Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Here are some alternative investments you are considering for one year. (i) Bank A promises to pay 8% on your deposit compounded annually. (ii)

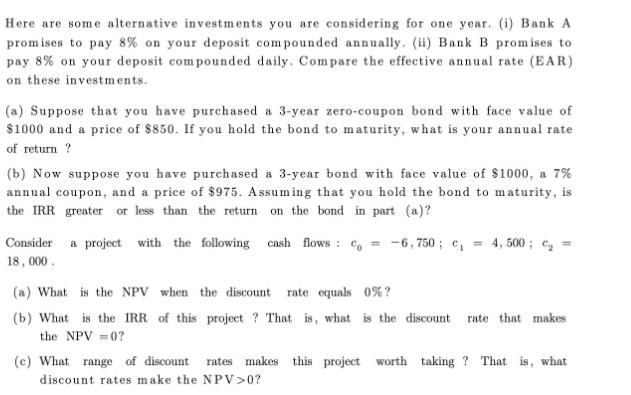

Here are some alternative investments you are considering for one year. (i) Bank A promises to pay 8% on your deposit compounded annually. (ii) Bank B promises to pay 8% on your deposit compounded daily. Compare the effective annual rate (EAR) on these investments. (a) Suppose that you have purchased a 3-year zero-coupon bond with face value of $1000 and a price of $850. If you hold the bond to maturity, what is your annual rate of return? (b) Now suppose you have purchased a 3-year bond with face value of $1000, a 7% annual coupon, and a price of $975. Assuming that you hold the bond to maturity, is the IRR greater or less than the return on the bond in part (a)? Consider a project with the following cash flows co= -6,750; c = 4,500; = 18,000. (a) What is the NPV when the discount rate equals 0%? (b) What is the IRR of this project? That is, what is the discount rate that makes the NPV =0? (c) What range of discount rates makes this project worth taking? That is, what discount rates make the NPV>0?

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Calculate the Effective Annual Rate EAR for Bank A compounded annually EAR 1 rn n 1 where r i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started