Question

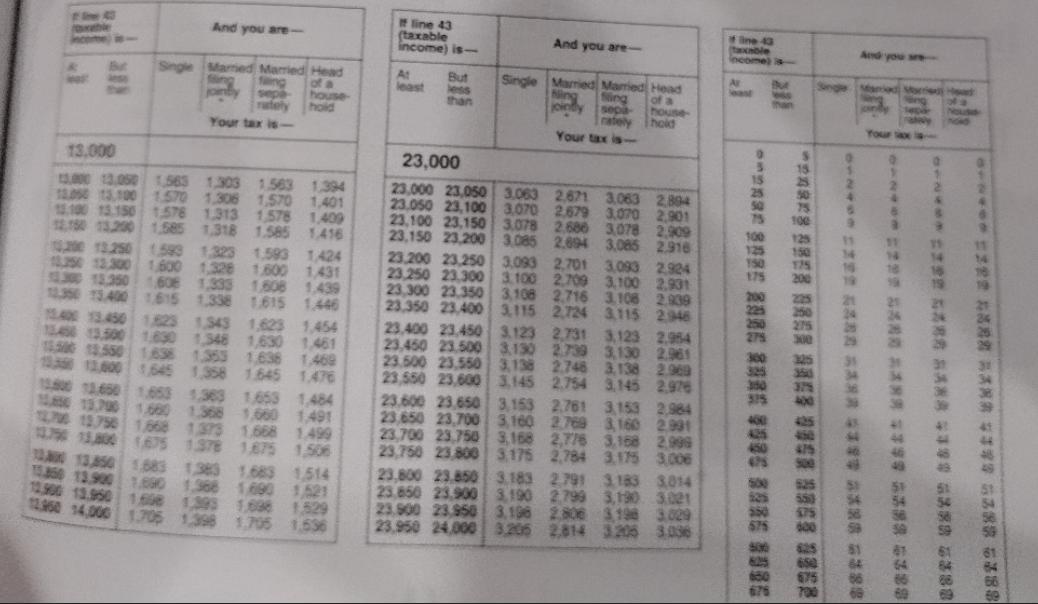

here are the income tables to use as well Tina Moore is a junior who earned $3,510 working at a card shop. Her employer deducted

here are the income tables to use as well

here are the income tables to use as well

Tina Moore is a junior who earned $3,510 working at a card shop. Her employer deducted $468 in withholding taxes. She has no adjustments to her income or additional income. Her mother claims her as a dependent. How much will Tina receive as a refund? Kim Chung worked for his uncle during the summer. He was paid $2,897 but no withholding tax was deducted. He earned $57 in interest on his savings account. He has no adjustments to his income and his parents claim him on their tax return. How much does he owe in federal income taxes?

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The amount of 3083 will be returned to Tina Moore We must first ascertain Tinas taxable income Her g...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App