Answered step by step

Verified Expert Solution

Question

1 Approved Answer

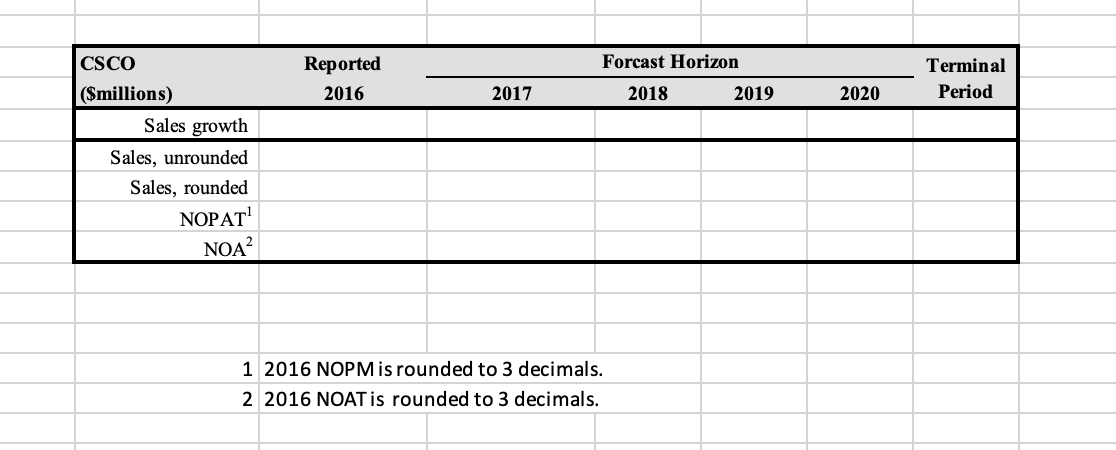

Here are my calculations so far. Please help me answet the following problems. Show calculations and formulas for Excel please. Attachments included. ROA = 9.14

Here are my calculations so far. Please help me answet the following problems. Show calculations and formulas for Excel please. Attachments included.

