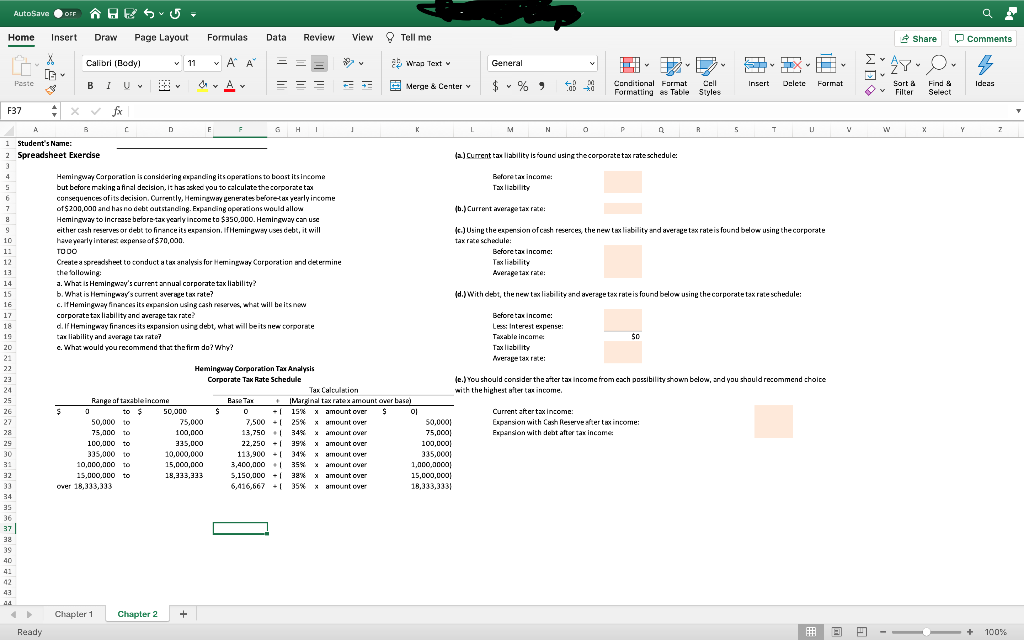

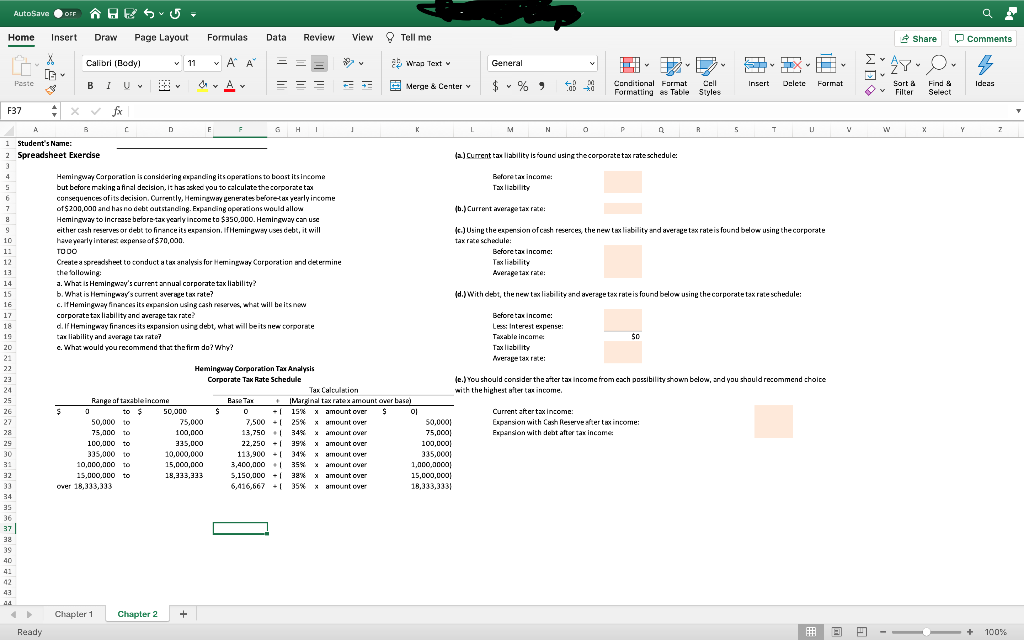

Hemingway Corporation is considering expanding its operations to boost its income but before making its final decision it has asked you to calculate the corporate tax consequences of its decision.

