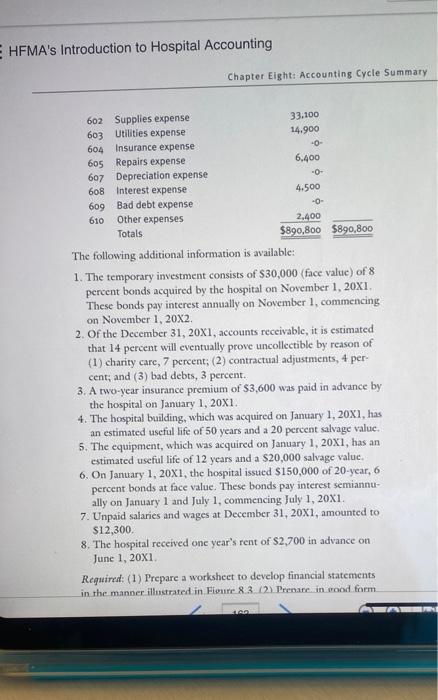

HEMA's Introduction to Hospital Accounting Chapter Eight: Accounting Cycle Summary 602 Supplies expense 33.100 603 Utilities expense 14.900 604 Insurance expense -0- 605 Repairs expense 6.400 607 Depreciation expense 608 Interest expense 4.500 609 Bad debt expense 610 Other expenses 2,400 Totals $890,800 $890,800 The following additional information is available: 1. The temporary investment consists of $30,000 (face value) of 8 percent bonds acquired by the hospital on November 1, 20X1. These bonds pay interest annually on November 1, commencing on November 1, 20X2 2. Of the December 31, 20X1, accounts receivable, it is estimated that 14 percent will eventually prove uncollectible by reason of (1) charity care, 7 percent; (2) contractual adjustments, 4 per- cent; and (3) bad debts, 3 percent. 3. A two-year insurance premium of $3,600 was paid in advance by the hospital on January 1, 20X1. 4. The hospital building, which was acquired on January 1, 20x1, has an estimated useful life of 50 years and a 20 percent salvage valuc. 5. The equipment, which was acquired on January 1, 20x1, has an estimated useful life of 12 years and a $20,000 salvage value 6. On January 1, 20X1, the hospital issued $150,000 of 20-year, 6 percent bonds at face value. These bonds pay interest semiannu- ally on January 1 and July 1, commencing July 1, 20x1. 7. Unpaid salaries and wages at December 31, 20x1, amounted to $12,300. 8. The hospital received one year's rent of $2,700 in advance on June 1, 20X1 Required: (1) Prepare a worksheet to develop financial statements in the manner illustrated in Fiore 8.3. 12. Prenare, in wood form HEMA's Introduction to Hospital Accounting Chapter Eight: Accounting Cycle Summary 602 Supplies expense 33.100 603 Utilities expense 14.900 604 Insurance expense -0- 605 Repairs expense 6.400 607 Depreciation expense 608 Interest expense 4.500 609 Bad debt expense 610 Other expenses 2,400 Totals $890,800 $890,800 The following additional information is available: 1. The temporary investment consists of $30,000 (face value) of 8 percent bonds acquired by the hospital on November 1, 20X1. These bonds pay interest annually on November 1, commencing on November 1, 20X2 2. Of the December 31, 20X1, accounts receivable, it is estimated that 14 percent will eventually prove uncollectible by reason of (1) charity care, 7 percent; (2) contractual adjustments, 4 per- cent; and (3) bad debts, 3 percent. 3. A two-year insurance premium of $3,600 was paid in advance by the hospital on January 1, 20X1. 4. The hospital building, which was acquired on January 1, 20x1, has an estimated useful life of 50 years and a 20 percent salvage valuc. 5. The equipment, which was acquired on January 1, 20x1, has an estimated useful life of 12 years and a $20,000 salvage value 6. On January 1, 20X1, the hospital issued $150,000 of 20-year, 6 percent bonds at face value. These bonds pay interest semiannu- ally on January 1 and July 1, commencing July 1, 20x1. 7. Unpaid salaries and wages at December 31, 20x1, amounted to $12,300. 8. The hospital received one year's rent of $2,700 in advance on June 1, 20X1 Required: (1) Prepare a worksheet to develop financial statements in the manner illustrated in Fiore 8.3. 12. Prenare, in wood form