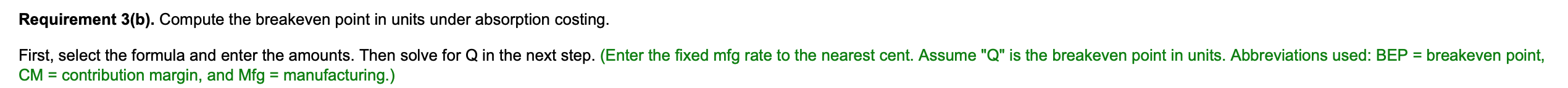

Help with this HW problem please? Only 1 requirement, drop down menu with the options is located below the question.

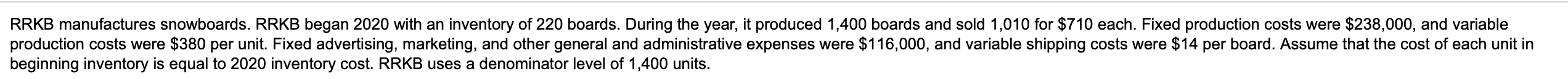

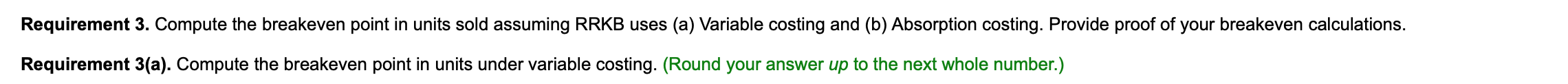

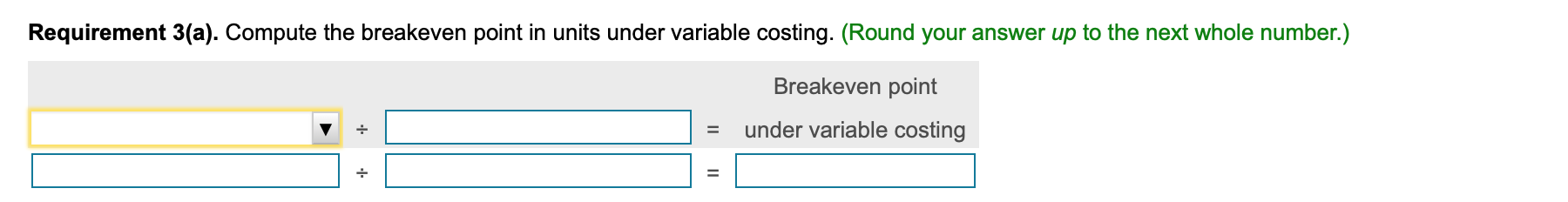

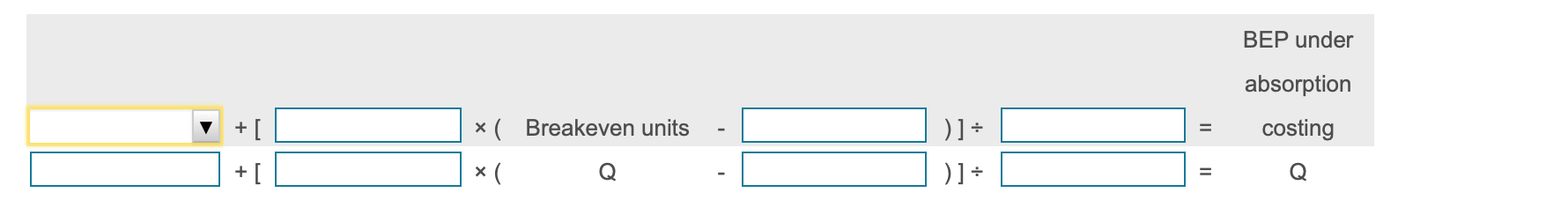

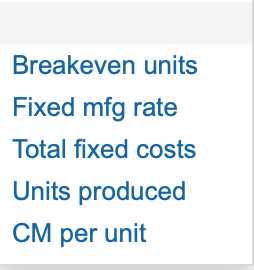

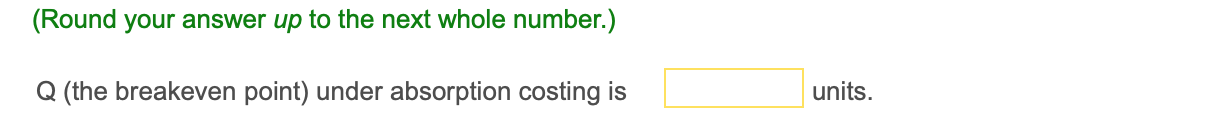

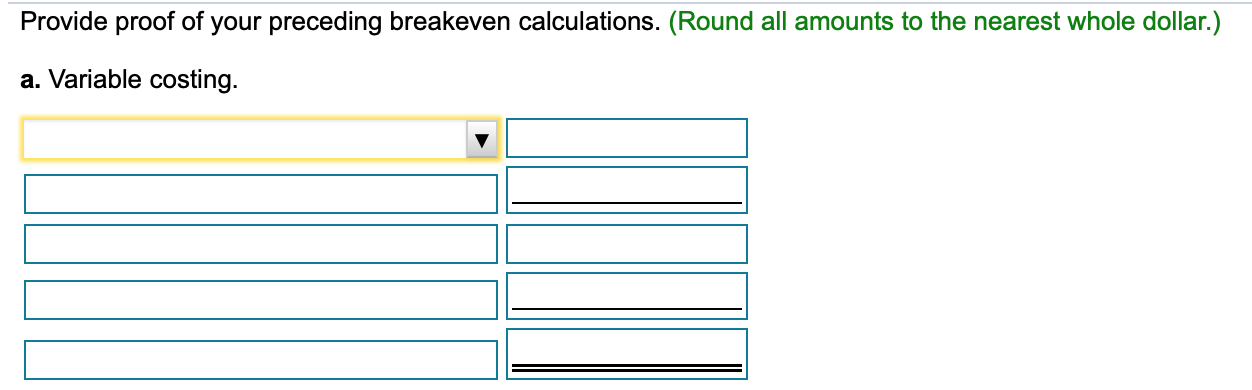

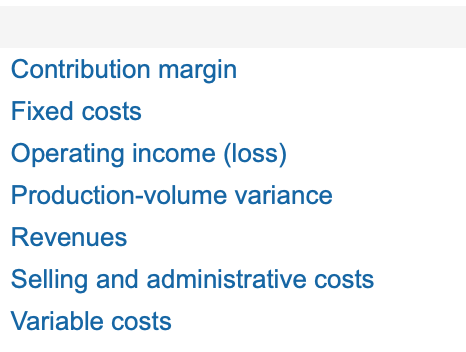

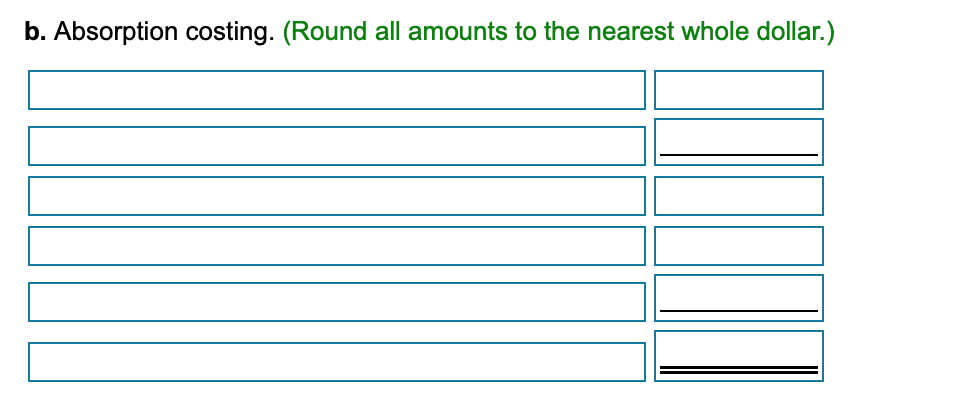

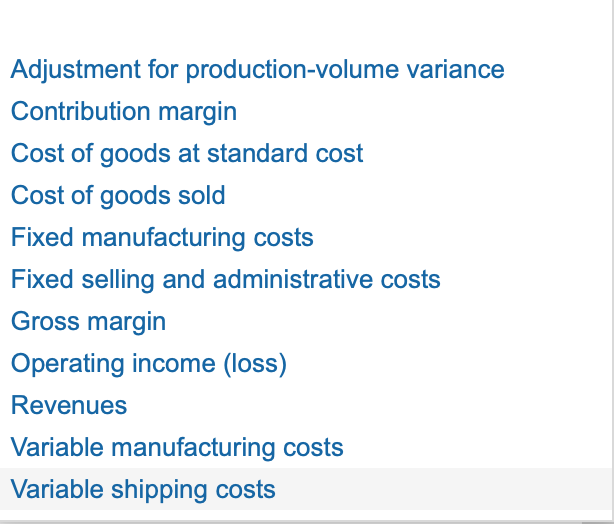

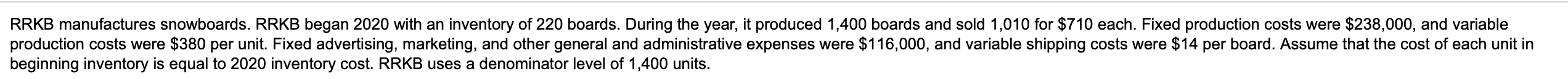

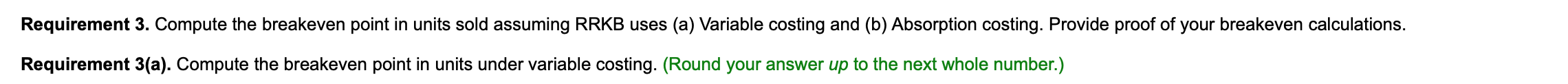

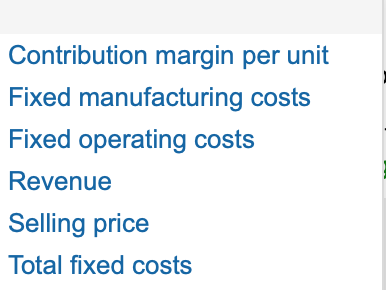

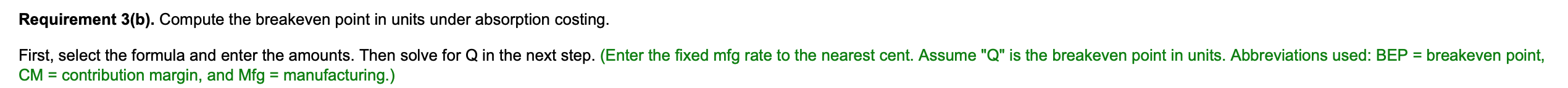

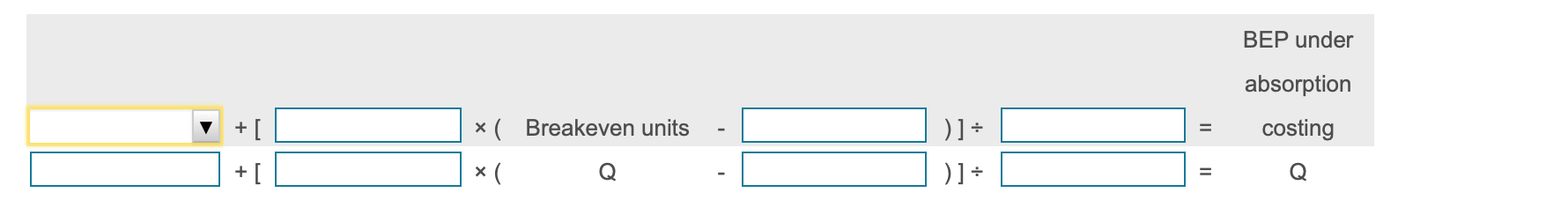

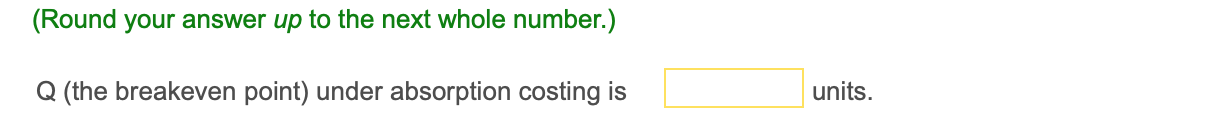

