Answered step by step

Verified Expert Solution

Question

1 Approved Answer

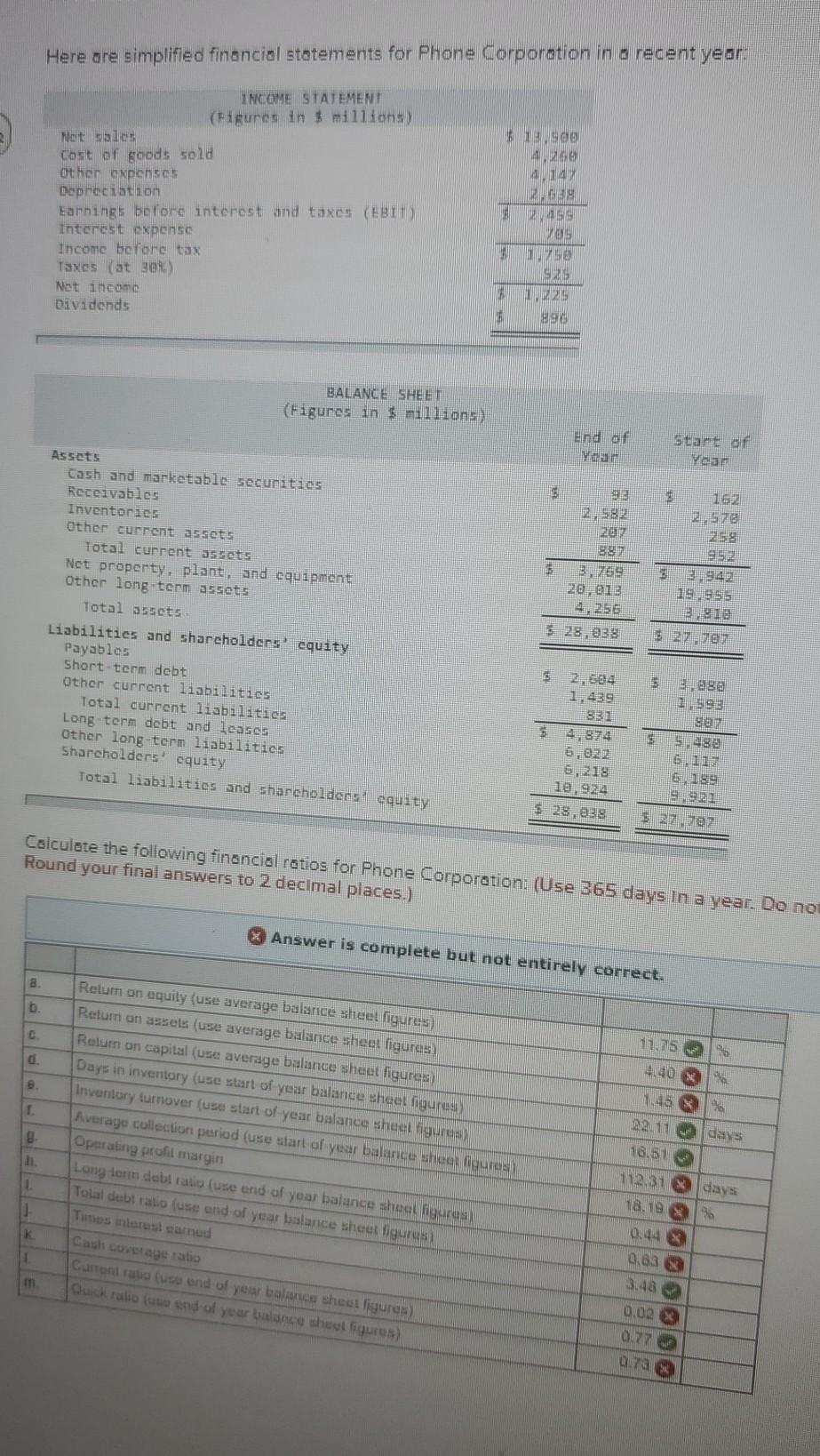

Here are simplified financial statements for Phone Corporation in a recent year: INCOME STATEMENT (Figures in 1 millions) Net saler Cost of goods sold Other

Here are simplified financial statements for Phone Corporation in a recent year: INCOME STATEMENT (Figures in 1 millions) Net saler Cost of goods sold Other axpenses Depreciation Earnings before interest and taxes (EBIT) Interest expense Income before tax Txes (at gen) Net income Dividends see 20 12 2099 999 OS 2 9 BALANCE SHEET (Figures in $ millions) end of Maar Stars of Yaan 16 25 25% 82 202 882 369 20013 B92 19955 Assets Cash and marketable secunities Receivables Inventories Other current assets Total current assets Net property, plant, and equipment Other long term assets Total assets Liabilities and shareholders equity Payables Short-term debt Other current liabilities Total current liabilities Long term debt and leases Other long term liabilities Shareholders' cquity Total liabilities and shareholden cquity 328,838 327 707 $ 2,694 1,439 831 28 19 SET $5 280 112 6189 992 277 6,218 10973 $28.038 Calculate the following financial ratios for Phone Corporation: (Use 365 days in a year. Do no Round your final answers to 2 decimal places.) Answer is complete but not entirely correct. 8 b. C 15 d. 440 145 x 1 2. 8 Relum on equily (use average balance sheet figures) Return on askels (use average balance sheet figures Rolumn on capital (uze average balance sheet figures Days in inventory (use start of year balance sheet figures Inventory tumover (use start of year balance sheet figures Average collection period (use start of year balance she was Operating profil margin Long term debt ratio (use end of year balance sheet figures Total debt ratio (use and of year balance sheet ligus Times interest surnud Cash Cage ratio Contrato (uso end of year balance sheet ligures) Quick ratio (ut end of your balance sheet figures) days 16.5 2.318 days 18.19 % 0.44 X 0.63 $ K 1 3.48 0.02 X 077 0.70

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started