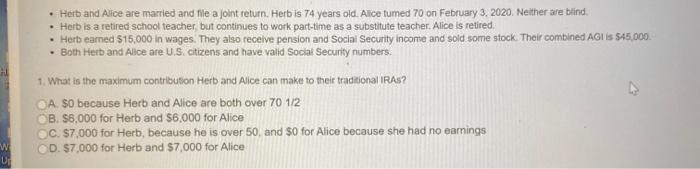

W Up Herb and Alice are married and file a joint return. Herb is 74 years old. Alice tumed 70 on February 3, 2020.

W Up Herb and Alice are married and file a joint return. Herb is 74 years old. Alice tumed 70 on February 3, 2020. Neither are blind. Herb is a retired school teacher, but continues to work part-time as a substitute teacher. Alice is retired. earned $15,000 in wages. They also receive pension and Social Security income and sold some stock. Their combined AGI is $45,000. Herb Both Herb and Alice are U.S. citizens and have valid Social Security numbers. 1. What is the maximum contribution Herb and Alice can make to their traditional IRAS? OA. SO because Herb and Alice are both over 70 1/2 OB. $6,000 for Herb and $6,000 for Alice OC. $7,000 for Herb, because he is over 50, and $0 for Alice because she had no earnings OD. $7,000 for Herb and $7,000 for Alice

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Q1 Answer is Option C Couples who are married filing jointly can ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started