Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Epsilon has a legal obligation to dispose of the machine safely at the end of its useful life. This obligation is reliably measurable and

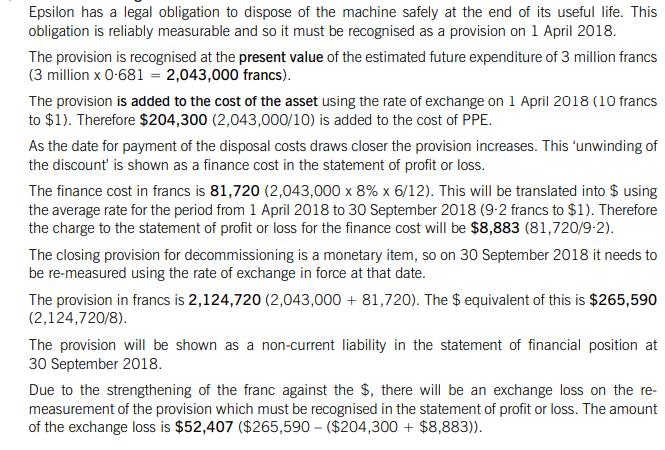

Epsilon has a legal obligation to dispose of the machine safely at the end of its useful life. This obligation is reliably measurable and so it must be recognised as a provision on 1 April 2018. The provision is recognised at the present value of the estimated future expenditure of 3 million francs (3 million x 0.681 = 2,043,000 francs). The provision is added to the cost of the asset using the rate of exchange on 1 April 2018 (10 francs to $1). Therefore $204,300 (2,043,000/10) is added to the cost of PPE. As the date for payment of the disposal costs draws closer the provision increases. This 'unwinding of the discount' is shown as a finance cost in the statement of profit or loss. The finance cost in francs is 81,720 (2,043,000 x 8% x 6/12). This will be translated into $ using the average rate for the period from 1 April 2018 to 30 September 2018 (9-2 francs to $1). Therefore the charge to the statement of profit or loss for the finance cost will be $8,883 (81,720/9-2). The closing provision for decommissioning is a monetary item, so on 30 September 2018 it needs to be re-measured using the rate of exchange in force at that date. The provision in francs is 2,124,720 (2,043,000 + 81,720). The $ equivalent of this is $265,590 (2,124,720/8). The provision will be shown as a non-current liability in the statement of financial position at 30 September 2018. Due to the strengthening of the franc against the $, there will be an exchange loss on the re- measurement of the provision which must be recognised in the statement of profit or loss. The amount of the exchange loss is $52,407 ($265,590 - ($204,300+ $8,883)).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Journal Entries 1 April 2018 PPE Machinery Dr 204300 Provision for Decommis...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started