help with this case 14-3

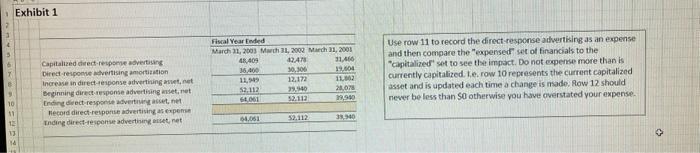

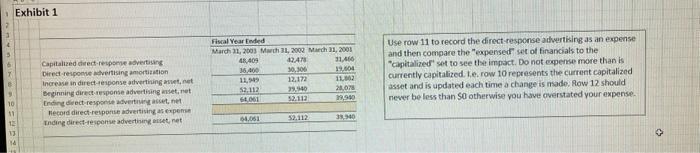

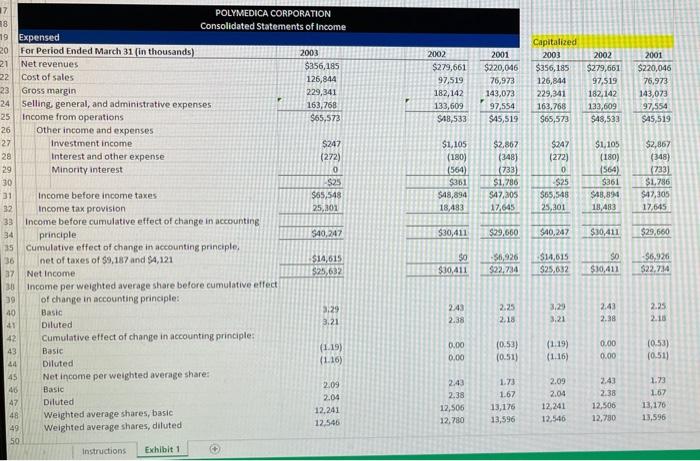

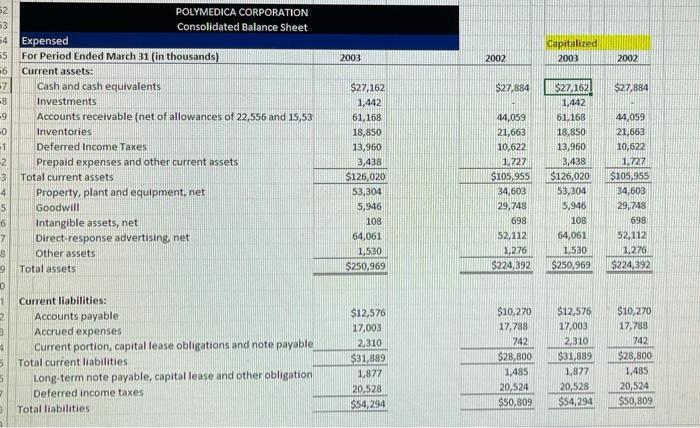

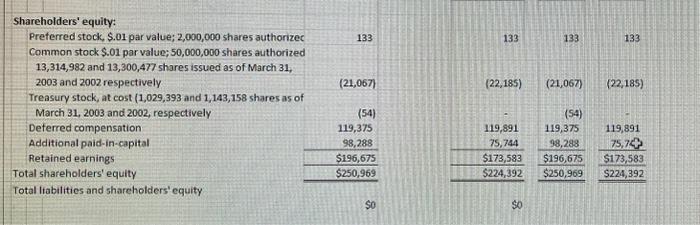

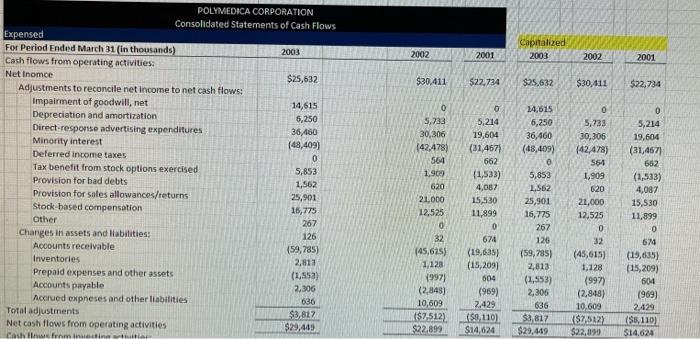

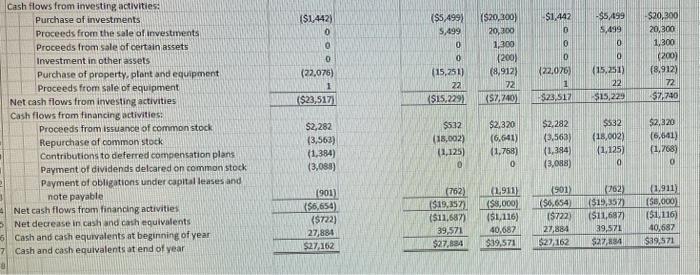

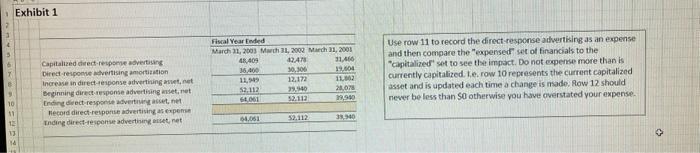

Capitalized dect-respome abvertiskn Direct response astvertising amortization increase in direct-response advertining anct, net begining dirctursponse advertising wiet, net Erdine dis ect responde asvertuwry ascet, net. Hecord direct-resporte advertising as copeme Inding direst-tesponse advertiong arset, net Use row 11 to record the direct-response advertiking as an expense and then compare the "expensed" set of finarcials to the "Capitalized" set to see the impsct. Do not oupense more than is carrently capitalized. t.e. row 10 represents the current capitalized asset and is updated each time a change is made, Rov 12 should never be less than $0 otherwise vou have overstated your expense. POLYMEDICA CORPORATION Consolidated Statements of Income Expensed For Period Ended March 31 (in thousands) Net revenues Cost of sales Gross margin Selling, general, and administrative expenses Income from operations \begin{tabular}{|c|||||||} \hline 2003 \\ \hline$356,185 \\ \hline 126,844 \\ \hline 229,341 \\ \hline 163,768 \\ \hline$65,573 \\ \hline \end{tabular} Other income and expenses Investment income Interest and other expense $247 Minority interest Income before income taxes Income tax provision Income before cumulative effect of change in accounting principle Cumulative effect of change in accounting principle, net of taxes of $9,187 and $4,121 Net income Income per weighted average share before cumulative effect of change in accounting principle: Basic Diluted Cumulative effect of change in accounting principle: Basic (272) Diluted Capitatized $1,105 (180) (564) 5361 151,786(733)54,30517,645 18,483 $220,0462001 76,973 143,073 133,609 $48,533$45,519143,07397,554 \begin{tabular}{|r|} \hline 163,768 \\ \hline$65,573 \\ \\ $247 \\ 1272) \\ 0 \\ \hline 5,55 \\ \hline$65,548 \\ 25,301 \\ \hline \end{tabular} \( \$ 30,4 1 1 \longdiv { \$ 2 9 , 6 6 0 } \) $40,247 $30,411 $29,660 Net income per weighted average share: Basic Diluted $30,411$0 $22,73456,926 $25.632.