Question

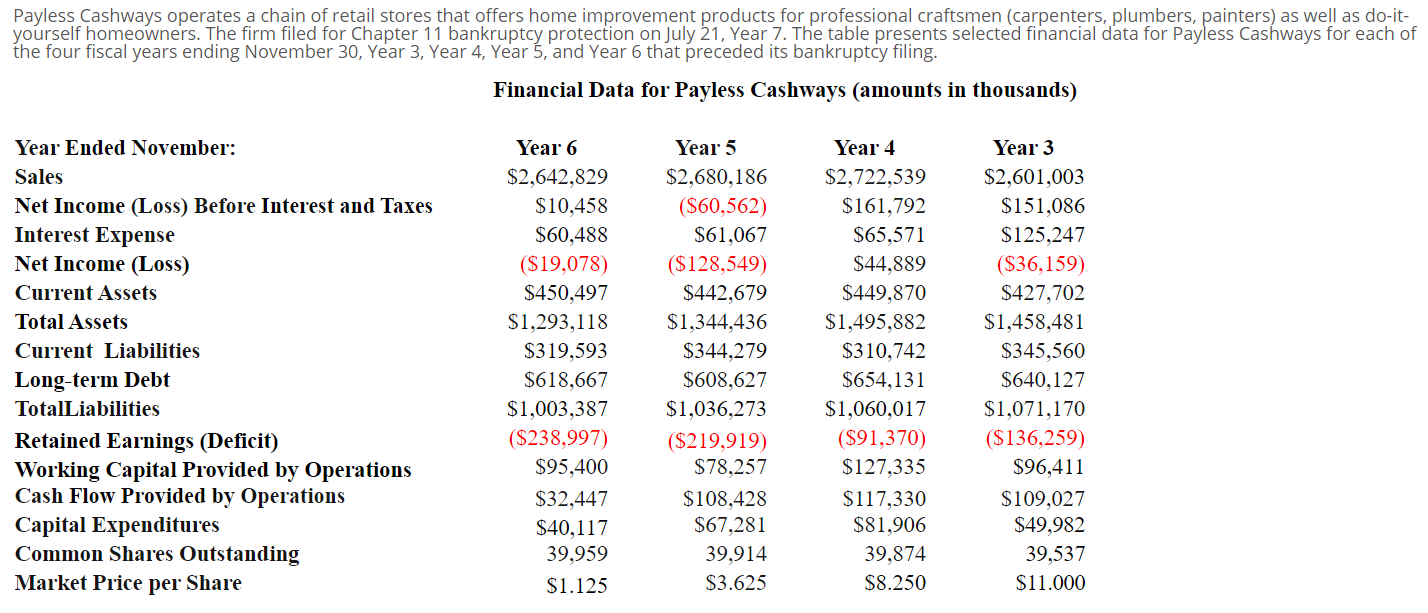

Here are the questions and the chart is below. Let me know if you have any questions! Thank you The current ratio as of the

Here are the questions and the chart is below. Let me know if you have any questions! Thank you

- The current ratio as of the end of year 4 was _________

One digit to the right of the decimal point is enough.

Question 2

The current ratio as of the end of year 5 was _________

. One digit to the right of the decimal point is enough.

Question 3

The current ratio as of the end of year 6 was _________

. One digit to the right of the decimal point is enough.

Question 4

Cash flow from operations to average current liabilities for year 4 was

. Express your answer as a decimal (not a percent). Include three digits to the right of the decimal point.

Question 5

Cash flow from operations to average current liabilities for year 5 was

. Express your answer as a decimal (not a percent). Include three digits to the right of the decimal point.

Question 6

Cash flow from operations to average current liabilities for year 6 was

. Express your answer as a decimal (not a percent). Include three digits to the right of the decimal point.

Question 7 of 230.5 PointsClick to see additional instructions

What follows is a numeric fill in the blank question with 1 blanks.

The long-term debt to equity ratio (at year end)as of the end of year 4 was _________

Blank 1. Fill in the blank, read surrounding text.

. One digit to the right of the decimal point is enough.

Mark for ReviewWhat's This?

Question 8 of 230.5 PointsClick to see additional instructions

What follows is a numeric fill in the blank question with 1 blanks.

The long-term debt to equity ratio (at year end)as of the end of year 5 was _________

Blank 1. Fill in the blank, read surrounding text.

. One digit to the right of the decimal point is enough.

Mark for ReviewWhat's This?

Question 9 of 230.5 PointsClick to see additional instructions

What follows is a numeric fill in the blank question with 1 blanks.

The long-term debt to equity ratio (at year end)as of the end of year 6 was _________

Blank 1. Fill in the blank, read surrounding text.

