Answered step by step

Verified Expert Solution

Question

1 Approved Answer

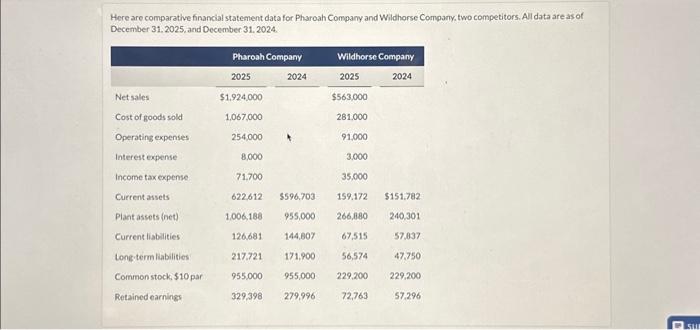

Here are comparative financial statement data for Pharoah Company and Wildhorse Company, two competitors. All data areas of December 31, 2025, and December 31,

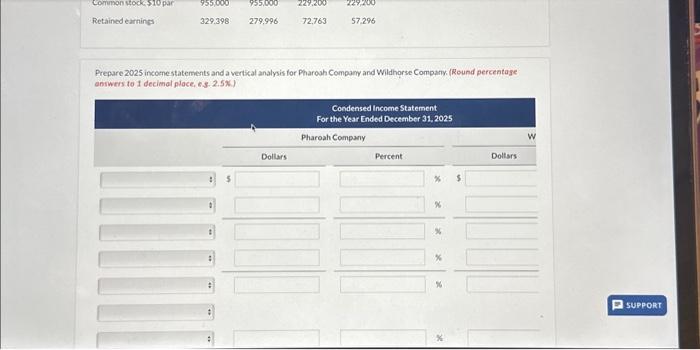

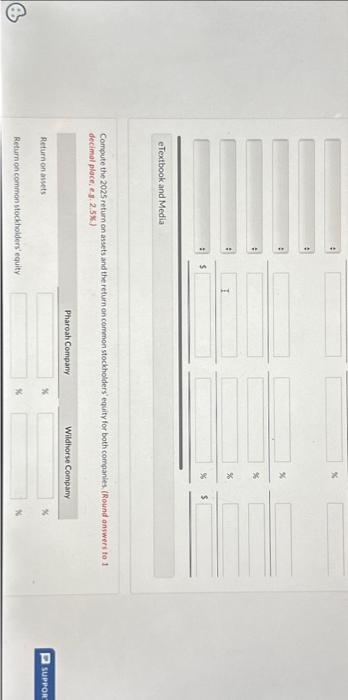

Here are comparative financial statement data for Pharoah Company and Wildhorse Company, two competitors. All data areas of December 31, 2025, and December 31, 2024. Pharoah Company Wildhorse Company 2025 2024 2025 2024 Net sales $1,924,000 $563,000 Cost of goods sold 1,067,000 281.000 Operating expenses 254,000 91,000 Interest expense 8,000 3,000 Income tax expense 71,700 35,000 Current assets 622,612 $596,703 159,172 $151,782 Plant assets (net) 1,006,188 955,000 266,880 240,301 Current liabilities 126,681 144,807 67,515 57.837 Long-term liabilities 217.721 171,900 56,574 47,750 Common stock, $10 par 955,000 955,000 229,200 229,200 Retained earnings 329,398 279,996 72,763 57.296 C SUB Common stock $10 par 955,000 955,000 229.200 229,200 Retained earnings 329.398 279,996 72,763 57,296 Prepare 2025 income statements and a vertical analysis for Pharoah Company and Wildhorse Company. (Round percentage answers to 1 decimal place, es. 2.5%) Condensed Income Statement For the Year Ended December 31, 2025 Pharoah Company W Dollars Percent Dollars % $ % SUPPORT eTextbook and Media % % % % $ Compute the 2025 return on assets and the return on common stockholders' equity for both companies. (Round answers to 1 decimal place, eg. 2.5%) Return on assets Return on common stockholders' equity Pharoah Company Wildhorse Company SUPPOR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started