Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HELP2 Fill in the table using the following information. Assets required for operation: $2,200 Case A-firm uses only equity financing Case B-firm uses 30% debt

HELP2

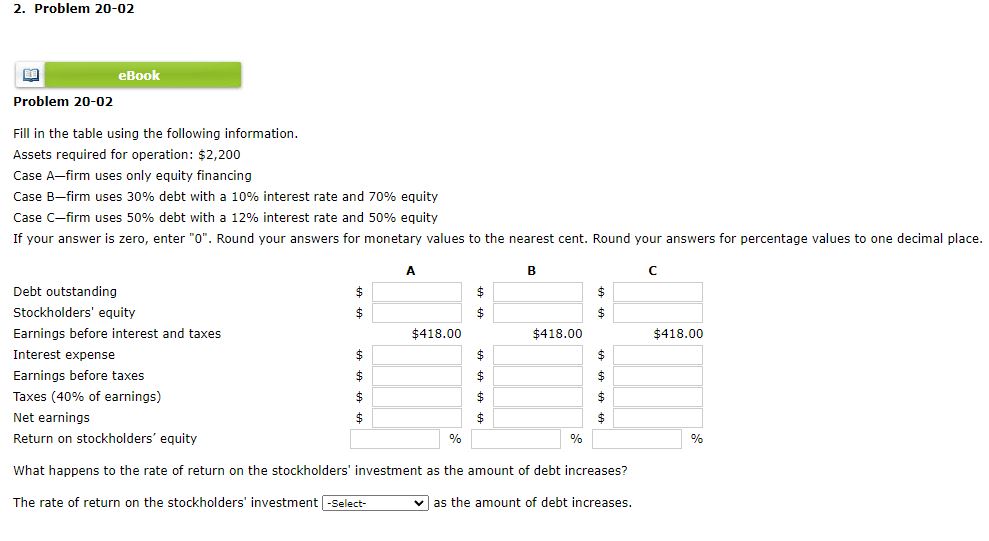

Fill in the table using the following information. Assets required for operation: $2,200 Case A-firm uses only equity financing Case B-firm uses 30% debt with a 10% interest rate and 70% equity Case C-firm uses 50% debt with a 12% interest rate and 50% equity If your answer is zero, enter "0". Round your answers for monetary values to the nearest cent. Round your answers for percentage values to one decimal place. What happens to the rate of return on the stockholders' investment as the amount of debt increases? The rate of return on the stockholders' investment as the amount of debt increasesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started