Answered step by step

Verified Expert Solution

Question

1 Approved Answer

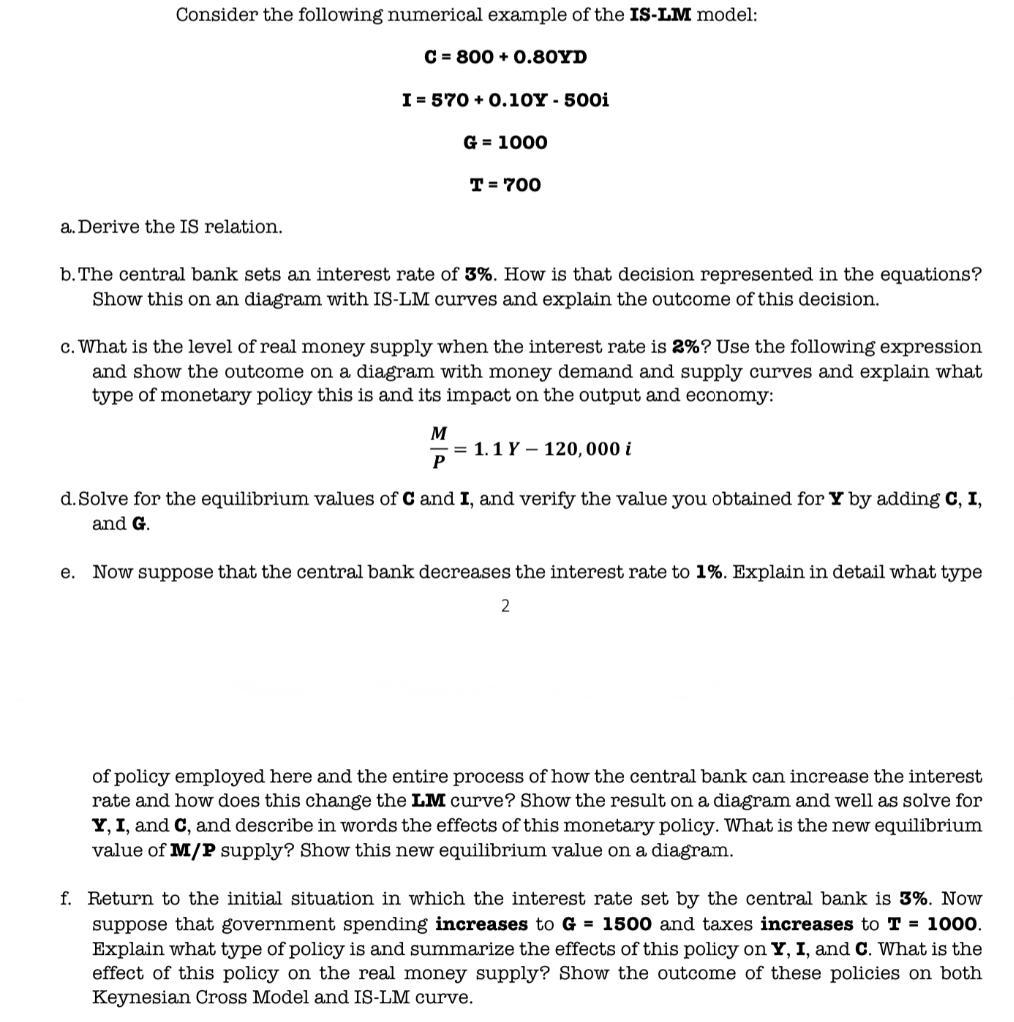

Consider the following numerical example of the IS-LM model: C = 800+ 0.80YD a. Derive the IS relation. I= 570+ 0.10Y - 500i G

Consider the following numerical example of the IS-LM model: C = 800+ 0.80YD a. Derive the IS relation. I= 570+ 0.10Y - 500i G = 1000 T = 700 b. The central bank sets an interest rate of 3%. How is that decision represented in the equations? Show this on an diagram with IS-LM curves and explain the outcome of this decision. M c. What is the level of real money supply when the interest rate is 2%? Use the following expression and show the outcome on a diagram with money demand and supply curves and explain what type of monetary policy this is and its impact on the output and economy: = 1.1 Y 120, 000 i d.Solve for the equilibrium values of C and I, and verify the value you obtained for Y by adding C, I, and G. e. Now suppose that the central bank decreases the interest rate to 1%. Explain in detail what type 2 of policy employed here and the entire process of how the central bank can increase the interest rate and how does this change the LM curve? Show the result on a diagram and well as solve for Y, I, and C, and describe in words the effects of this monetary policy. What is the new equilibrium value of M/P supply? Show this new equilibrium value on a diagram. f. Return to the initial situation in which the interest rate set by the central bank is 3%. Now suppose that government spending increases to G = 1500 and taxes increases to T = 1000. Explain what type of policy is and summarize the effects of this policy on Y, I, and C. What is the effect of this policy on the real money supply? Show the outcome of these policies on both Keynesian Cross Model and IS-LM curve.

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started