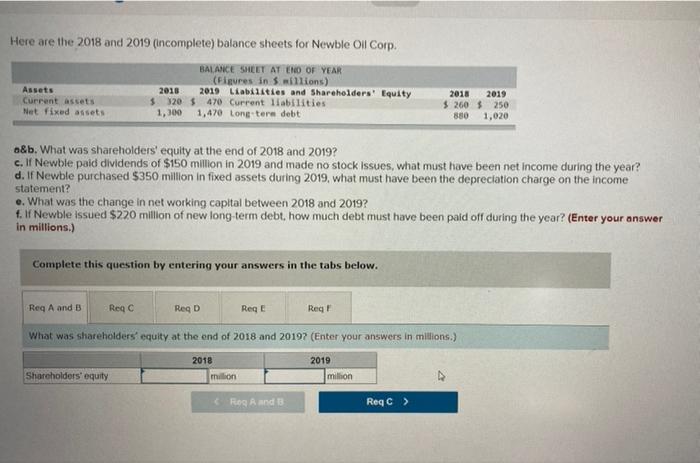

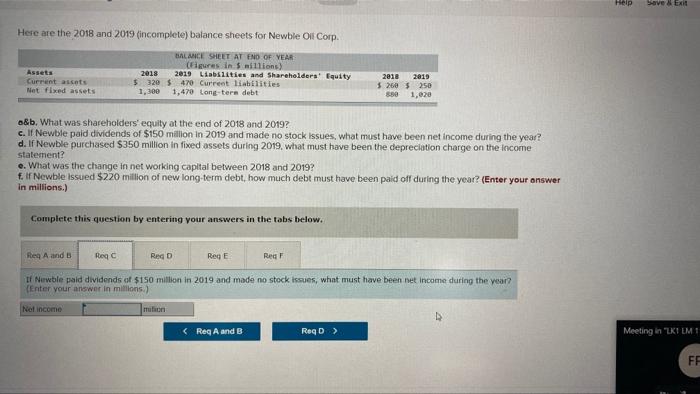

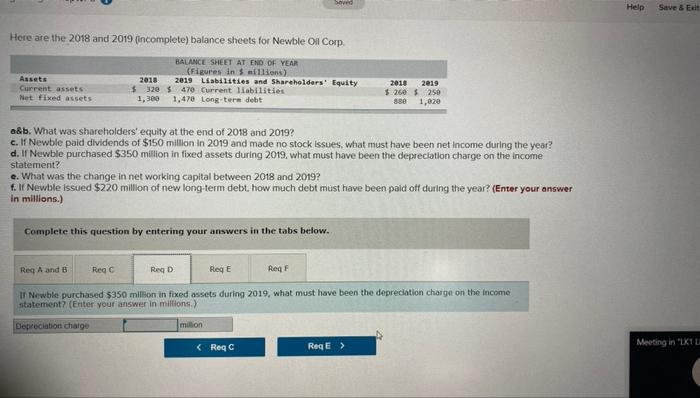

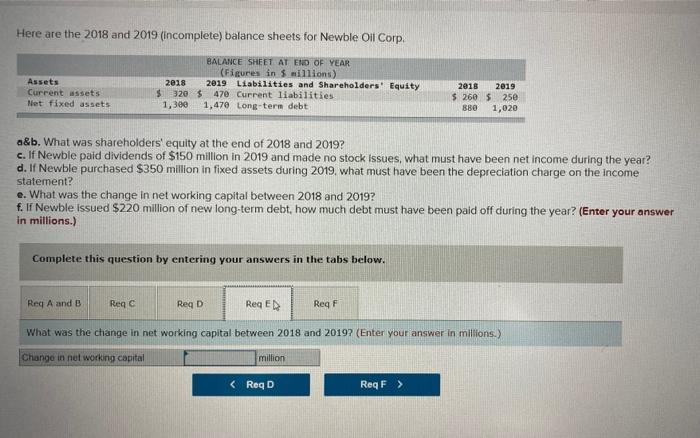

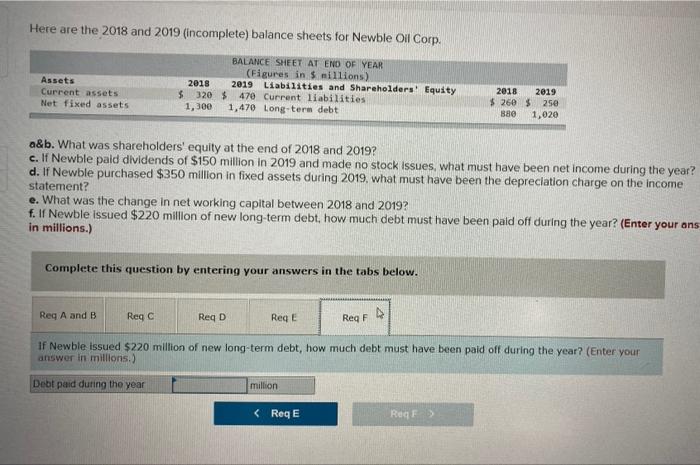

Here are the 2018 and 2019 (incomplete) balance sheets for Newble Oil Corp. BALANCE SHEET AT END OF YEAR (Figures in millions) Assets 2018 2019 Liabilities and Shareholders' Equity Current assets $3205470 Current liabilities Net fixed assets 1,470 Longtere debt 2018 2019 $260 $ 250 880 1,020 1,300 o&b. What was shareholders' equity at the end of 2018 and 2019? c. If Newble paid dividends of $150 million in 2019 and made no stock Issues, what must have been net income during the year? d. If Newble purchased $350 million in fixed assets during 2019, what must have been the depreciation charge on the income statement? e. What was the change in net working capital between 2018 and 2019? t. If Newble issued $220 million of new long term debt, how much debt must have been paid off during the year? (Enter your answer in millions.) Complete this question by entering your answers in the tabs below. Req A and B Reqc Reg D Req Reg What was shareholders' equity at the end of 2018 and 2019? (Enter your answers in millions.) 2018 2019 milion Shareholders' equity million Rog Rand Regc > Help Save & Exit Here are the 2018 and 2019 (incomplete) balance sheets for Newble Oil Corp. Assets Current assets Net fixed assets BALANCE SHEET AT END OF YEAR les in 5 millions) 2018 2019 Liabilities and Shareholders' Equity $ 320 $470 Current liabilities 1.300 1,470 Long-tern debt 2018 2819 5.260 $ 250 850 1,020 a&b. What was shareholders' equity at the end of 2018 and 2019? c. If Newble paid dividends of $150 million in 2019 and made no stock issues, what must have been net income during the year? d. If Newble purchased $350 million in fixed assets during 2019, what must have been the depreciation charge on the income statement? e. What was the change in net working capital between 2018 and 2019? f. If Newble Issued $220 million of new long term debt, how much debt must have been paid off during the year? (Enter your answer in millions.) Complete this question by entering your answers in the tabs below. Req A and Regc Red D Reg E Red F If Newble paid dividends of $150 million in 2019 and made no stock issues, what must have been net income during the year? (Enter your answer in millions.) Net income mon D Meeting in LKT LMT FF FE Seved Help Save & Exit Here are the 2018 and 2019 (incomplete) balance sheets for Newble Oil Corp Assets Current assets Net fixed assets BALANCE SHEET AT END OF YEAR (Figures in 5 millions) 2013 2019 Liabilities and Shareholders' Equity $ 320 $ 470 Current liabilities 1,300 1,470 Long term debt 2010 2019 $ 260 $ 250 880 1,020 o&b. What was shareholders' equity at the end of 2018 and 2019? c. If Newble paid dividends of $150 million in 2019 and made