR.(Round your answer to 2 decimal places.) 4. Calculate the payback period (Round your answer to 1 decimal place.) 5. Calculate the NPV (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of S1) (Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Round your final answer to nearest whole dollar amount.) $ 5 1. Annual Operating income 2 Annual Net Cash Inflow 3 ARR 4 Payback Period 5 NPV 450 000 479.000 13.98% 6 7 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started