Answered step by step

Verified Expert Solution

Question

1 Approved Answer

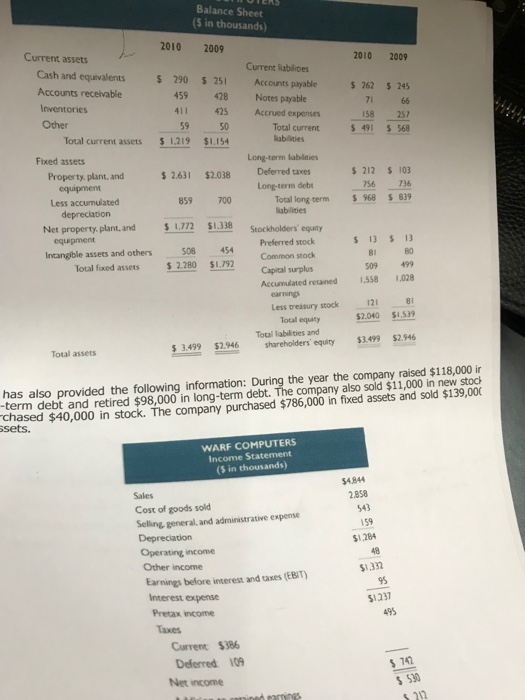

here CNS Balance Sheet (s in thousands) 2010 2009 2010 2009 $ 290 459 251 428 425 50 $1.154 Current liabilities Accounts payable Notes payable

here

CNS Balance Sheet (s in thousands) 2010 2009 2010 2009 $ 290 459 251 428 425 50 $1.154 Current liabilities Accounts payable Notes payable Accrued expenses Total current Kables $ 2625 245 7166 158 257 $ 491 568 59 $ 1.219 Current assets Cash and equivalents Accounts receivable Inventories Other Total current assets Fixed assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Intangible assets and others Total foxed assets $2.631 $2.038 Long-term labilities Deferred taxes Long-term debt Total long term abilities $ 212 756 $968 S 103 736 $ 839 859700 $ 1.772 $1.338 508 $ 2.280 454 $1.792 $ 135 13 BI 80 509499 1.558 1028 Stockholders' equity Preferred stock Common stock Capital surplus Accumulated retained earnings Less treasury stock Total equity Toual abilities and Shareholders' equity 12181 $2.040 51.539 $2.946 $3.499 $ 3.499 $2.946 Total assets has also provided the following information: During the year the company raised $118,000 ir -term debt and retired $98,000 in long-term debt. The company also sold $11,000 in new stoc "chased $40.000 in stock. The company purchased $786,000 in fixed assets and sold $139,000 ssets. WARF COMPUTERS Income Statement (s in thousands) $4844 2858 159 $1284 $1.332 Sales Cost of goods sold Selling general, and administrative expense Depreciation Operating income Other income Earnings before interest and taxes (EBIT) Interest expense Pretax income Taxes Current $386 Deferred. 109 Net income B earings 1231 495 $742 570 LUWS AT WARF COMPUTERS, INC. warf Computers, Inc., was founded 15 years ago by Nick Warf, a computer programmer. The smal tial investment to start the company was made by Nick and his friends. Over the years, this same group has supplied the limited additional investment needed by the company in the form of both equity and short and long-term debt. Recently the company has developed a virtual keyboard (VK). The uses sophisticated artificial intelligence algorithms that allow the user to speak naturally and have the computer input the text, correct spelling and grammatical errors, and format the document according to reset user guidelines. The VK even suggests alternative phrasing and sentence structure, and it provides detailed stylistic diagnostics. Based on a proprietary very advanced software/hardware hybric echnology, the system is a full generation beyond what is currently on the market. To introduce the VK he company will require significant outside investment. Nick has made the decision to seek this outside financing in the form of new equity investments and investors and the banks will require a detailed financial analysis. You nk loans. Naturally, new ployer, Angus Jones & Partners, LLC, has asked you to examine the financial statements provided by k. Here are the balance sheet for the two most recent years and the most recent income statement: - has sold provided to ff into CNS Balance Sheet (s in thousands) 2010 2009 2010 2009 $ 290 459 251 428 425 50 $1.154 Current liabilities Accounts payable Notes payable Accrued expenses Total current Kables $ 2625 245 7166 158 257 $ 491 568 59 $ 1.219 Current assets Cash and equivalents Accounts receivable Inventories Other Total current assets Fixed assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Intangible assets and others Total foxed assets $2.631 $2.038 Long-term labilities Deferred taxes Long-term debt Total long term abilities $ 212 756 $968 S 103 736 $ 839 859700 $ 1.772 $1.338 508 $ 2.280 454 $1.792 $ 135 13 BI 80 509499 1.558 1028 Stockholders' equity Preferred stock Common stock Capital surplus Accumulated retained earnings Less treasury stock Total equity Toual abilities and Shareholders' equity 12181 $2.040 51.539 $2.946 $3.499 $ 3.499 $2.946 Total assets has also provided the following information: During the year the company raised $118,000 ir -term debt and retired $98,000 in long-term debt. The company also sold $11,000 in new stoc "chased $40.000 in stock. The company purchased $786,000 in fixed assets and sold $139,000 ssets. WARF COMPUTERS Income Statement (s in thousands) $4844 2858 159 $1284 $1.332 Sales Cost of goods sold Selling general, and administrative expense Depreciation Operating income Other income Earnings before interest and taxes (EBIT) Interest expense Pretax income Taxes Current $386 Deferred. 109 Net income B earings 1231 495 $742 570 LUWS AT WARF COMPUTERS, INC. warf Computers, Inc., was founded 15 years ago by Nick Warf, a computer programmer. The smal tial investment to start the company was made by Nick and his friends. Over the years, this same group has supplied the limited additional investment needed by the company in the form of both equity and short and long-term debt. Recently the company has developed a virtual keyboard (VK). The uses sophisticated artificial intelligence algorithms that allow the user to speak naturally and have the computer input the text, correct spelling and grammatical errors, and format the document according to reset user guidelines. The VK even suggests alternative phrasing and sentence structure, and it provides detailed stylistic diagnostics. Based on a proprietary very advanced software/hardware hybric echnology, the system is a full generation beyond what is currently on the market. To introduce the VK he company will require significant outside investment. Nick has made the decision to seek this outside financing in the form of new equity investments and investors and the banks will require a detailed financial analysis. You nk loans. Naturally, new ployer, Angus Jones & Partners, LLC, has asked you to examine the financial statements provided by k. Here are the balance sheet for the two most recent years and the most recent income statement: - has sold provided to ff into

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started