Answered step by step

Verified Expert Solution

Question

1 Approved Answer

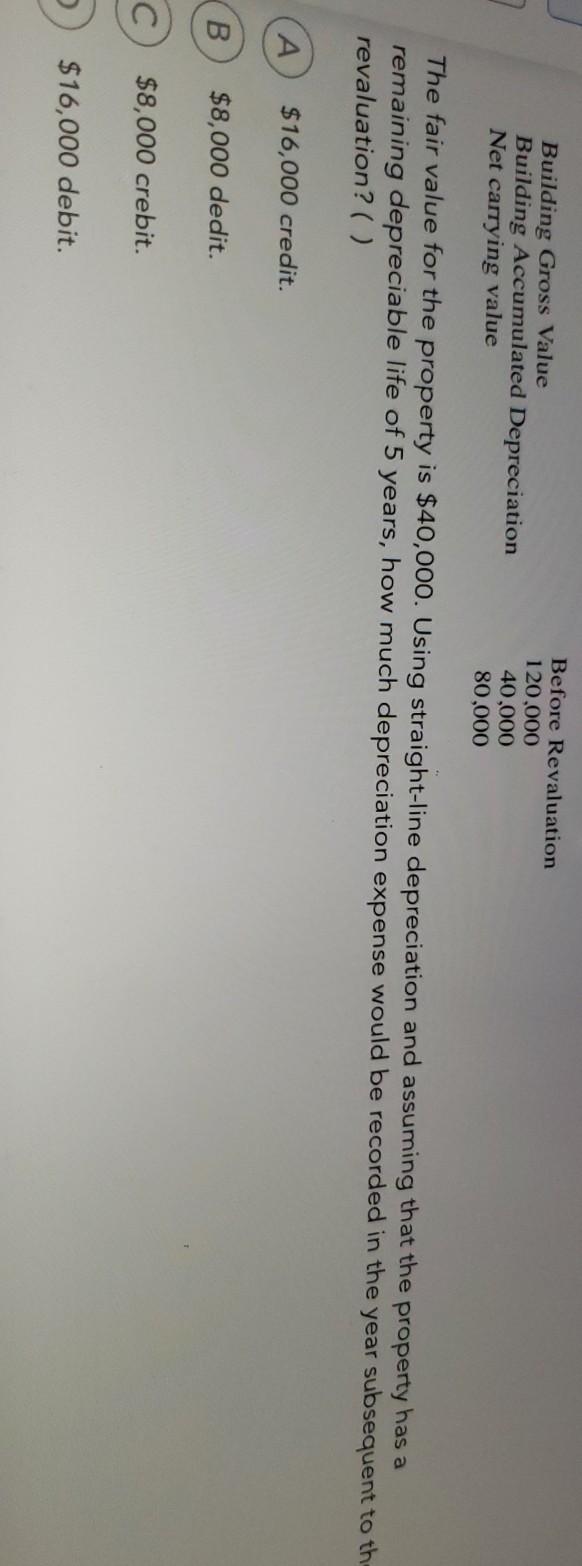

here are 4 questions, please help me Building Gross Value Building Accumulated Depreciation Net carrying value Before Revaluation 120.000 40,000 80,000 The fair value for

