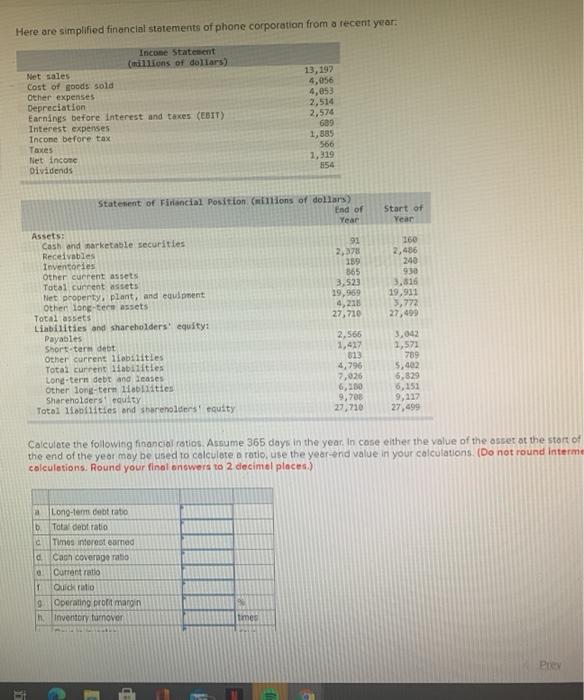

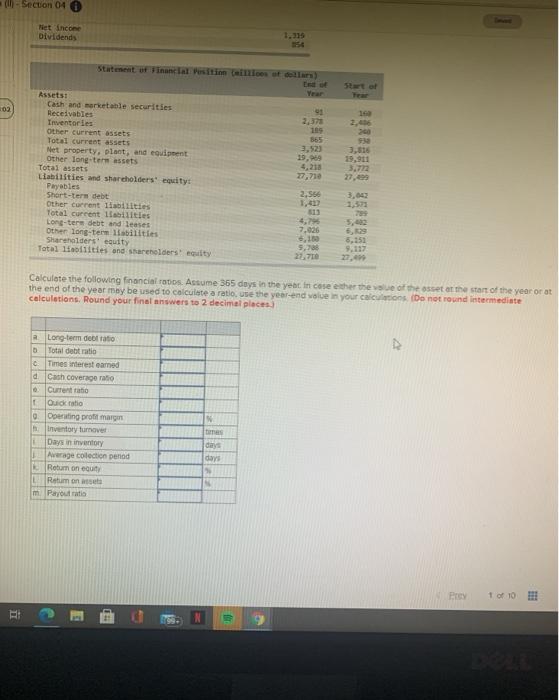

Here are simplified financial statements of phone corporation from a recent year: Income Statement (millions of dollars) Net sales Cost of goods sold Other expenses Depreciation Earnings before interest and taxes (EBIT) Interest expenses Incone before tax Taxes Net Incore Dividends 13,192 5,056 4,053 2,514 2,574 609 1,883 566 2.319 854 Start of Year Statement of Financial Position (illions of dollars) End of Year Assets: Cash and marketable securities 91 Receivables 2,378 Inventories 159 Other current assets 865 Total current assets 3,523 Het property, plant, and equipment 19,959 Other long-term assets 4,218 Total assets 27,710 Liabilities and shareholders equity: Payables 2,566 Short-term debt 1,412 Other current liabilities 813 Total current liabilities 4,796 Long-tern debt and seases 7,026 Other long-tern labilities 6,150 Shareholders equity 9,708 Totol liabilities and shareholders' equity 27,710 260 2,486 240 930 3.816 19,911 3,772 27,499 3,042 2,572 789 5,402 5.829 6,153 9,217 27,499 Calculate the following financial ratios. Assume 365 days in the year. In case either the value of the asset at the start of the end of the year may be used to calculate o ratio, use the year-end value in your calculations. (Do not round Interme calculations. Round your final onswers to 2 decimal places.) a Long-term debt ratio b Total debt ratio a Times interest Burned d Cash coverage ratio 0 Current ratio 1 Ouick ratio 9 Operating profit margin h Inventory turnover times Prev Section 04 when Net Income Dividends 1.315 Statement of Financial Position lies de 202 2,37 105 14 2,46 3,516 Assets Cath and marketable securities Receivables Inventories Other current assets Total current assets Net property, plant, and equipment Other long-term assets Total assets Llabilities and shareholders' equity Payables Short-term debt Other current liabilities Total current liabilities Long-term debt and leases Other long-term abilities Shareholders' equity Total linolities and shareholders' culty 27,710 27,00 2,566 3,043 13 7.026 5,629 5,351 9,788 27.40 Calculate the following financial ratos. Assume 365 days in the year in case ether the value of the asset at the start of the year or at the end of the year may be used to calculate a ratio use the year-end value in your calculations. Do not round intermediate calculations, Round your final answers to 2 decimal places a Long-term debitato D Total debt ratio c Times interest earned d Cash coverage ratio Current ratio Qudrato 0 Operating profit marge Inventory turnover Days in inventory Average collection period Robur one Return on m Payout it days days Prey 1 of 10 !!! RE 158. Here are simplified financial statements of phone corporation from a recent year: Income Statement (millions of dollars) Net sales Cost of goods sold Other expenses Depreciation Earnings before interest and taxes (EBIT) Interest expenses Incone before tax Taxes Net Incore Dividends 13,192 5,056 4,053 2,514 2,574 609 1,883 566 2.319 854 Start of Year Statement of Financial Position (illions of dollars) End of Year Assets: Cash and marketable securities 91 Receivables 2,378 Inventories 159 Other current assets 865 Total current assets 3,523 Het property, plant, and equipment 19,959 Other long-term assets 4,218 Total assets 27,710 Liabilities and shareholders equity: Payables 2,566 Short-term debt 1,412 Other current liabilities 813 Total current liabilities 4,796 Long-tern debt and seases 7,026 Other long-tern labilities 6,150 Shareholders equity 9,708 Totol liabilities and shareholders' equity 27,710 260 2,486 240 930 3.816 19,911 3,772 27,499 3,042 2,572 789 5,402 5.829 6,153 9,217 27,499 Calculate the following financial ratios. Assume 365 days in the year. In case either the value of the asset at the start of the end of the year may be used to calculate o ratio, use the year-end value in your calculations. (Do not round Interme calculations. Round your final onswers to 2 decimal places.) a Long-term debt ratio b Total debt ratio a Times interest Burned d Cash coverage ratio 0 Current ratio 1 Ouick ratio 9 Operating profit margin h Inventory turnover times Prev Section 04 when Net Income Dividends 1.315 Statement of Financial Position lies de 202 2,37 105 14 2,46 3,516 Assets Cath and marketable securities Receivables Inventories Other current assets Total current assets Net property, plant, and equipment Other long-term assets Total assets Llabilities and shareholders' equity Payables Short-term debt Other current liabilities Total current liabilities Long-term debt and leases Other long-term abilities Shareholders' equity Total linolities and shareholders' culty 27,710 27,00 2,566 3,043 13 7.026 5,629 5,351 9,788 27.40 Calculate the following financial ratos. Assume 365 days in the year in case ether the value of the asset at the start of the year or at the end of the year may be used to calculate a ratio use the year-end value in your calculations. Do not round intermediate calculations, Round your final answers to 2 decimal places a Long-term debitato D Total debt ratio c Times interest earned d Cash coverage ratio Current ratio Qudrato 0 Operating profit marge Inventory turnover Days in inventory Average collection period Robur one Return on m Payout it days days Prey 1 of 10 !!! RE 158