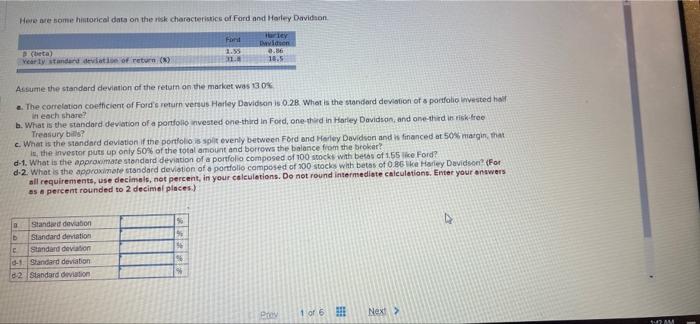

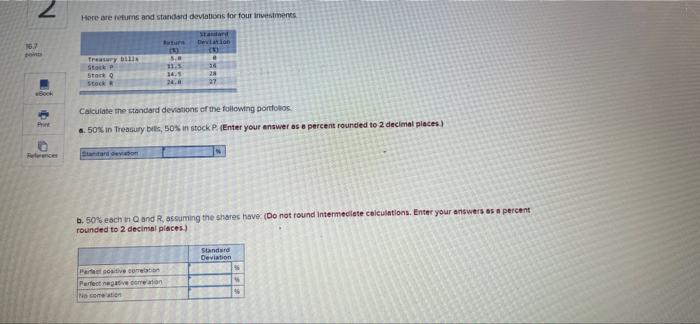

Here are some historical data on the risk characteristics of Ford and Harley Davidson Ford 1.55 Turley tiden 0.16 18.5 eta) Yearty standardeve of return Assume the standard deviation of the return on the market was 130% The correlation coefficient of Ford's return versus Harley Davidson is 0.28 What is the standard deviation of a portfolio invested hall in each share? b. What is the standard deviation of a portfolio invested one-third in Ford, one-thed in Harley Davidson, and one-third in risk free Treasury bis? c. What is the standard deviation if the portfolio is split evenly between Ford and Harley Davidson and is financed at 50% marginha in the investor puts up only 50% of the total amount and borrows the balance from the broker! d-1. What is the approximate standard deviation of a portfolio composed of 100 stocks with beas of 1.65 Ford? d-2. What is the approximate standard deviation of a portfolio composed of 300 stocles with betas of 0.86 ke Harley Davidson (For all requirements, use decimals, not percent, in your calculations. Do not round intermediate calculations. Enter your answers as percent rounded to 2 decimal places.) Standard deviation D Standard deviation Standard deviation 0-1 Standard deviation 82 Standard deviation Prov 1 of 6 !!! Next > 42 AM 2 Here are refums and standard deviations for four investments stand Dewan 16.3 Bu 3. Treasury but Stock P Stot SEOR 14.5 24.4 . 2 28 27 . Print ola Calculate the standard deviations of the following portfotos .. 50% in Treasury bilis, 50% in stock P. (Enter your answer as a percent rounded to 2 decimal places) Preces b. 50% each in and Rassuming the shares have (Do not round Intermediate calculations. Enter your answers as a percent rounded to 2 decimal places) Standard Deviation Partitive correo Perfect negative correo No to Here are some historical data on the risk characteristics of Ford and Harley Davidson Ford 1.55 Turley tiden 0.16 18.5 eta) Yearty standardeve of return Assume the standard deviation of the return on the market was 130% The correlation coefficient of Ford's return versus Harley Davidson is 0.28 What is the standard deviation of a portfolio invested hall in each share? b. What is the standard deviation of a portfolio invested one-third in Ford, one-thed in Harley Davidson, and one-third in risk free Treasury bis? c. What is the standard deviation if the portfolio is split evenly between Ford and Harley Davidson and is financed at 50% marginha in the investor puts up only 50% of the total amount and borrows the balance from the broker! d-1. What is the approximate standard deviation of a portfolio composed of 100 stocks with beas of 1.65 Ford? d-2. What is the approximate standard deviation of a portfolio composed of 300 stocles with betas of 0.86 ke Harley Davidson (For all requirements, use decimals, not percent, in your calculations. Do not round intermediate calculations. Enter your answers as percent rounded to 2 decimal places.) Standard deviation D Standard deviation Standard deviation 0-1 Standard deviation 82 Standard deviation Prov 1 of 6 !!! Next > 42 AM 2 Here are refums and standard deviations for four investments stand Dewan 16.3 Bu 3. Treasury but Stock P Stot SEOR 14.5 24.4 . 2 28 27 . Print ola Calculate the standard deviations of the following portfotos .. 50% in Treasury bilis, 50% in stock P. (Enter your answer as a percent rounded to 2 decimal places) Preces b. 50% each in and Rassuming the shares have (Do not round Intermediate calculations. Enter your answers as a percent rounded to 2 decimal places) Standard Deviation Partitive correo Perfect negative correo No to