Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Henderson radio One thing is certain, said Roberta Flannagan with a smile to her husband, Robert, over breakfast on Monday. I'll get a number of

Henderson radio

"One thing is certain," said Roberta Flannagan with a smile to her husband,

Robert, over breakfast on Monday. "I'll get a number of views on what our re-

quired return on equity is. I'm sure I'll get a rather detailed memo from TH, and

Fred and I seem to differ on the company's future prospects." Flannagan is the

chief finance officer of Henderson Radio, and until her arrival six years ago there

was no formal evaluation of the company's required return or cost of capital,

and no systematic procedure for evaluating capital budgeting proposals.

Investment selections were frequently made on '

"feel" and the opinion of Fred

Miller, the firm's talented general manager. Fortunately, his sense of what

would sell was uncanny and Henderson grew rapidly.

THE FIRM

Henderson, like many firms in the electrical equipment industry, is well diver-

sified in terms of products and markets and obtains a healthy percentage of its

sales from government contracts. Unlike most of the other companies, however,

it has not been especially aggressive in seeking government defense business.

Management's thinking is that the political winds surrounding defense spend-

ing can abruptly change direction, so it is best to stay out. Henderson is also un-

usual in that it has made no effort to move outside the electrical equipment in-

dustry. In recent years companies like American Electric and Westinghome have

entered such areas as financial services and cable TV. Miller has always resisted

this type of diversification, which he believes would overextend the company.

And precisely that has happened to some of the firms that tried.

Six years ago Miller worried that the industry was becoming "too darn com-

petitive" and felt Henderson would have to improve in all areas to continue to

grow. At his request the finance department was strengthened and Flannagan

was hired as a result. Currently it is time to review the hurdle rate the firm uses

in its capital budgeting. The final decision is made from Flannagan's office, but

suggestions are always received from Miller and Thomas Henderson, a major

stockholder and son of the company's founder.

TWO MEMORANDA

When Flanagan arrived at her office on Monday she found memos from both

of them and a letter from the firm's investment bankers. Miller suggested us-

ing a lower proportion of debt to finance projects. Although he feels the firm's

debt-equity mix has been optimal, he believes "increasing industry competition

coupled with uncertainty surrounding the world economy" dictate a more con-

servative financing mix in the future. Miller also notes that production tech-

niques within the industry are changing. Specifically, production processes will

likely involve a larger amount of fixed costs and a smaller amount of variable

"but if you look carefully you can read them." He recommended that "any cost-

of-equity estimate assume a 4 percent per year increase in dividends into the

foreseeable future." But Miller, who was still not comfortable with the concept

of a required return, wondered why the estimation was necessary. He pointed

to an in-house study showing the company earned 21.3 percent on the invest-

ments it had made over the last decade. "Why not use the return we have actu-

ally achieved as the hurdle rate instead of speculating on what we think the rate

is? Please give this idea consideration," he wrote in his memo.

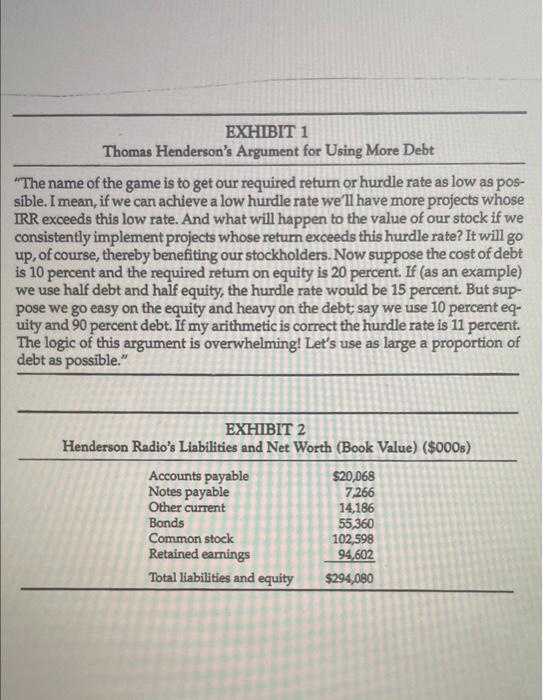

Thomas Henderson's opinions were quite different. "If it were my decision I

would use 10 percent equity and 90 percent debt. It makes no sense to use as

much equity as we do considering debt is so much cheaper." (See his argument

in Exhibit 1.) He then stated that if his suggested financing mix was considered

too radical he felt the company could safely increase its debt proportion to 30

percent, which he thought was the upper range of the industry average. Finally,

he predicted a "rosy future" for earnings and believed yearly dividends should

increase by 16 percent per year.

