Answered step by step

Verified Expert Solution

Question

1 Approved Answer

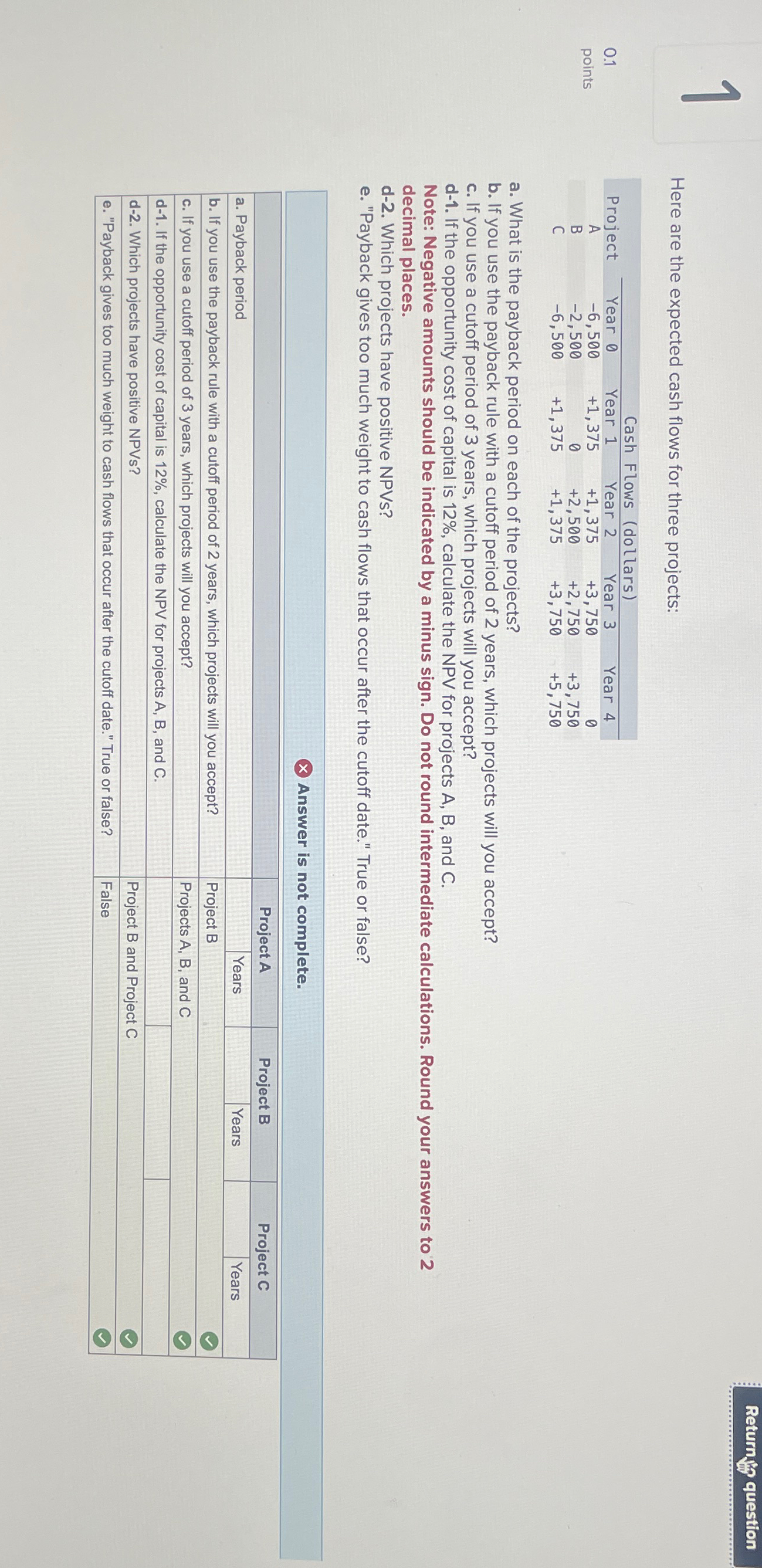

Here are the expected cash flows for three projects: Cash Flows (dollars) 0.1 Project Year 0 Year 1 Year 2 Year 3 Year 4

Here are the expected cash flows for three projects: Cash Flows (dollars) 0.1 Project Year 0 Year 1 Year 2 Year 3 Year 4 A points -6,500 +1,375 +1,375 +3,750 0 B -2,500 0 +2,500 +2,750 +3,750 C -6,500 +1,375 +1,375 +3,750 +5,750 a. What is the payback period on each of the projects? b. If you use the payback rule with a cutoff period of 2 years, which projects will you accept? c. If you use a cutoff period of 3 years, which projects will you accept? d-1. If the opportunity cost of capital is 12%, calculate the NPV for projects A, B, and C. Note: Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places. d-2. Which projects have positive NPVs? e. "Payback gives too much weight to cash flows that occur after the cutoff date." True or false? Answer is not complete. Project A a. Payback period Years Project B Years Project C Years b. If you use the payback rule with a cutoff period of 2 years, which projects will you accept? Project B c. If you use a cutoff period of 3 years, which projects will you accept? Projects A, B, and C d-1. If the opportunity cost of capital is 12%, calculate the NPV for projects A, B, and C. d-2. Which projects have positive NPVs? e. "Payback gives too much weight to cash flows that occur after the cutoff date." True or false? False Project B and Project C Return question

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started