$14.615 243 Weighted average shares, basic 3.29 3.21 2.38 2.25 3.29 2.43 2.38 2.25 2.18 (1.19) 0.00 (0.53) (1.19) (0.51) (1.16) 0.00 (0.53) (1.16) 0.00 2.09 2.43 2.04 2.38 1.73 12,506 1.67 12,241 Weighted average shares, diluted 12.546 12,780 13,176 2.09 0.00 (0.51) 59 Instructions Exhibit 1 POLYMEDICA CORPORATION Expensed For Period Ended March 31 (in thousands) Current assets: Cash and cash equivalents Investments Accounts receivable (net of allowances of 22,556 and 15,53 Inventories Deferred Income Taxes Prepaid expenses and other current assets Total current assets Property, plant and equipment, net Goodwill Intangible assets, net Direct-response advertising, net Other assets Total assets Current liabilities: Accounts payable Accrued expenses Current portion, capital lease obligations and note payable Total current liabilities Long-term note payable, capital lease and other obligation $31,8891,87 Deferred income taxes Total liabilities Shareholders' equity: Preferred stock, $.01 par value; 2,000,000 shares authorizec Common stock $.01 par value; 50,000,000 shares authorized 13,314,982 and 13,300,477 shares issued as of March 31 . 2003 and 2002 respectively Treasury stock, at cost (1,029,393 and 1,143,158 shares as of March 31, 2003 and 2002, respectively Deferred compensation Additional paid-in-capital Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 133 133 133 133 (22,185) (21,067) (22,185) (54) 119,375 98,288 $196,675$250,969 so (54) so POLMEOICA CORPORATION Consolidated Statements of Cash Flows Cash flows from investing activities: Purchase of investments Proceeds from the sale of investments Proceeds from sale of certain assets Investment in other assets Purchase of property, plant and equipment (\$1,442) Proceeds from sale of equipment Net cash flows from investing activities Cash flows from financing activities: Proceeds from issuance of common stock Repurchase of common stock Contributions to deferred compensation plans Payment of dividends delcared on common stock Payment of obligations under capital leases and note payable Net cash flows from financing activitied Net decrease in cash and cash equivalents (22,076) ($5,499)($20,300) $1,442 $5,499$20,300 0 5,499 20,300 0 5,499 20,300 0 1,300 0. (200) 0 (15,251) (8,912) D. 1,300 (22,076) (15,251) (200) (8,912) 1($23,517) \begin{tabular}{|r|r|r|} \hline 1 & 22 & 72 \\ \hline$23,517 & $15,229 & $7,740 \\ \hline \end{tabular} $2,282 $532 (3,563) (18,002) $2,320 (1,125) 0 (1,758) (3,089) 0 $2,282 $532 52,320 [3,563\} (18,002) [6,641) (1,394) (1,125) (1.768) (3,088) a 0 Cash and cash equivalents at beginning of year \begin{tabular}{c|c|c} \hline(901) & (762) & (1,911) \\ \hline($4,654) & ($19,357) & (55,000) \\ \hline($72) & ($11,697) & ($1,116) \\ 27,884 & 39,571 & 40,687 \\ \hline$27,162 & $27,834 & $39,571 \\ \hline \end{tabular} Cash and cash equivalents at end of year (901)($6,654)($722)27,884$27,162 Capitalized dect-respome abvertiskn Direct response astvertising amortization increase in direct-response advertining anct, net begining dirctursponse advertising wiet, net Erdine dis ect responde asvertuwry ascet, net. Hecord direct-resporte advertising as copeme Inding direst-tesponse advertiong arset, net Use row 11 to record the direct-response advertiking as an expense and then compare the "expensed" set of finarcials to the "Capitalized" set to see the impsct. Do not oupense more than is carrently capitalized. t.e. row 10 represents the current capitalized asset and is updated each time a change is made, Rov 12 should never be less than $0 otherwise vou have overstated your expense. POLYMEDICA CORPORATION Consolidated Statements of Income Expensed For Period Ended March 31 (in thousands) Net revenues Cost of sales Gross margin Selling, general, and administrative expenses Income from operations \begin{tabular}{|c|||||||} \hline 2003 \\ \hline$356,185 \\ \hline 126,844 \\ \hline 229,341 \\ \hline 163,768 \\ \hline$65,573 \\ \hline \end{tabular} Other income and expenses Investment income Interest and other expense $247 Minority interest Income before income taxes Income tax provision Income before cumulative effect of change in accounting principle Cumulative effect of change in accounting principle, net of taxes of $9,187 and $4,121 Net income Income per weighted average share before cumulative effect of change in accounting principle: Basic Diluted Cumulative effect of change in accounting principle: Basic (272) Diluted Capitatized $1,105 (180) (564) 5361 151,786(733)54,30517,645 18,483 $220,0462001 76,973 143,073 133,609 $48,533$45,519143,07397,554 \begin{tabular}{|r|} \hline 163,768 \\ \hline$65,573 \\ \\ $247 \\ 1272) \\ 0 \\ \hline 5,55 \\ \hline$65,548 \\ 25,301 \\ \hline \end{tabular} \( \$ 30,4 1 1 \longdiv { \$ 2 9 , 6 6 0 } \) $40,247 $30,411 $29,660 Net income per weighted average share: Basic Diluted $30,411$0 $22,73456,926 $25.632.