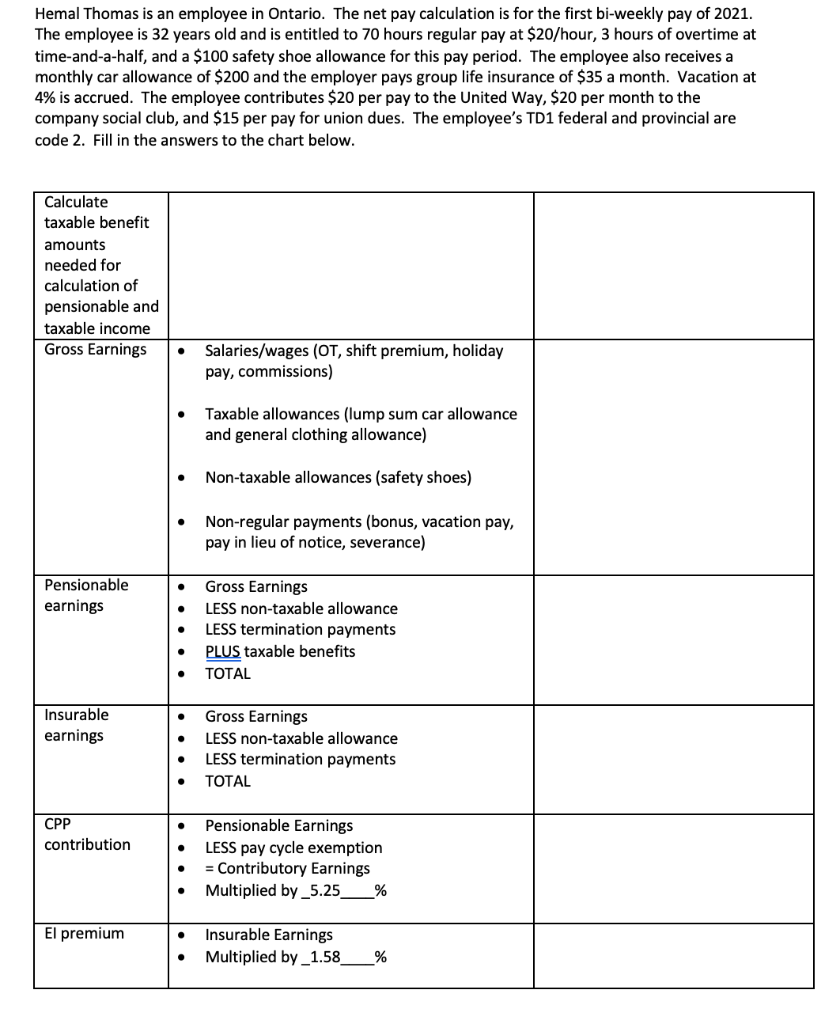

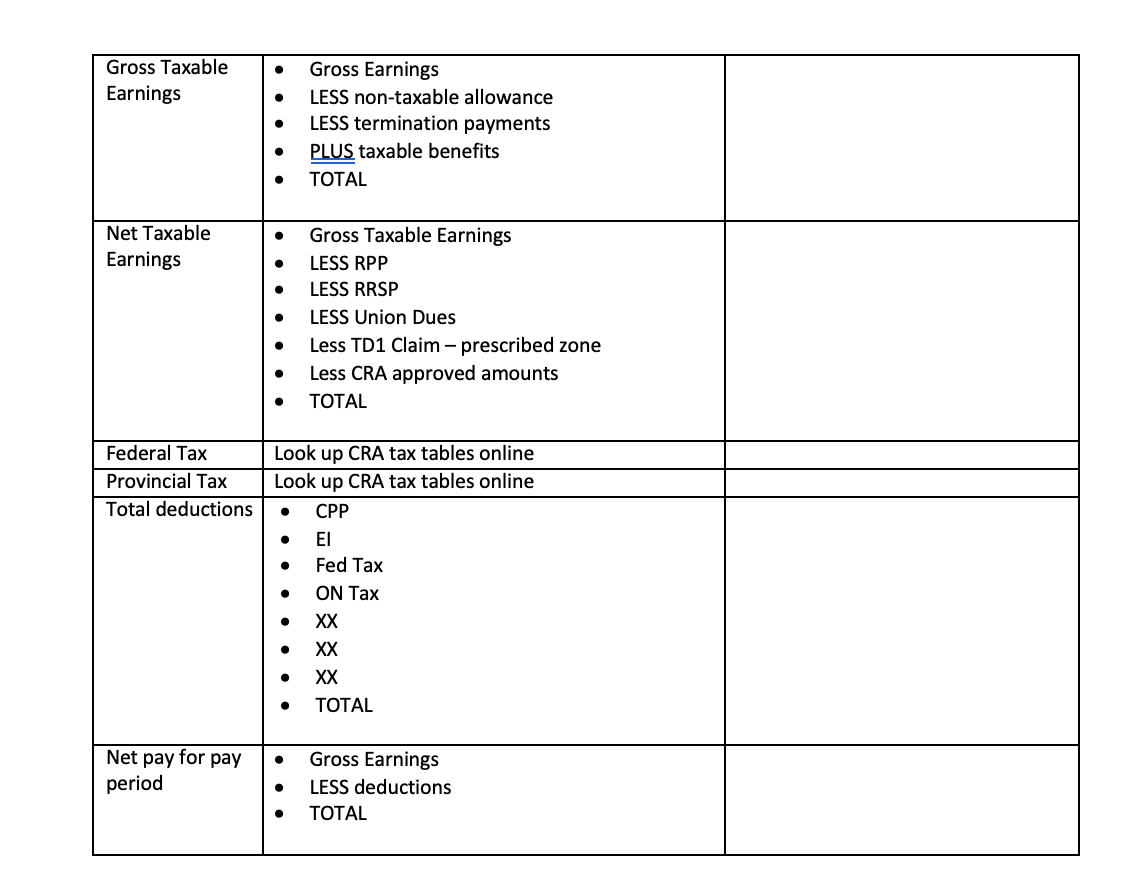

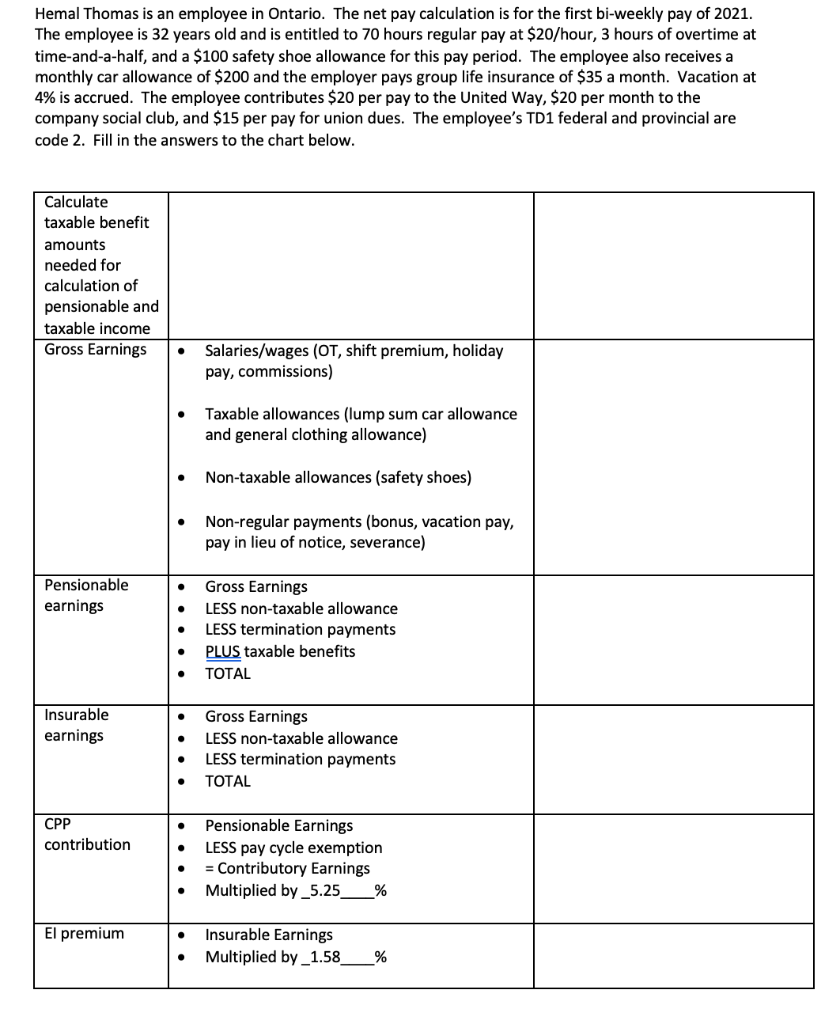

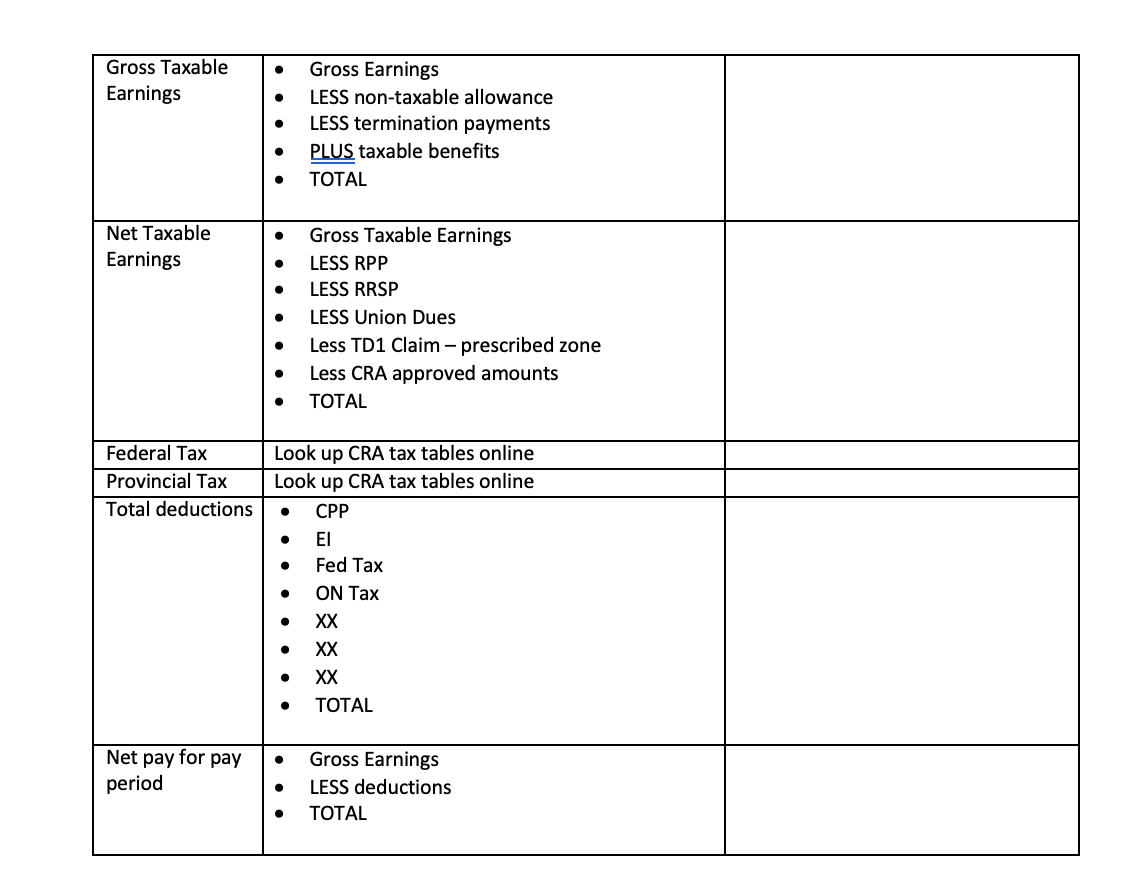

Hemal Thomas is an employee in Ontario. The net pay calculation is for the first bi-weekly pay of 2021. The employee is 32 years old and is entitled to 70 hours regular pay at $20/hour, 3 hours of overtime at time-and-a-half, and a $100 safety shoe allowance for this pay period. The employee also receives a monthly car allowance of $200 and the employer pays group life insurance of $35 a month. Vacation at 4% is accrued. The employee contributes $20 per pay to the United Way, $20 per month to the company social club, and $15 per pay for union dues. The employee's TD1 federal and provincial are code 2. Fill in the answers to the chart below. Calculate taxable benefit amounts needed for calculation of pensionable and taxable income Gross Earnings . Salaries/wages (OT, shift premium, holiday pay, commissions) Taxable