AutoSave OFF OFF AGES Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Calibrl (body) v AP X LG ab Wran Text v General LTX HI 28.0 4 Paste B 1 1 A = = - - Merge & Center Insert Delete Format Conditional Format Cell Formatting as Table Styles Sort & Filter v Find & Select Ideas F37 T W X Y 7 A B C D E F G I 1 1 K L M N P 5 U 1 Student's Name: 2 Spreadsheet Exercise (a) Current tax liability is found using thecorporate tax rate schedule: 3 4 Hemingway Carporation is considering expanding its operations to boast its income Before tax income: 5 but before making a final decision, is has seks you to calculate the corporate tax Tax liability 6 cunsequences of its decision. Currently, Hemingway generates before yearly income 7 of $200,000 and has nodebt outstanding. Expanding operations would allow (6.) Current average tax ruce 8 Hemingway to increase before tax yearly income to $350,000. Hemingway can use 9 either cash reserves or debt to financeits expansion. IfHemingway uses cebt, it will 1.) Using the expensionofcash reserces, the new talebilityard average texraleisuund belon using the curporate 10 have yearly interes: expense of $70,000. tax race schedule: 11 TODO Beforetax income: 12 Create a spreadsheet to conduct ata analysis ur Herningway Corporation and determine 13 the following Average tax race: 14 a. What is Hemingway's current annual corporate tax liability? 15 b. What is Hemingway's current average les rate? Ad.) With debt, the new tsx liability and average tax rate is found below using the corporate tax rate schedule: 16 c.it Hemingway finances its expansion using cash reserves, what will be its new 17 corporate tax liability and average takrat.c? Before tax income 18 d. If Hemingway finances its expansion using debt, what will be its new corporate Les interest expense: 19 tax liability and average tax rate7 Taxable income $0 20 c. What would you recommend that the firm do? Why? Tax liability 21 Merage tax rate: 22 Hemingway Corporation Tax Analysis 23 Corporate Tax Rate Schedule 1c.) You should consider the after tax income from cach possibility shown below, and you should recommend choice 24 Tax Calculation with the highest after tat income 25 Range af taxable income Base Tax + Marginal tax ratex amount over base 26 3 3 to $ 50,000 S 0 - 15 X amount over S 01 Current after tax income: 27 50,000 to 75,000 7,500 + 25% amount over +1 % X 50,0001 Expansion with Cash Reserve after tax income: 28 75,000 10 100,000 13,7501 34% x amount over 75,0001 Expansion with debt after tax income 29 100.000 to 335.000 22.250 -1 39% amount over 100,0001 335,000 10 10,000,000 113,900 -34% X amount over 335,0001 10,000,000 to 15,000,000 3,400,000 + 35% X amount om 1,000,0000 32 15.000.000 10 19,333,333 5.150.000 - - 1 322 X amount over 15,000,000 over 18,333,333 6,416,667 +1 35% * amount over 18,333,3331 34 35 36 371 39 3S 40 41 42 43 14 Chapter 1 Chapter 2 + Ready 100% AutoSave OFF OFF AGES Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Calibrl (body) v AP X LG ab Wran Text v General LTX HI 28.0 4 Paste B 1 1 A = = - - Merge & Center Insert Delete Format Conditional Format Cell Formatting as Table Styles Sort & Filter v Find & Select Ideas F37 T W X Y 7 A B C D E F G I 1 1 K L M N P 5 U 1 Student's Name: 2 Spreadsheet Exercise (a) Current tax liability is found using thecorporate tax rate schedule: 3 4 Hemingway Carporation is considering expanding its operations to boast its income Before tax income: 5 but before making a final decision, is has seks you to calculate the corporate tax Tax liability 6 cunsequences of its decision. Currently, Hemingway generates before yearly income 7 of $200,000 and has nodebt outstanding. Expanding operations would allow (6.) Current average tax ruce 8 Hemingway to increase before tax yearly income to $350,000. Hemingway can use 9 either cash reserves or debt to financeits expansion. IfHemingway uses cebt, it will 1.) Using the expensionofcash reserces, the new talebilityard average texraleisuund belon using the curporate 10 have yearly interes: expense of $70,000. tax race schedule: 11 TODO Beforetax income: 12 Create a spreadsheet to conduct ata analysis ur Herningway Corporation and determine 13 the following Average tax race: 14 a. What is Hemingway's current annual corporate tax liability? 15 b. What is Hemingway's current average les rate? Ad.) With debt, the new tsx liability and average tax rate is found below using the corporate tax rate schedule: 16 c.it Hemingway finances its expansion using cash reserves, what will be its new 17 corporate tax liability and average takrat.c? Before tax income 18 d. If Hemingway finances its expansion using debt, what will be its new corporate Les interest expense: 19 tax liability and average tax rate7 Taxable income $0 20 c. What would you recommend that the firm do? Why? Tax liability 21 Merage tax rate: 22 Hemingway Corporation Tax Analysis 23 Corporate Tax Rate Schedule 1c.) You should consider the after tax income from cach possibility shown below, and you should recommend choice 24 Tax Calculation with the highest after tat income 25 Range af taxable income Base Tax + Marginal tax ratex amount over base 26 3 3 to $ 50,000 S 0 - 15 X amount over S 01 Current after tax income: 27 50,000 to 75,000 7,500 + 25% amount over +1 % X 50,0001 Expansion with Cash Reserve after tax income: 28 75,000 10 100,000 13,7501 34% x amount over 75,0001 Expansion with debt after tax income 29 100.000 to 335.000 22.250 -1 39% amount over 100,0001 335,000 10 10,000,000 113,900 -34% X amount over 335,0001 10,000,000 to 15,000,000 3,400,000 + 35% X amount om 1,000,0000 32 15.000.000 10 19,333,333 5.150.000 - - 1 322 X amount over 15,000,000 over 18,333,333 6,416,667 +1 35% * amount over 18,333,3331 34 35 36 371 39 3S 40 41 42 43 14 Chapter 1 Chapter 2 + Ready 100%