Answered step by step

Verified Expert Solution

Question

1 Approved Answer

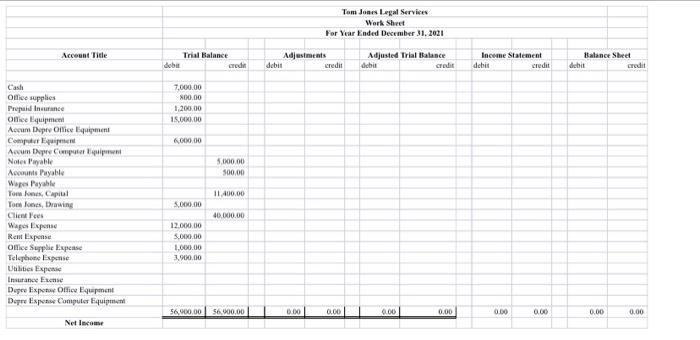

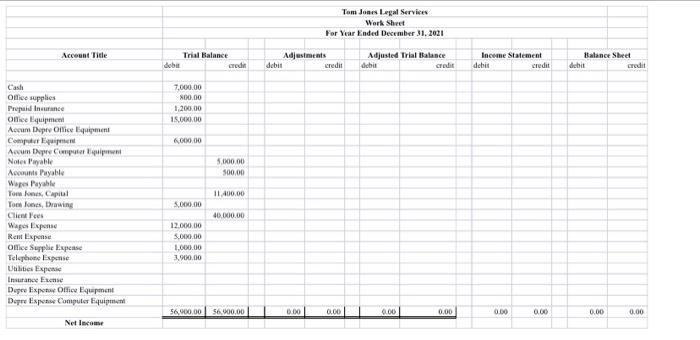

helppppppp Tom Jones Legal Services Work Sheet For Year Ended December 31, 2021 Account Title doba Trial Balance cred Adjustments debit credit Adjusted Trial Balance

helppppppp

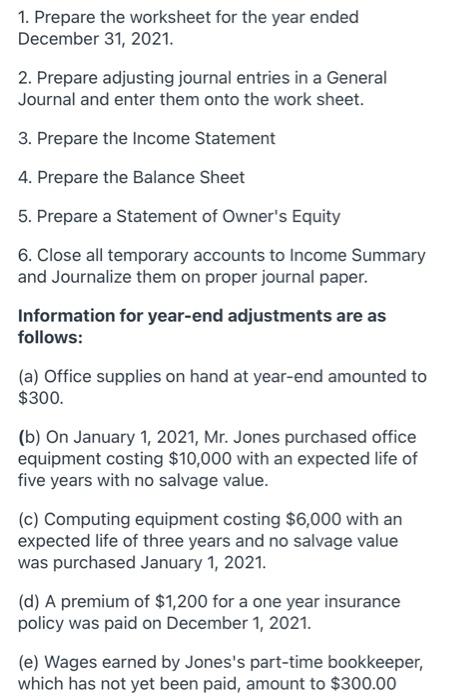

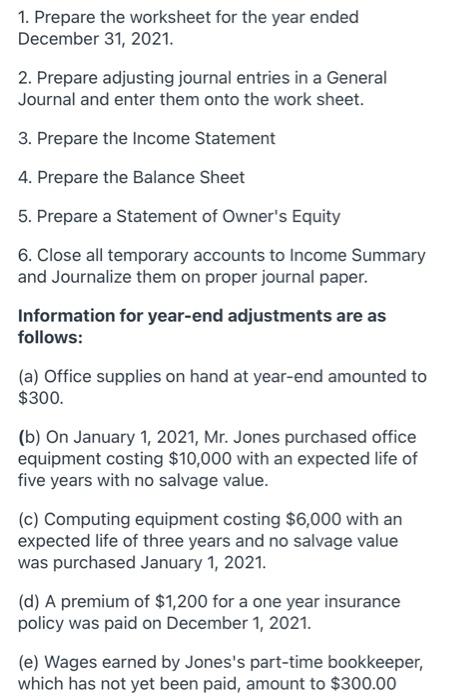

Tom Jones Legal Services Work Sheet For Year Ended December 31, 2021 Account Title doba Trial Balance cred Adjustments debit credit Adjusted Trial Balance cred Insome Statement debit credit Balance Sheet dcbit credit 7.000.00 200.00 1,200.00 15.000.00 6.000.00 5,000.00 500.00 Cash Office supplies Prepaid nunc Office Hopment Accum Depey Omequipment Computer Equip Acum put Notes Payable Accounts Payable Wared Payable Tomos Capital Toe Roos, Drawing Clientes Wages Expense Rent Expense Office Suppliespase Telephone Expense Utilities Exporte Insurance Depee Expo Office Equipment Der Expo Computer Equipment 11 400.00 5.000.00 40,000.00 12.000.00 5.000.00 1.000.00 3,900.00 56,000.00 56 000,00 6.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Net Income 1. Prepare the worksheet for the year ended December 31, 2021. 2. Prepare adjusting journal entries in a General Journal and enter them onto the work sheet. 3. Prepare the income Statement 4. Prepare the Balance Sheet 5. Prepare a Statement of Owner's Equity 6. Close all temporary accounts to Income Summary and Journalize them on proper journal paper. Information for year-end adjustments are as follows: (a) Office supplies on hand at year-end amounted to $300. (b) On January 1, 2021, Mr. Jones purchased office equipment costing $10,000 with an expected life of five years with no salvage value. (c) Computing equipment costing $6,000 with an expected life of three years and no salvage value was purchased January 1, 2021. (d) A premium of $1,200 for a one year insurance policy was paid on December 1, 2021. (e) Wages earned by Jones's part-time bookkeeper, which has not yet been paid, amount to $300.00 Tom Jones Legal Services Work Sheet For Year Ended December 31, 2021 Account Title doba Trial Balance cred Adjustments debit credit Adjusted Trial Balance cred Insome Statement debit credit Balance Sheet dcbit credit 7.000.00 200.00 1,200.00 15.000.00 6.000.00 5,000.00 500.00 Cash Office supplies Prepaid nunc Office Hopment Accum Depey Omequipment Computer Equip Acum put Notes Payable Accounts Payable Wared Payable Tomos Capital Toe Roos, Drawing Clientes Wages Expense Rent Expense Office Suppliespase Telephone Expense Utilities Exporte Insurance Depee Expo Office Equipment Der Expo Computer Equipment 11 400.00 5.000.00 40,000.00 12.000.00 5.000.00 1.000.00 3,900.00 56,000.00 56 000,00 6.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Net Income 1. Prepare the worksheet for the year ended December 31, 2021. 2. Prepare adjusting journal entries in a General Journal and enter them onto the work sheet. 3. Prepare the income Statement 4. Prepare the Balance Sheet 5. Prepare a Statement of Owner's Equity 6. Close all temporary accounts to Income Summary and Journalize them on proper journal paper. Information for year-end adjustments are as follows: (a) Office supplies on hand at year-end amounted to $300. (b) On January 1, 2021, Mr. Jones purchased office equipment costing $10,000 with an expected life of five years with no salvage value. (c) Computing equipment costing $6,000 with an expected life of three years and no salvage value was purchased January 1, 2021. (d) A premium of $1,200 for a one year insurance policy was paid on December 1, 2021. (e) Wages earned by Jones's part-time bookkeeper, which has not yet been paid, amount to $300.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started