ROA = 9.14 % ROE = 16.89% ROE = 16.95%

NOA = $84,539. NOPAT = $8,139.6

| Sales | $53,186.76 | $57,441.70 | $60,313.79 | $62,123.20 | $63,365.66 |

| NOPAT | $11,594.71 | $12,522.29 | $13,148.41 | $13,542.86 | $13,813.71 |

| NOA | $108,766.38 | $117,467.69 | $123,341.08 | $127,041.31 | $129,582.13 |

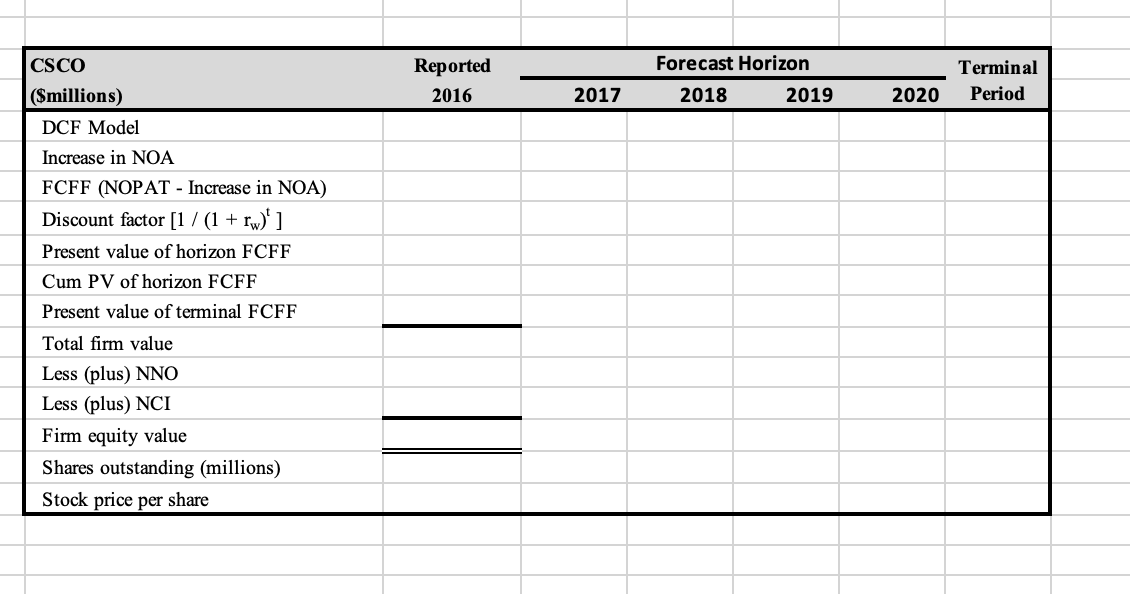

I did this manually, how do I add it in Exel using formula? and I having trouble with the DCF model.

Estimate the value of a share of Cisco common stock as of July 30, 2016 using the discounted cash flow (DCF) model and sales, NOPAT and NOA forecast in. Describe the DCF model, and explain the computations and results.