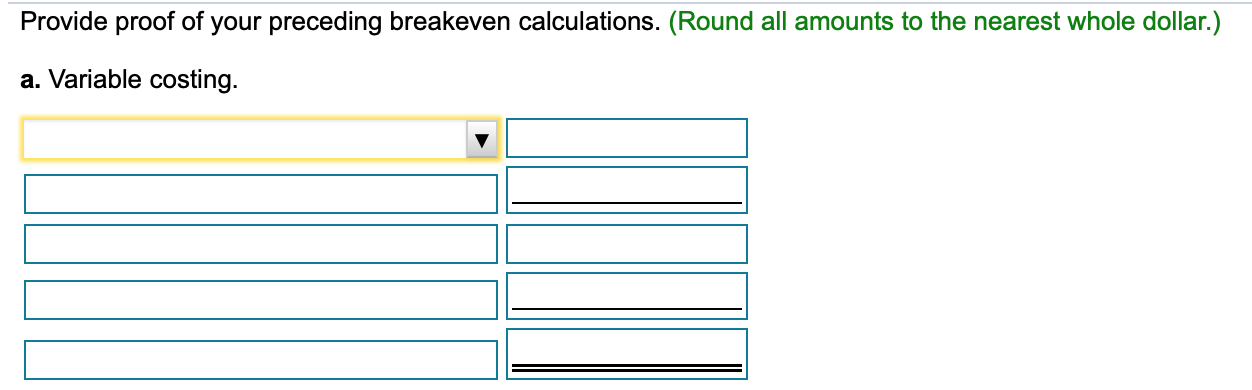

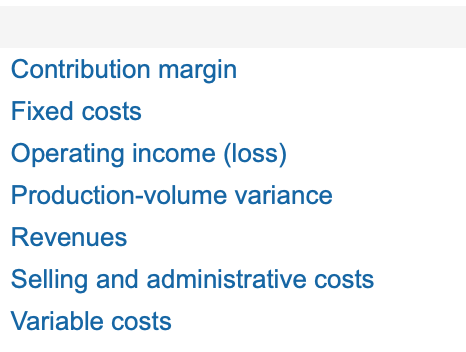

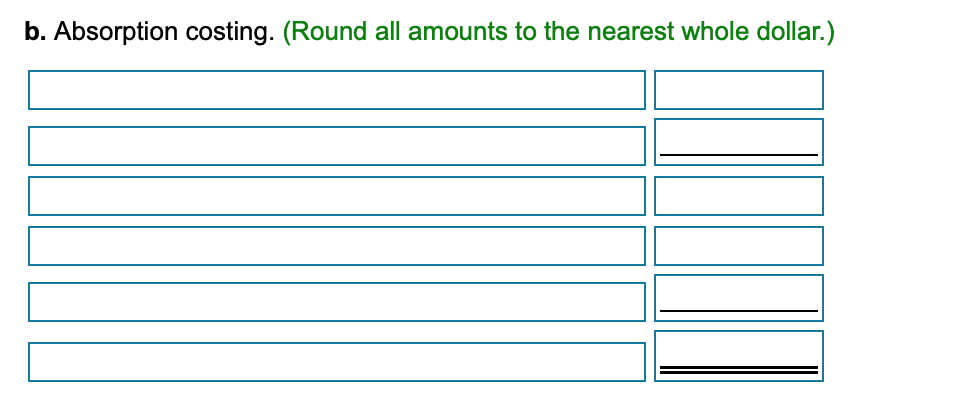

RRKB manufactures snowboards. RRKB began 2020 with an inventory of 220 boards. During the year, it produced 1,400 boards and sold 1,010 for $710 each. Fixed production costs were $238,000, and variable production costs were $380 per unit. Fixed advertising, marketing, and other general and administrative expenses were $116,000, and variable shipping costs were $14 per board. Assume that the cost of each unit in beginning inventory is equal to 2020 inventory cost. RRKB uses a denominator level of 1,400 units. Requirement 3. Compute the breakeven point in units sold assuming RRKB uses (a) Variable costing and (b) Absorption costing. Provide proof of your breakeven