$14.615 243 Weighted average shares, basic 3.29 3.21 2.38 2.25 3.29 2.43 2.38 2.25 2.18 (1.19) 0.00 (0.53) (1.19) (0.51) (1.16) 0.00 (0.53) (1.16) 0.00 2.09 2.43 2.04 2.38 1.73 12,506 1.67 12,241 Weighted average shares, diluted 12.546 12,780 13,176 2.09 0.00 (0.51) 59 Instructions Exhibit 1 POLYMEDICA CORPORATION Expensed For Period Ended March 31 (in thousands) Current assets: Cash and cash equivalents Investments Accounts receivable (net of allowances of 22,556 and 15,53 Inventories Deferred Income Taxes Prepaid expenses and other current assets Total current assets Property, plant and equipment, net Goodwill Intangible assets, net Direct-response advertising, net Other assets Total assets Current liabilities: Accounts payable Accrued expenses Current portion, capital lease obligations and note payable Total current liabilities Long-term note payable, capital lease and other obligation $31,8891,87 Deferred income taxes Total liabilities Shareholders' equity: Preferred stock, $.01 par value; 2,000,000 shares authorizec Common stock $.01 par value; 50,000,000 shares authorized 13,314,982 and 13,300,477 shares issued as of March 31 . 2003 and 2002 respectively Treasury stock, at cost (1,029,393 and 1,143,158 shares as of March 31, 2003 and 2002, respectively Deferred compensation Additional paid-in-capital Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 133 133 133 133 (22,185) (21,067) (22,185) (54) 119,375 98,288 $196,675$250,969 so (54) so POLMEOICA CORPORATION Consolidated Statements of Cash Flows Cash flows from investing activities: Purchase of investments Proceeds from the sale of investments Proceeds from sale of certain assets Investment in other assets Purchase of property, plant and equipment (\$1,442) Proceeds from sale of equipment Net cash flows from investing activities Cash flows from financing activities: Proceeds from issuance of common stock Repurchase of common stock Contributions to deferred compensation plans Payment of dividends delcared on common stock Payment of obligations under capital leases and note payable Net cash flows from financing activitied Net decrease in cash and cash equivalents (22,076) ($5,499)($20,300) $1,442 $5,499$20,300 0 5,499 20,300 0 5,499 20,300 0 1,300 0. (200) 0 (15,251) (8,912) D. 1,300 (22,076) (15,251) (200) (8,912) 1($23,517) \begin{tabular}{|r|r|r|} \hline 1 & 22 & 72 \\ \hline$23,517 & $15,229 & $7,740 \\ \hline \end{tabular} $2,282 $532 (3,563) (18,002) $2,320 (1,125) 0 (1,758) (3,089) 0 $2,282 $532 52,320 [3,563\} (18,002) [6,641) (1,394) (1,125) (1.768) (3,088) a 0 Cash and cash equivalents at beginning of year \begin{tabular}{c|c|c} \hline(901) & (762) & (1,911) \\ \hline($4,654) & ($19,357) & (55,000) \\ \hline($72) & ($11,697) & ($1,116) \\ 27,884 & 39,571 & 40,687 \\ \hline$27,162 & $27,834 & $39,571 \\ \hline \end{tabular} Cash and cash equivalents at end of year (901)($6,654)($722)27,884$27,162