Answered step by step

Verified Expert Solution

Question

1 Approved Answer

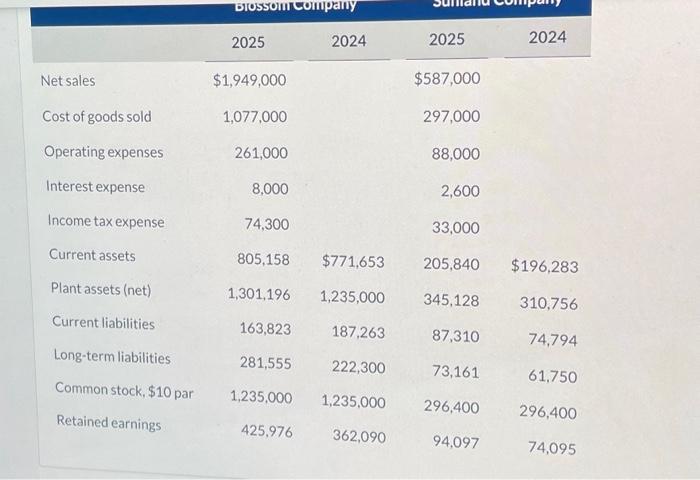

Here are comparative financial statement data for Blossom Company and Sunland Company, two competitors. All data are as of December 31, 2025, and December 31,

Here are comparative financial statement data for Blossom Company and Sunland Company, two competitors. All data are as of December 31, 2025, and December 31, 2024. Net sales Cost of goods sold Operating expenses Interest expense Income tax expense Current assets Plant assets (net) Current liabilities Long-term liabilities Common stock, $10 par Retained earnings Blossom Company 2025 $1,949,000 1,077,000 261,000 8,000 74,300 805,158 $771,653 1,301,196 1,235,000 163,823 281,555 2024 1,235,000 187,263 222,300 1,235,000 Sunland Company 2025 $587,000 297,000 88,000 2,600 33,000 205,840 $196,283 345,128 310,756 87,310 2024 73,161 296,400 74,794 61,750 296,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started