calculations. Requirement 3(a). Compute the breakeven point in units under variable costing. (Round your answer up to the next whole number.) Requirement 3(a). Compute the breakeven point in units under variable costing. (Round your answer up to the next whole number.) Breakeven point under variable costing + = Contribution margin per unit Fixed manufacturing costs Fixed operating costs Revenue Selling price Total fixed costs Requirement 3(b). Compute the breakeven point in units under absorption costing. First, select the formula and enter the amounts. Then solve for Q in the next step. (Enter the fixed mfg rate to the nearest cent. Assume "Q" is the breakeven point in units. Abbreviations used: BEP = breakeven point, CM = contribution margin, and Mfg = manufacturing.) BEP under absorption costing + [ )]: * ( Breakeven units *( Q )] : Q Breakeven units Fixed mfg rate Total fixed costs Units produced CM per unit (Round your answer up to the next whole number.) Q (the breakeven point) under absorption costing is units. Provide proof of your preceding breakeven calculations. (Round all amounts to the nearest whole dollar.) a. Variable costing. Contribution margin Fixed costs Operating income (loss) Production-volume variance Revenues Selling and administrative costs Variable costs b. Absorption costing. (Round all amounts to the nearest whole dollar.) Adjustment for production-volume variance Contribution margin Cost of goods at standard cost Cost of goods sold Fixed manufacturing costs Fixed selling and administrative costs Gross margin Operating income (loss) Revenues Variable manufacturing costs Variable shipping costs