Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Here are the options in order of the blanks: 1.celery, tomatoes, carrots 2. stones, sticks, rocks 3. negative , positive 4. reward, promote,punish 5. less,

Here are the options in order of the blanks:

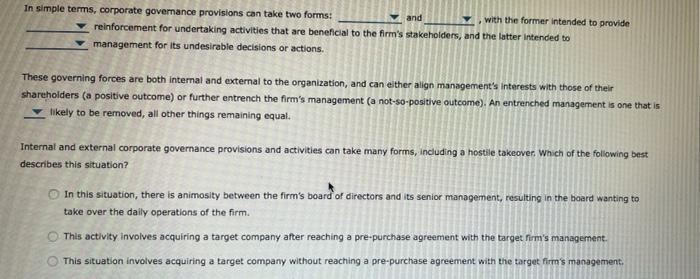

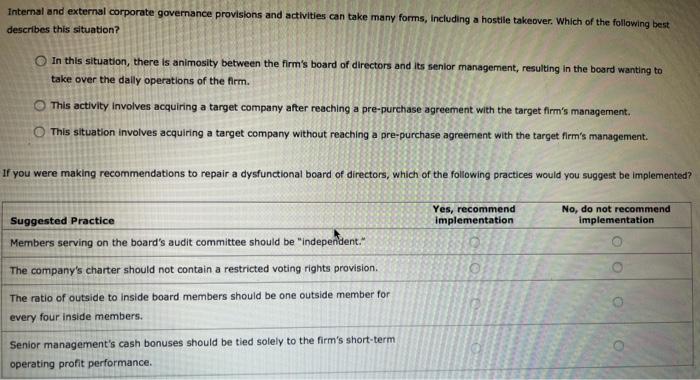

In simple terms, corporate governance provisions can take two forms: and with the former intended to provide reinforcement for undertaking activities that are beneficial to the firm's stakeholders, and the latter intended to management for its undesirable decisions or actions. These governing forces are both internal and external to the organization, and can either align management's Interests with those of their shareholders (a positive outcome) or further entrench the firm's management (a not-so-positive outcome). An entrenched management is one that is likely to be removed, all other things remaining equal. Internal and external corporate governance provisions and activities can take many forms, including a hostile takeover. Which of the following best describes this situation? In this situation, there is animosity between the firm's board of directors and its senior management, resulting in the board wanting to take over the daily operations of the firm. This activity involves acquiring a target company after reaching a pre-purchase agreement with the target firm's management. This situation involves acquiring a target company without reaching a pre-purchase agreement with the target firm's management. Internal and external corporate governance provisions and activities can take many forms, including a hostile takeover. Which of the following best describes this situation? In this situation, there is animosity between the firm's board of directors and its senior management, resulting in the board wanting to take over the daily operations of the firm. This activity involves acquiring a target company after reaching a pre-purchase agreement with the target firm's management. This situation involves acquiring a target company without reaching a pre-purchase agreement with the target firm's management. If you were making recommendations to repair a dysfunctional board of directors, which of the following practices would you suggest be implemented? Yes, recommend implementation No, do not recommend implementation Suggested Practice Members serving on the board's audit committee should be "independent." The company's charter should not contain a restricted voting rights provision The ratio of outside to Inside board members should be one outside member for every four inside members. Senior management's cash bonuses should be tied solely to the firm's short-term operating profit performance 1.celery, tomatoes, carrots

2. stones, sticks, rocks

3. negative , positive

4. reward, promote,punish

5. less, more

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started