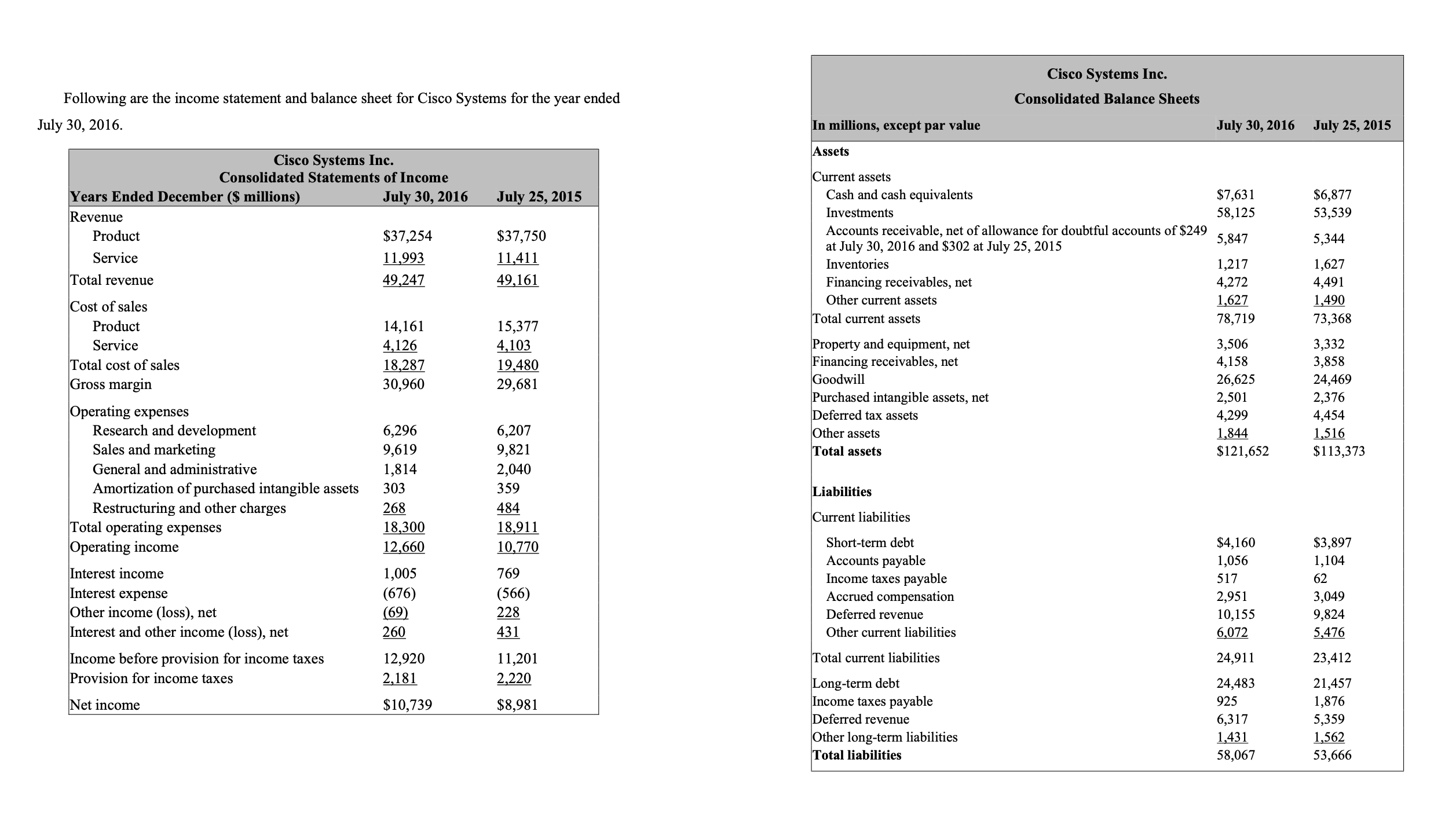

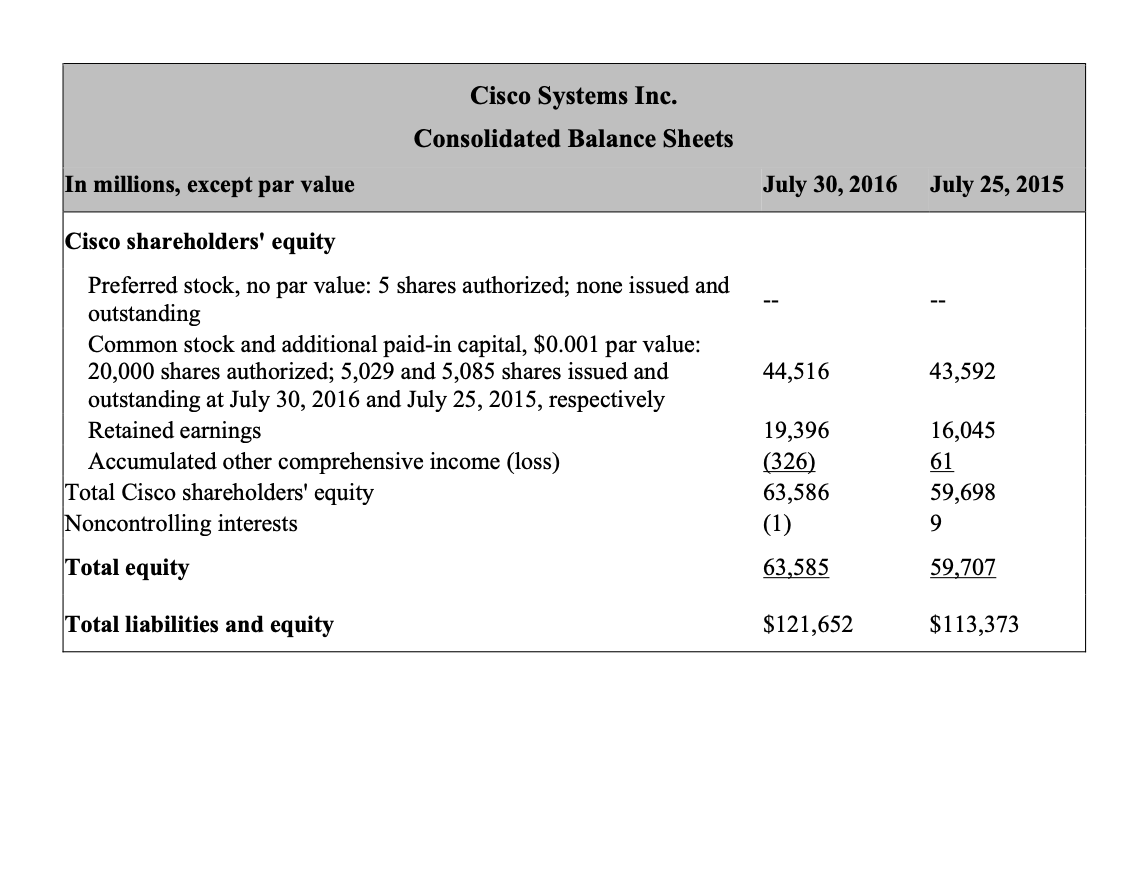

Following are the income statement and balance sheet for Cisco Systems for the year ended July 30, 2016. Cisco Systems Inc. Consolidated Balance Sheets

Following are the income statement and balance sheet for Cisco Systems for the year ended July 30, 2016. Cisco Systems Inc. Consolidated Balance Sheets Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started