here are 4 questions, please help me

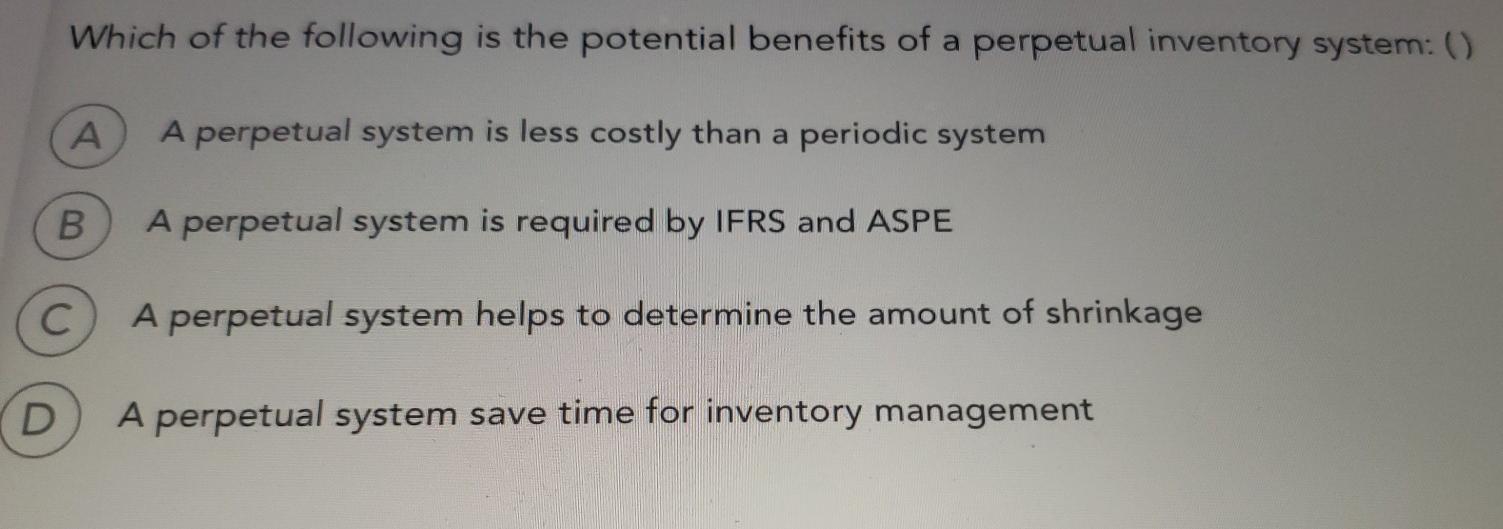

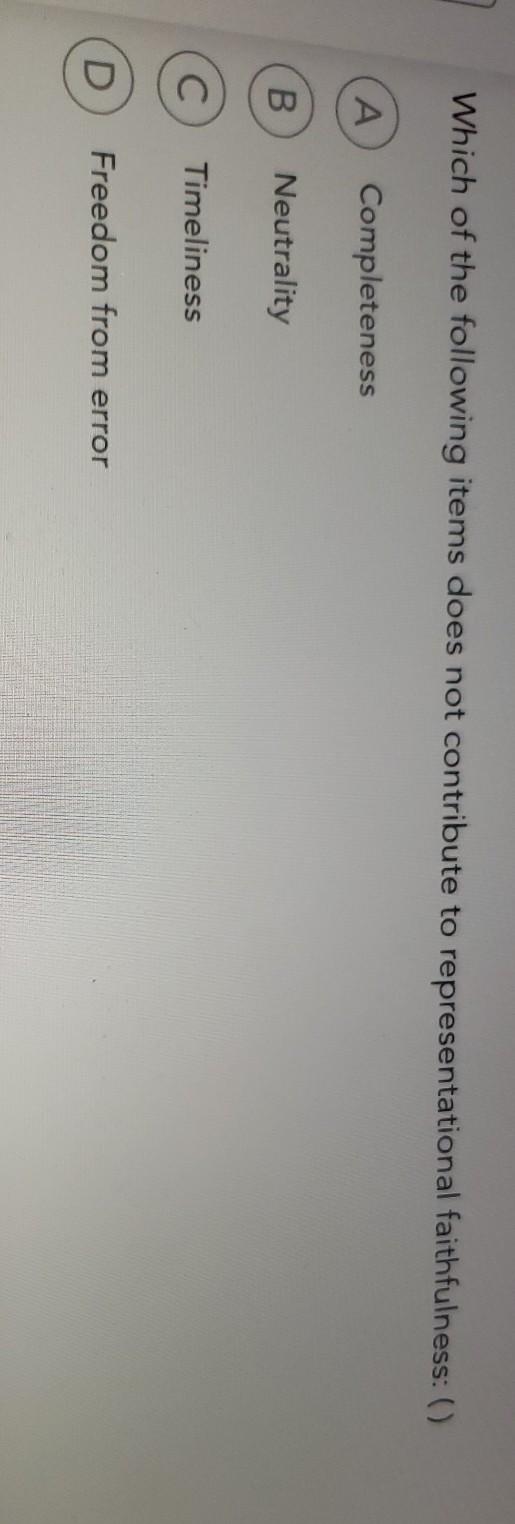

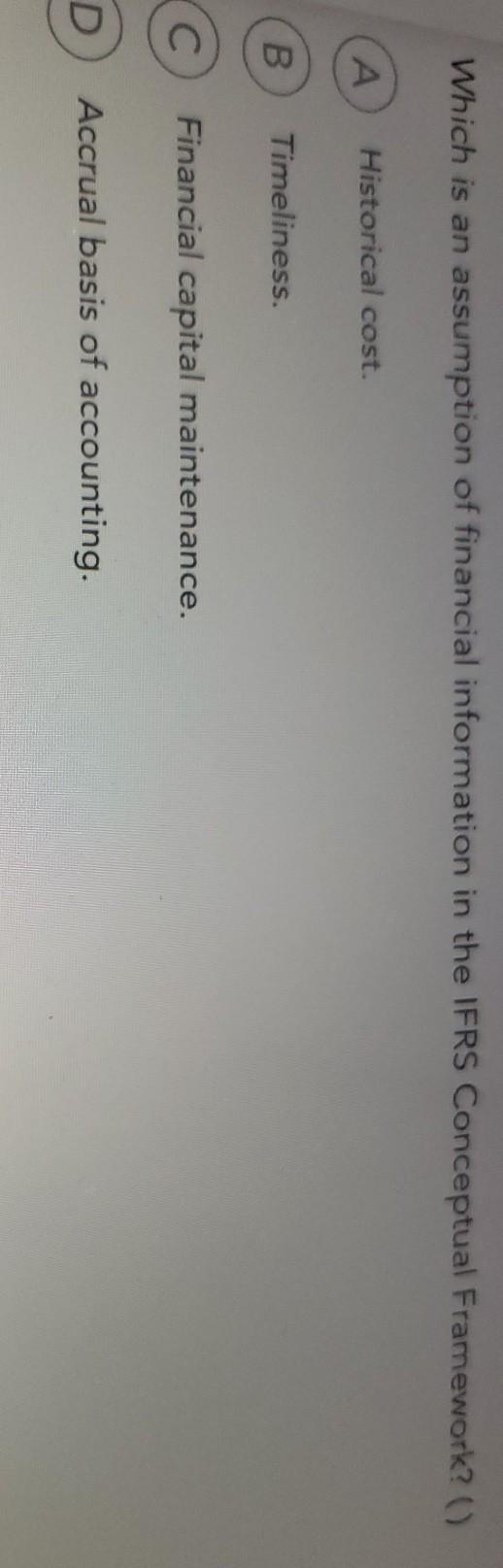

Building Gross Value Building Accumulated Depreciation Net carrying value Before Revaluation 120.000 40,000 80,000 The fair value for the property is $40,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to th- revaluation? ( ) A $16,000 credit. B. $8,000 dedit. C $8,000 crebit. $16,000 debit. Which of the following is the potential benefits of a perpetual inventory system: () A perpetual system is less costly than a periodic system B A perpetual system is required by IFRS and ASPE C A perpetual system helps to determine the amount of shrinkage D A perpetual system save time for inventory management Which of the following items does not contribute to representational faithfulness: () Completeness B Neutrality C Timeliness D Freedom from error Which is an assumption of financial information in the IFRS Conceptual Framework?) A Historical cost. B Timeliness. C Financial capital maintenance. D Accrual basis of accountingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started