. One digit to the right of the decimal point is enough.

Mark for ReviewWhat's This?

Question 10 of 230.5 PointsClick to see additional instructions

What follows is a numeric fill in the blank question with 1 blanks.

Total liabilities to total assets (at year end) as of the end of year 4 was _________

Blank 1. Fill in the blank, read surrounding text.

. Express your answer as a decimal (not a percent). Include three digits to the right of the decimal point.

Mark for ReviewWhat's This?

Question 11 of 230.5 PointsClick to see additional instructions

What follows is a numeric fill in the blank question with 1 blanks.

Total liabilities to total assets (at year end) as of the end of year 5 was _________

Blank 1. Fill in the blank, read surrounding text.

. Express your answer as a decimal (not a percent). Include three digits to the right of the decimal point.

Mark for ReviewWhat's This?

Question 12 of 230.5 PointsClick to see additional instructions

What follows is a numeric fill in the blank question with 1 blanks.

Total liabilities to total assets (at year end) as of the end of year 6 was _________

Blank 1. Fill in the blank, read surrounding text.

. Express your answer as a decimal (not a percent). Include three digits to the right of the decimal point.

Mark for ReviewWhat's This?

Question 13 of 230.5 PointsClick to see additional instructions

What follows is a numeric fill in the blank question with 1 blanks.

Cash flow from operations to average total liabilities for year 4 was

Blank 1. Fill in the blank, read surrounding text.

. Express your answer as a decimal (not a percent). Include three digits to the right of the decimal point.

Mark for ReviewWhat's This?

Question 14 of 230.5 PointsClick to see additional instructions

What follows is a numeric fill in the blank question with 1 blanks.

Cash flow from operations to average total liabilities for year 5 was

Blank 1. Fill in the blank, read surrounding text.

. Express your answer as a decimal (not a percent). Include three digits to the right of the decimal point.

Mark for ReviewWhat's This?

Question 15 of 230.5 PointsClick to see additional instructions

What follows is a numeric fill in the blank question with 1 blanks.

Cash flow from operations to average total liabilities for year 6 was

Blank 1. Fill in the blank, read surrounding text.

. Express your answer as a decimal (not a percent). Include three digits to the right of the decimal point.

Mark for ReviewWhat's This?

Question 16 of 230.5 PointsClick to see additional instructions

What follows is a numeric fill in the blank question with 1 blanks.

The interest coverage ratio (times interest earned) for year 4 was

Blank 1. Fill in the blank, read surrounding text.

. One digit to the right of the decimal point is enough.

Mark for ReviewWhat's This?

Question 17 of 230.5 PointsClick to see additional instructions

What follows is a numeric fill in the blank question with 1 blanks.

The interest coverage ratio (times interest earned) for year 5 was

Blank 1. Fill in the blank, read surrounding text.

. One digit to the right of the decimal point is enough.

Mark for ReviewWhat's This?

Question 18 of 230.5 PointsClick to see additional instructions

What follows is a numeric fill in the blank question with 1 blanks.

The interest coverage ratio (times interest earned) for year 6 was

Blank 1. Fill in the blank, read surrounding text.

. One digit to the right of the decimal point is enough

Mark for ReviewWhat's This?

Question 19 of 231 PointsClick to see additional instructions

What follows is a numeric fill in the blank question with 1 blanks.

Altman's Z-score for Payless Cashways for Year 3 was __________

Blank 1. Fill in the blank, read surrounding text.

. Include two digits to the right of the decimal point.

Mark for ReviewWhat's This?

Question 20 of 231 PointsClick to see additional instructions

What follows is a numeric fill in the blank question with 1 blanks.

Altman's Z-score for Payless Cashways for Year 4 was __________

Blank 1. Fill in the blank, read surrounding text.

. Include two digits to the right of the decimal point.

Mark for ReviewWhat's This?

Question 21 of 231 PointsClick to see additional instructions

What follows is a numeric fill in the blank question with 1 blanks.

Altman's Z-score for Payless Cashways for Year 5 was __________

Blank 1. Fill in the blank, read surrounding text.

. Include two digits to the right of the decimal point.

Mark for ReviewWhat's This?

Question 22 of 231 PointsClick to see additional instructions

What follows is a numeric fill in the blank question with 1 blanks.

Altman's Z-score for Payless Cashways for Year 6 was __________

Blank 1. Fill in the blank, read surrounding text.

. Include two digits to the right of the decimal point.

Mark for ReviewWhat's This?

Question 23 of 232 PointsUsing these analyses, discuss the most important factors that signal the bankruptcy of Payless Cashways in Year 7. Three or four sentences should be enough.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started