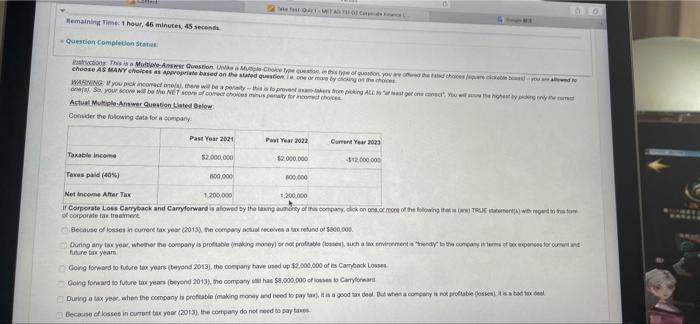

Hemaining Time: 1 hour, 46 minutes 45 seconds - Question Completion Status Is This is a Mures Question Choice of you who choose AS MANY Choles as appropriate based on the stated in one or more by the WANG you pick incorrect there will be your erat Se your own the NET se come chusty for the Actuat MultipleAnswer Question Listetti Consider the following data for a company Past Year 2021 Post Year 2022 Current Year 2023 Taxable income $2.000.000 32.000.000 512.000.000 Taxes paid (40%) 300,000 100.000 Net Income After Tax 1.200,000 1.200.000 it Corporate Los Cairytack and Carryforward is slowed by the langsunny company dick on the long TRUE regard to the to of corporate as treatment Because of losses incurrent tax year (2013), the company cul receive a tax retund of $800.000 During any tax year, whether the company is profitable (making money or not profitable for such a taximent is way to company storms of experte Future tax years Going forward to future tax years beyond 2013, the company wewed up $2,000,000 of its Camyback Los Going forward to future tax years beyond 2013, the company has $9.000.000 to Canyon During a tax you when the company is profitable making money and need to pay is a good to but what a company is not profitable is botox Because of losses montax yeur (2013), the company do not need to paymes Hemaining Time: 1 hour, 46 minutes 45 seconds - Question Completion Status Is This is a Mures Question Choice of you who choose AS MANY Choles as appropriate based on the stated in one or more by the WANG you pick incorrect there will be your erat Se your own the NET se come chusty for the Actuat MultipleAnswer Question Listetti Consider the following data for a company Past Year 2021 Post Year 2022 Current Year 2023 Taxable income $2.000.000 32.000.000 512.000.000 Taxes paid (40%) 300,000 100.000 Net Income After Tax 1.200,000 1.200.000 it Corporate Los Cairytack and Carryforward is slowed by the langsunny company dick on the long TRUE regard to the to of corporate as treatment Because of losses incurrent tax year (2013), the company cul receive a tax retund of $800.000 During any tax year, whether the company is profitable (making money or not profitable for such a taximent is way to company storms of experte Future tax years Going forward to future tax years beyond 2013, the company wewed up $2,000,000 of its Camyback Los Going forward to future tax years beyond 2013, the company has $9.000.000 to Canyon During a tax you when the company is profitable making money and need to pay is a good to but what a company is not profitable is botox Because of losses montax yeur (2013), the company do not need to paymes