Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Henry Spencer is interested in saving money to put his son, Shawn, through college. Shawn is turning 6 years old today, and Henry wants

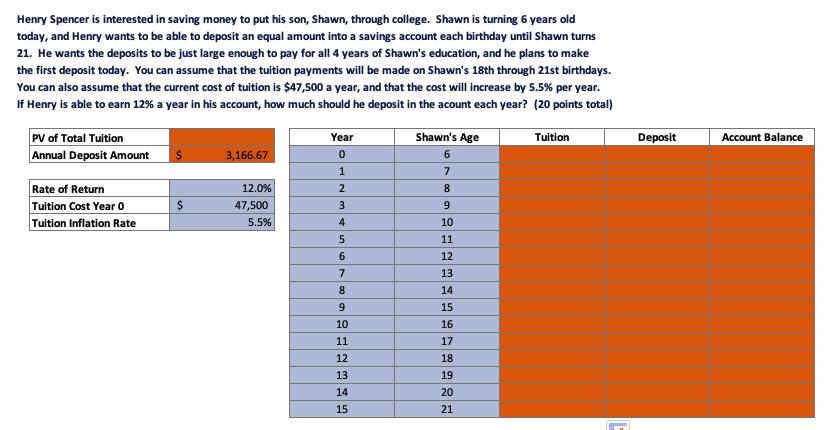

Henry Spencer is interested in saving money to put his son, Shawn, through college. Shawn is turning 6 years old today, and Henry wants to be able to deposit an equal amount into a savings account each birthday until Shawn turns 21. He wants the deposits to be just large enough to pay for all 4 years of Shawn's education, and he plans to make the first deposit today. You can assume that the tuition payments will be made on Shawn's 18th through 21st birthdays. You can also assume that the current cost of tuition is $47,500 a year, and that the cost will increase by 5.5% per year. If Henry is able to earn 12% a year in his account, how much should he deposit in the acount each year? (20 points total) PV of Total Tuition Annual Deposit Amount Rate of Return Tuition Cost Year 0 Tuition Inflation Rate $ 3,166.67 12.0% 47,500 5.5% Year 0 1 2 3 4 56 7 8 9 10 11 12 13 14 15 Shawn's Age 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 Tuition Deposit Account Balance

Step by Step Solution

★★★★★

3.28 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations 1 Calculate the future value of the tuition costs ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started