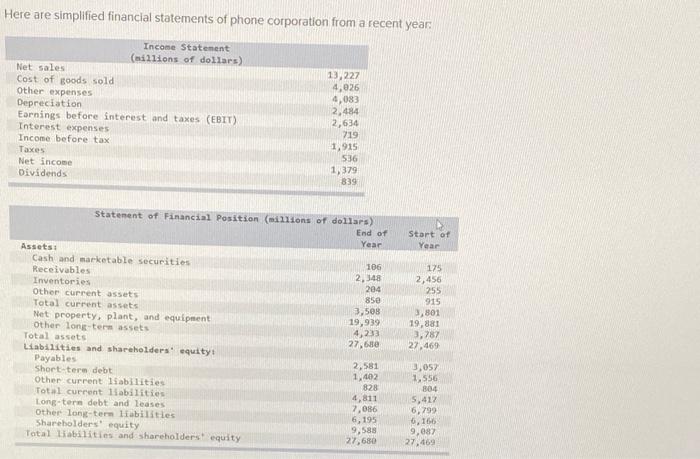

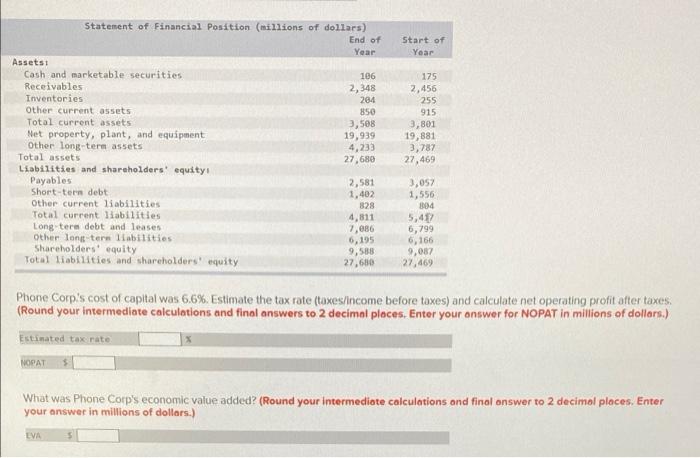

Here are simplified financial statements of phone corporation from a recent year Income Statement (millions of dollars) Net sales Cost of goods sold Other expenses Depreciation Earnings before interest and taxes (EBIT) Interest expenses Income before tax Taxes Net income Dividends 13,227 4,026 6,083 2.484 12,634 219 1,915 536 1,379 839 Start of Year Statement of Financial Position (illions of dollars) End of Year Assets Cash and marketable securities 106 Receivables 2,348 Inventories 204 Other current assets 85e Total current assets 3,508 Net property, plant, and equipment 19,939 Other long-term assets Total assets 4,233 Liabilities and shareholders' equity: 27, 68e Payables 2,581 Short term debt 1.402 Other current liabilities 828 Total current liabilities 4,811 Long-term debt and leases 7,086 Other long-term liabilities 6,195 Shareholders' equity 9,585 Total abilities and shareholders equity 27,680 175 2,456 255 915 3801 19,881 3,787 27,469 3,052 1.556 804 5,412 6,799 6,166 9,087 27.469 Start of Year Statement of Financial Position (millions of dollars) End of Year Assets Cash and marketable securities 106 Receivables 2,348 Inventories 284 Other current assets 850 Total current assets 3,508 Net property, plant, and equipment 19,939 Other long-term assets 4,233 Total assets 27,680 Liabilities and shareholders' equity Payables 2,581 Short-term debt 1,402 Other current liabilities 828 Total current liabilities 4,811 Long term debt and leases 7,086 Other long term liabilities 6,195 Shareholders equity 9,588 Total liabilities and shareholders' equity 27,630 175 2,456 255 915 3,801 19,881 3,787 27,469 3,057 1,556 2004 5,47 6,799 6,166 9,087 27,469 Phone Corp's cost of capital was 6.6%. Estimate the tax rate (taxes/income before taxes) and calculate net operating profit after taxes. (Round your intermediate calculations and final answers to 2 decimal places. Enter your answer for NOPAT in millions of dollars.) Estimated tax rate NOSAT What was Phone Corp's economic value added? (Round your intermediate calculations and final answer to 2 decimal places. Enter your answer in millions of dollars.) LVA