no stock issues, what must have been net income during the year? d. If Newble purchased $350 million in fixed assets during 2019. what must have been the depreciation charge on the income statement? e. What was the change in net working capital between 2018 and 2019? f. l Newble issued $220 million of new long-term debt how much debt must have been paid off during the year? (Enter your answer in millions.) Complete this question by entering your answers in the tabs below. Reg A and B Regc Reg D ReqE ReqF If Newble purchased $350 million in fixed assets during 2019, what must have been the depreciation charge on the income statement? (Enter your answer in millions Depreciation charge million Meeting in "LKU Here are the 2018 and 2019 (incomplete) balance sheets for Newble Oil Corp. Assets Current assets Net fixed assets BALANCE SHEET AT END OF YEAR Figures in 5 millions) 2018 2019 Liabilities and Shareholders' Equity $320 $ 470 Current liabilities 1,300 1,470 Long-term debt 2018 2019 $ 260 5 250 880 1,020 a&b. What was shareholders' equity at the end of 2018 and 2019? c. If Newble paid dividends of $150 million in 2019 and made no stock Issues, what must have been net income during the year? d. If Newble purchased $350 million in fixed assets during 2019. what must have been the depreciation charge on the income statement? e. What was the change in net working capital between 2018 and 2019? f. If Newble issued $220 million of new long-term debt, how much debt must have been paid off during the year? (Enter your answer in millions.) Complete this question by entering your answers in the tabs below. Red A and B Reqc Reg D RegED Reg F What was the change in net working capital between 2018 and 2019? (Enter your answer in millions.) Change in net working capital million Here are the 2018 and 2019 (incomplete) balance sheets for Newble Oil Corp. Assets Current assets Net fixed assets BALANCE SHEET AT END OF YEAR (Figures in S millions) 2018 2019 Liabilities and Shareholders' Equity $ 320$ 470 Current liabilities 1,300 1,470 Long-term debt 2018 2019 $ 260 $ 250 1,020 a&b. What was shareholders' equity at the end of 2018 and 2019? c. If Newble paid dividends of $150 million in 2019 and made no stock issues, what must have been net income during the year? d. If Newble purchased $350 million in fixed assets during 2019. what must have been the depreciation charge on the income statement? e. What was the change in net working capital between 2018 and 2019? f. If Newble issued $220 million of new long-term debt, how much debt must have been paid off during the year? (Enter your ans in millions.) Complete this question by entering your answers in the tabs below. Reg A and B Reg C Reg D Reg ReqF If Newble issued $220 million of new long-term debt, how much debt must have been paid off during the year? (Enter your answer in millions.) Debt paid during the year million