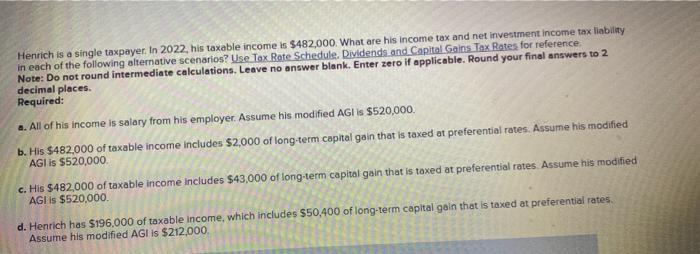

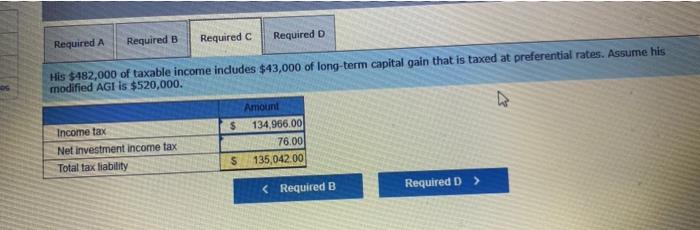

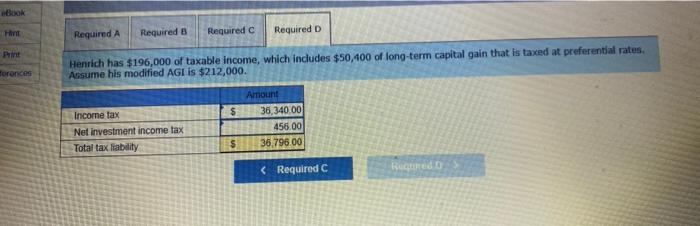

Henrich is a single taxpayer in 2022 , his taxable income is $482,000. What are his income tax and net investment income tax liability in each of the following altemative scenarios? Use Tox Rate Schedule. Dividends and Capital Gains Tax Rates for reference: Note: Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable. Round your final answers to 2 decimal places. Required: a. All of his income is salary from his employer. Assume his modified AGI is $520,000. b. His $482,000 of taxable income includes $2,000 of long-term capital gain that is taxed at preferential rates. Assume his modified AGI is $520,000 c. His $482,000 of taxable income includes $43,000 of long-term capital gain that is taxed at preferential rates. Assume his modified AGI is $520,000 d. Henrich has $196,000 of taxable income, which includes $50,400 of long-term capital gain that is taxed at preferential rates. Assume his modified AGI is \$212,000. His $482,000 of taxable income indudes $43,000 of long-term capital gain that is taxed at preferential rates. Assume his modified AGI is $520,000. Henrich has $196,000 of taxable income, which includes $50,400 of long-term capital gain that is taxed at preferential rates; Ansume his modified AGI is $212,000. Henrich is a single taxpayer in 2022 , his taxable income is $482,000. What are his income tax and net investment income tax liability in each of the following altemative scenarios? Use Tox Rate Schedule. Dividends and Capital Gains Tax Rates for reference: Note: Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable. Round your final answers to 2 decimal places. Required: a. All of his income is salary from his employer. Assume his modified AGI is $520,000. b. His $482,000 of taxable income includes $2,000 of long-term capital gain that is taxed at preferential rates. Assume his modified AGI is $520,000 c. His $482,000 of taxable income includes $43,000 of long-term capital gain that is taxed at preferential rates. Assume his modified AGI is $520,000 d. Henrich has $196,000 of taxable income, which includes $50,400 of long-term capital gain that is taxed at preferential rates. Assume his modified AGI is \$212,000. His $482,000 of taxable income indudes $43,000 of long-term capital gain that is taxed at preferential rates. Assume his modified AGI is $520,000. Henrich has $196,000 of taxable income, which includes $50,400 of long-term capital gain that is taxed at preferential rates; Ansume his modified AGI is $212,000