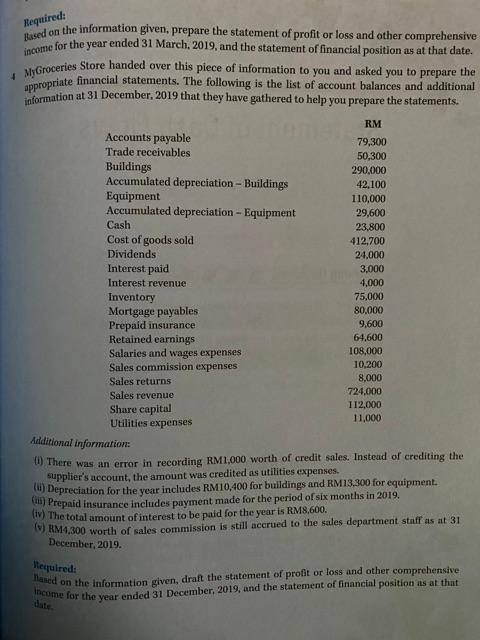

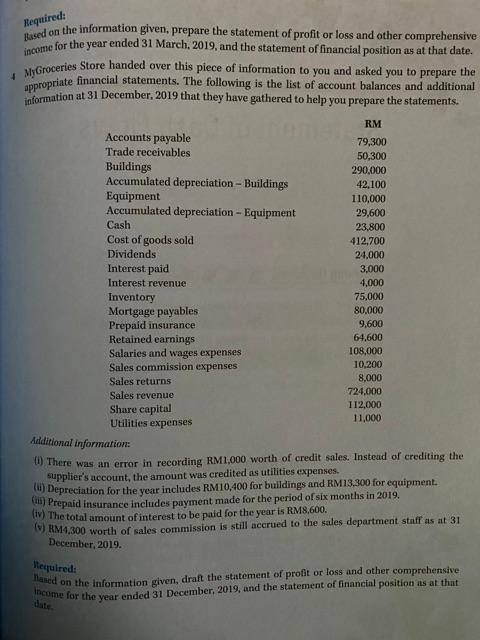

Hequired: Based on the information given, prepare the statement of profit or loss and other comprehensive 14 income for the year ended 31 March, 2019, and the statement of financial position as at that date. Store handed over this piece of information to you and asked you to prepare the appropriate financial statements. The following is the list of account balances and additional information at 31 December, 2019 that they have gathered to help you prepare the statements. MyGroceries RM Accounts payable 79,300 Trade receivables 50,300 Buildings 290,000 Accumulated depreciation - Buildings 42.100 Equipment 110,000 Accumulated depreciation - Equipment 29,600 Cash 23,800 Cost of goods sold 412,700 Dividends 24,000 Interest paid 3,000 Interest revenue 4,000 Inventory 75,000 Mortgage payables 80.000 Prepaid insurance 9,600 Retained earnings 64,600 Salaries and wages expenses 108,000 Sales commission expenses 10,200 Sales returns 8,000 724,000 Sales revenue 112.000 Share capital 11,000 Utilities expenses Additional information: (0) There was an error in recording RM 1,000 worth of credit sales. Instead of crediting the supplier's account, the amount was credited as utilities expenses. (0) Depreciation for the year includes RM10,400 for buildings and RM13.300 for equipment in Prepaid insurance includes payment made for the period of six months in 2019. (iv) The total amount of interest to be paid for the year is RM8,600. C) RM4,300 worth of sales commission is still accrued to the sales department staff as at 31 December, 2019. Required: Maned on the Information given, draft the statement of profit or loss and other comprehensive Income for the year ended 31 December, 2019, and the statement of financial position as at that Hequired: Based on the information given, prepare the statement of profit or loss and other comprehensive 14 income for the year ended 31 March, 2019, and the statement of financial position as at that date. Store handed over this piece of information to you and asked you to prepare the appropriate financial statements. The following is the list of account balances and additional information at 31 December, 2019 that they have gathered to help you prepare the statements. MyGroceries RM Accounts payable 79,300 Trade receivables 50,300 Buildings 290,000 Accumulated depreciation - Buildings 42.100 Equipment 110,000 Accumulated depreciation - Equipment 29,600 Cash 23,800 Cost of goods sold 412,700 Dividends 24,000 Interest paid 3,000 Interest revenue 4,000 Inventory 75,000 Mortgage payables 80.000 Prepaid insurance 9,600 Retained earnings 64,600 Salaries and wages expenses 108,000 Sales commission expenses 10,200 Sales returns 8,000 724,000 Sales revenue 112.000 Share capital 11,000 Utilities expenses Additional information: (0) There was an error in recording RM 1,000 worth of credit sales. Instead of crediting the supplier's account, the amount was credited as utilities expenses. (0) Depreciation for the year includes RM10,400 for buildings and RM13.300 for equipment in Prepaid insurance includes payment made for the period of six months in 2019. (iv) The total amount of interest to be paid for the year is RM8,600. C) RM4,300 worth of sales commission is still accrued to the sales department staff as at 31 December, 2019. Required: Maned on the Information given, draft the statement of profit or loss and other comprehensive Income for the year ended 31 December, 2019, and the statement of financial position as at that