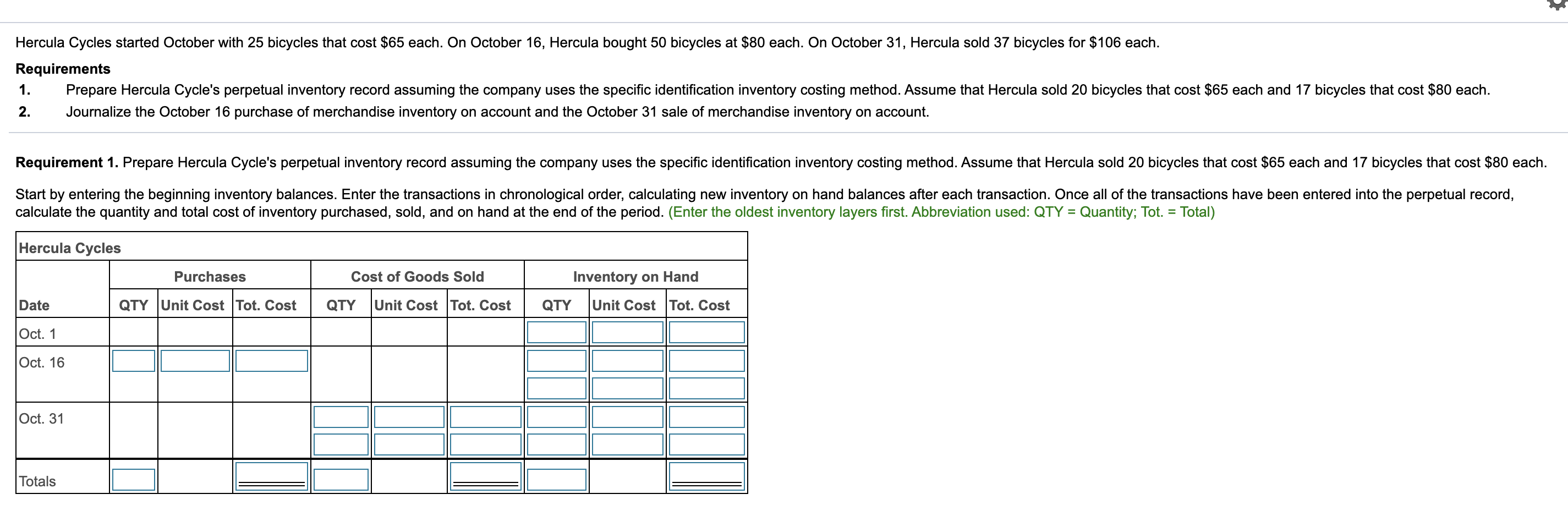

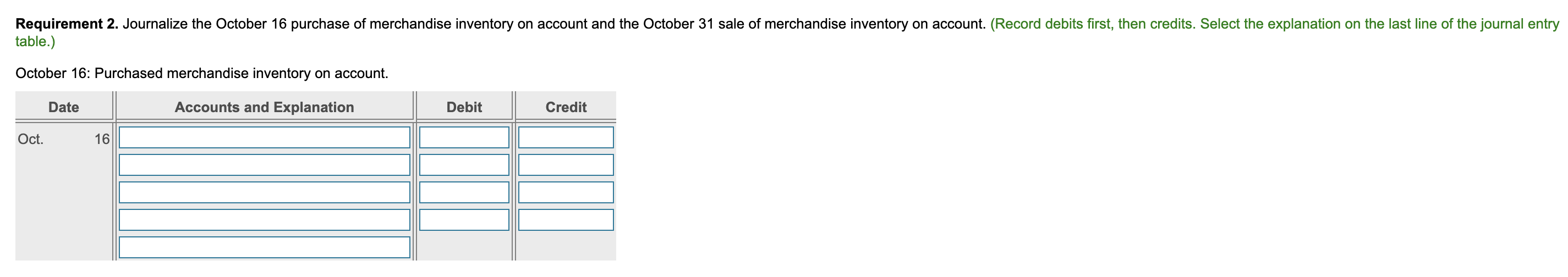

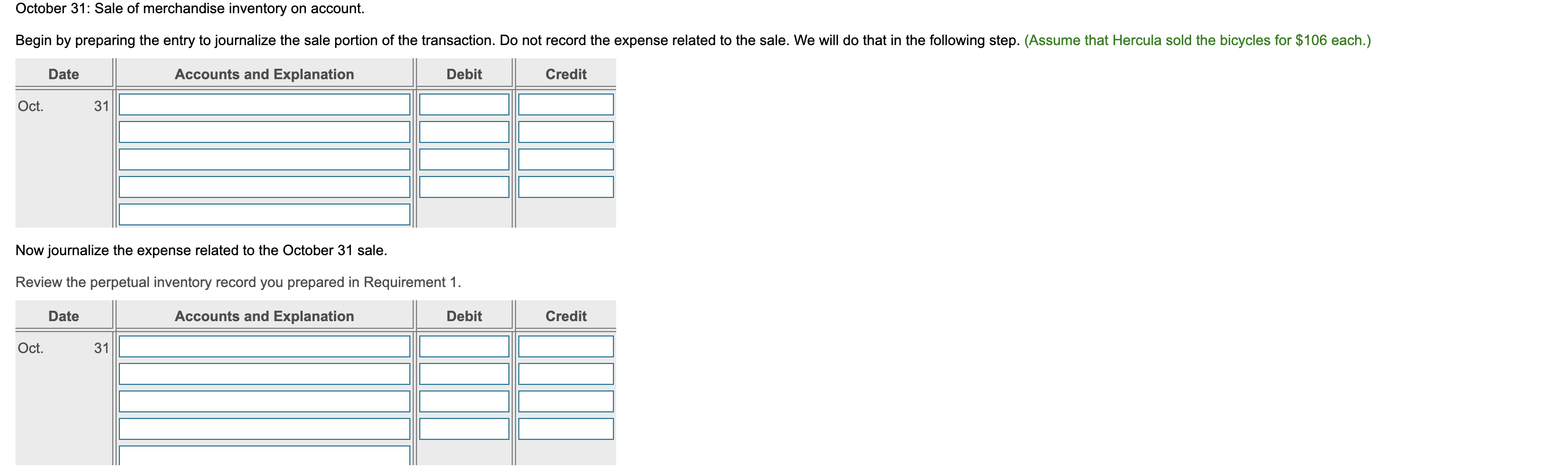

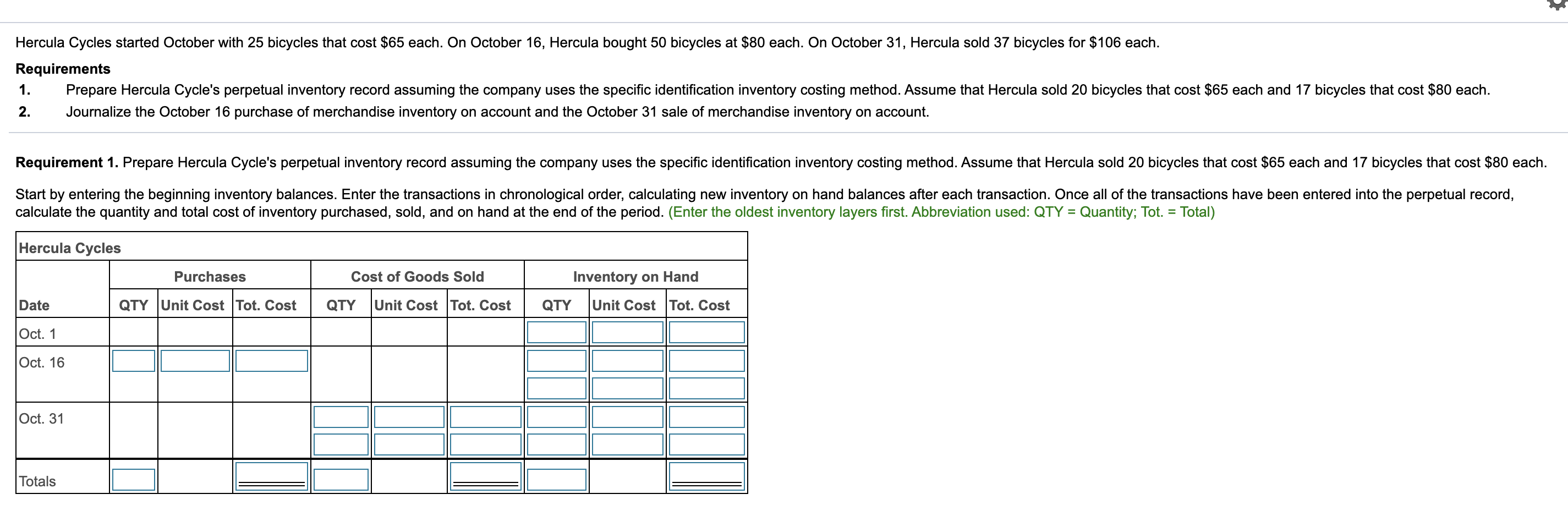

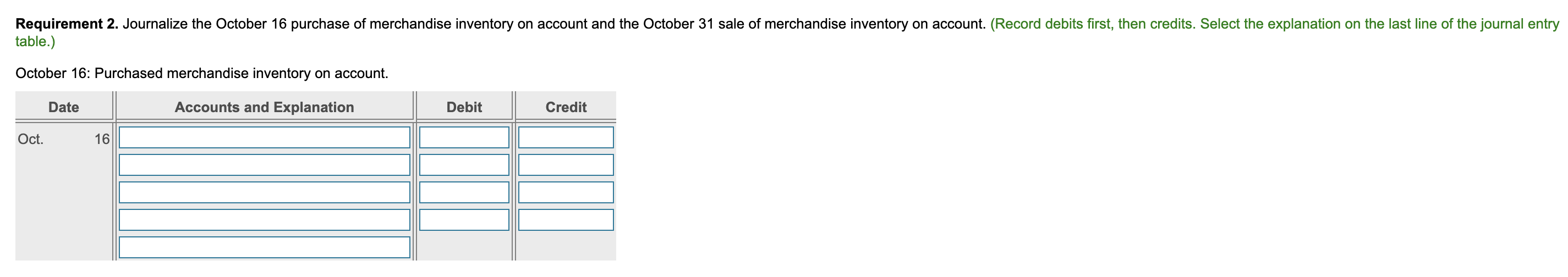

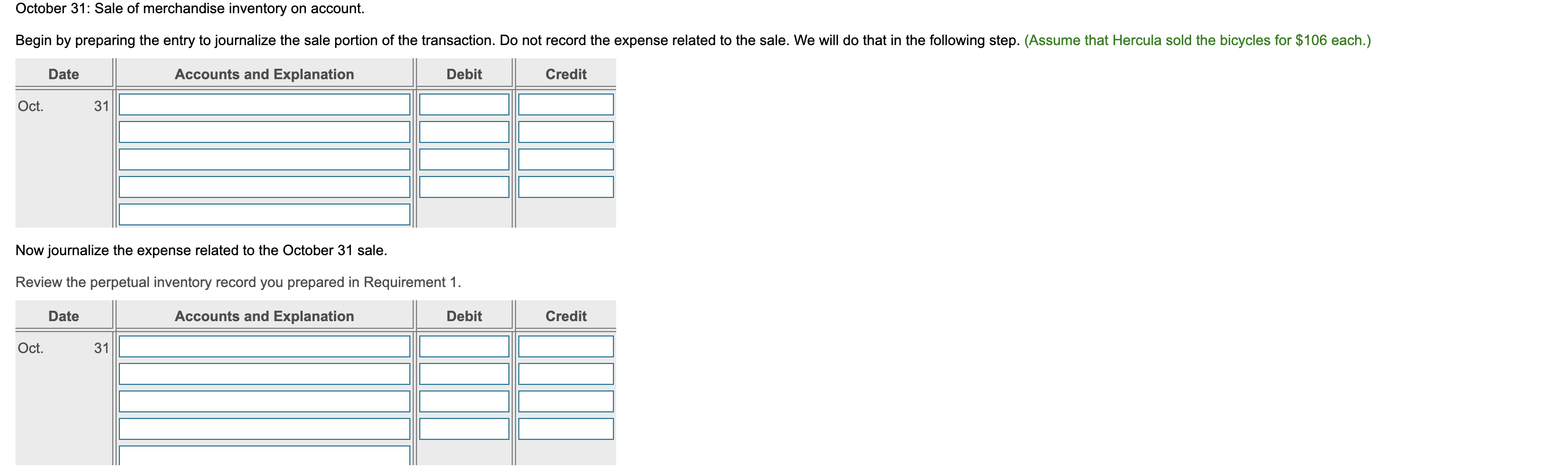

Hercula Cycles started October with 25 bicycles that cost $65 each. On October 16, Hercula bought 50 bicycles at $80 each. On October 31, Hercula sold 37 bicycles for $106 each. Requirements 1. Prepare Hercula Cycle's perpetual inventory record assuming the company uses the specific identification inventory costing method. Assume that Hercula sold 20 bicycles that cost $65 each and 17 bicycles that cost $80 each. 2. Journalize the October 16 purchase of merchandise inventory on account and the October 31 sale of merchandise inventory on account. Requirement 1. Prepare Hercula Cycle's perpetual inventory record assuming the company uses the specific identification inventory costing method. Assume that Hercula sold 20 bicycles that cost $65 each and 17 bicycles that cost $80 each. Start by entering the beginning inventory balances. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first. Abbreviation used: QTY = Quantity; Tot. = Total) Hercula Cycles Purchases Cost of Goods Sold QTY Unit Cost Tot. Cost Inventory on Hand QTY Unit Cost Date QTY Unit Cost Tot. Cost Oct. 1 Oct. 16 Oct. 31 Totals Requirement 2. Journalize the October 16 purchase of merchandise inventory on account and the October 31 sale of merchandise inventory on account. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) October 16: Purchased merchandise inventory on account. Date Accounts and Explanation Debit Credit Oct. R 16 October 31: Sale of merchandise inventory on account. Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following step. (Assume that Hercula sold the bicycles for $106 each.) Date Accounts and Explanation Debit Credit Oct. Now journalize the expense related to the October 31 sale. Review the perpetual inventory record you prepared in Requirement 1. Date Accounts and Explanation Debit Credit Oct. 31 |||