Answered step by step

Verified Expert Solution

Question

1 Approved Answer

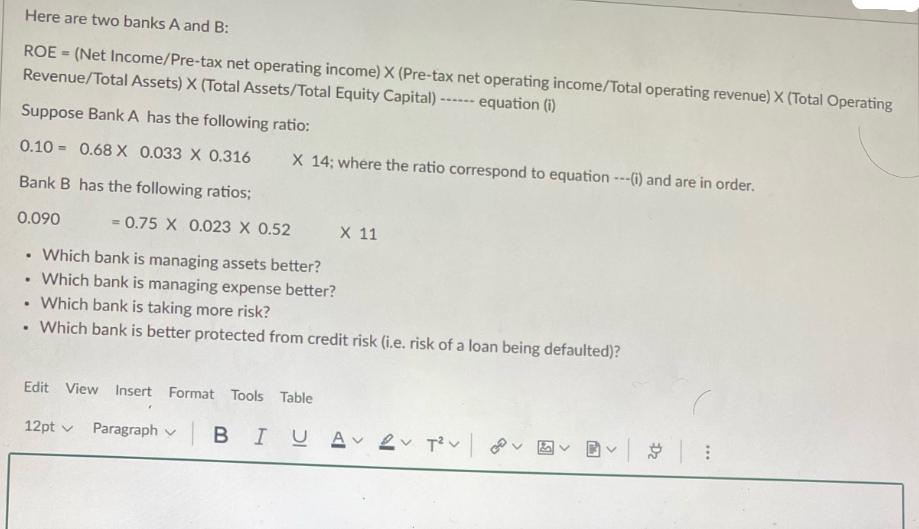

Here are two banks A and B: ROE (Net Income/Pre-tax net operating income) X (Pre-tax net operating income/Total operating revenue) X (Total Operating Revenue/Total

Here are two banks A and B: ROE (Net Income/Pre-tax net operating income) X (Pre-tax net operating income/Total operating revenue) X (Total Operating Revenue/Total Assets) X (Total Assets/Total Equity Capital) Suppose Bank A has the following ratio: equation (i) 0.10 0.68 X 0.033 X 0.316 X 14; where the ratio correspond to equation ---(i) and are in order. Bank B has the following ratios; 0.090 = 0.75 X 0.023 X 0.52 X 11 . Which bank is managing assets better? . Which bank is managing expense better? . Which bank is taking more risk? . Which bank is better protected from credit risk (i.e. risk of a loan being defaulted)? Edit View Insert Format Tools Table 12pt v Paragraph BIUAT v

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the performance of Bank A and Bank B based on the given ratios lets break down the calcul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started