allowances (lump sum car allowance and general clothing allowance) C Non-taxable allowances (safety shoes) . Non-regular payments (bonus, vacation pay, pay in lieu of notice, severance) . Pensionable earnings . Gross Earnings LESS non-taxable allowance LESS termination payments PLUS taxable benefits TOTAL . Insurable earnings . Gross Earnings LESS non-taxable allowance LESS termination payments TOTAL . CPP contribution . Pensionable Earnings LESS pay cycle exemption = Contributory Earnings Multiplied by _5.25 % . El premium Insurable Earnings Multiplied by _1.58_ % Gross Taxable Earnings . Gross Earnings LESS non-taxable allowance LESS termination payments PLUS taxable benefits TOTAL . . . Net Taxable Earnings . . Gross Taxable Earnings LESS RPP LESS RRSP LESS Union Dues Less TD1 Claim - prescribed zone Less CRA approved amounts TOTAL . . Federal Tax Provincial Tax Total deductions . Look up CRA tax tables online Look up CRA tax tables online CPP EI Fed Tax ON Tax XX XX XX TOTAL . . . . . Net pay for pay period Gross Earnings LESS deductions TOTAL . Hemal Thomas is an employee in Ontario. The net pay calculation is for the first bi-weekly pay of 2021. The employee is 32 years old and is entitled to 70 hours regular pay at $20/hour, 3 hours of overtime at time-and-a-half, and a $100 safety shoe allowance for this pay period. The employee also receives a monthly car allowance of $200 and the employer pays group life insurance of $35 a month. Vacation at 4% is accrued. The employee contributes $20 per pay to the United Way, $20 per month to the company social club, and $15 per pay for union dues. The employee's TD1 federal and provincial are code 2. Fill in the answers to the chart below. Calculate taxable benefit amounts needed for calculation of pensionable and taxable income Gross Earnings . Salaries/wages (OT, shift premium, holiday pay, commissions) Taxable allowances (lump sum car allowance and general clothing allowance) C Non-taxable allowances (safety shoes) . Non-regular payments (bonus, vacation pay, pay in lieu of notice, severance) . Pensionable earnings . Gross Earnings LESS non-taxable allowance LESS termination payments PLUS taxable benefits TOTAL . Insurable earnings . Gross Earnings LESS non-taxable allowance LESS termination payments TOTAL . CPP contribution . Pensionable Earnings LESS pay cycle exemption = Contributory Earnings Multiplied by _5.25 % . El premium Insurable Earnings Multiplied by _1.58_ % Gross Taxable Earnings . Gross Earnings LESS non-taxable allowance LESS termination payments PLUS taxable benefits TOTAL . . . Net Taxable Earnings . . Gross Taxable Earnings LESS RPP LESS RRSP LESS Union Dues Less TD1 Claim - prescribed zone Less CRA approved amounts TOTAL . . Federal Tax Provincial Tax Total deductions . Look up CRA tax tables online Look up CRA tax tables online CPP EI Fed Tax ON Tax XX XX XX TOTAL . . . . . Net pay for pay period Gross Earnings LESS deductions TOTAL