FLANNAGAN'S VIEW

Flanagan was certainly not in accord with Millner. She agreed there was more

competition but felt the market would be larger, too. For example, she believed

a strong demand for personal computers would lead to a much greater demand

for semiconductors, an important product of Henderson. Flannagan's view was that dividends and earning would grow indefinitely at a rate of 9-11 percent per

year. Nonetheless, she has much respect for Miller, who she thinks is the top

GM in the industry. Flannagan, however, does agree with Miller regarding the

technological changes that will alter the industry's production techniques and

cause an increase in operating leverage. She also believes that this fact is not

fully appreciated by industry analysts and the GMs of other firms.

The letter from the investment bankers contained no surprises. It pointed out

that the industry debt percentage ranged from 15 percent to 25 percent, where

the amounts of debt and equity were measured at book values and not market

values, and when accruals and accounts payable (so-called free capital) were ex-

cluded. The bankers recommended no increase in Henderson's present debt

percentage because of uncertainty about how the financial markets would react

and because there was some possibility Henderson's bond rating would fall.

They also felt the company could issue bonds at 12 percent and notes at 10 per-

cent and pointed out that one prestigious investment advisory service was pre-

dicting annual earnings and dividend growth for Henderson of 11 percent over

the next four years and 6 percent per year after that.

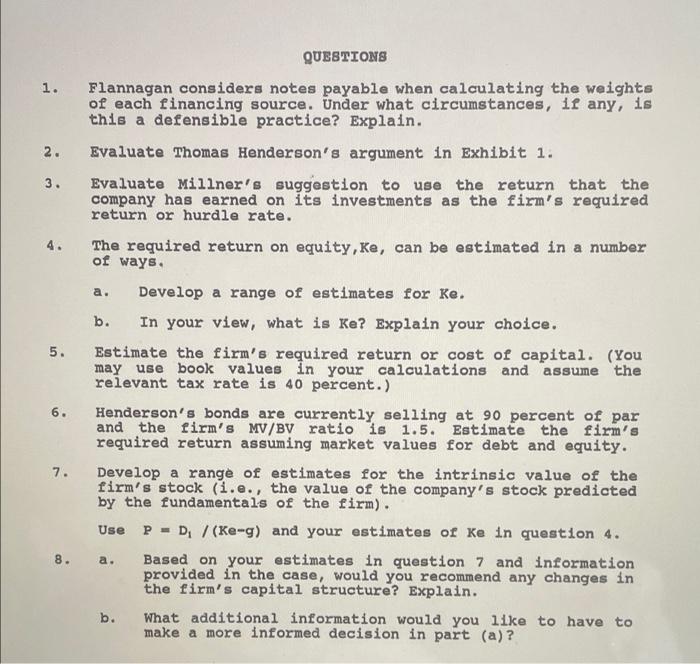

After reading all the correspondence Flanagan then reviewed some other in-

formation she had gathered, including the firm's current financing mix. (See

Exhibit 2.) Over the past year Henderson's stock ranged in price from $45 to $64

a share, and it is now at $50. The current dividend is $4 per share, and the firm's

relevant tax rate is 40 percent. Beta estimates for the company's stock ranged

from 1.3 to 1.7. These figures suggested Henderson was above average in risk,

a view she knew few of the company's executives would argue with. After sur-

veying a number of studies, she concluded investors must expect a risk pre-

mium of 8 percent above the risk-free return to buy the stock of an average risk

company, and a 17 percent premium if the company was considered extremely

risky. Finally, she noted the current rate on long-term government bonds was 9

percent.

As Flanagan began to prepare an estimate of the required return she

thought, "I wish someone would invent a method that takes the judgment out

of the evaluation. It may be true that the study of the required return is a science,

but the application of the theory is a real art.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started