Here I am uploading 5 photos It is same question. please Help me to solve this problem. You can use exal and upload photo please.

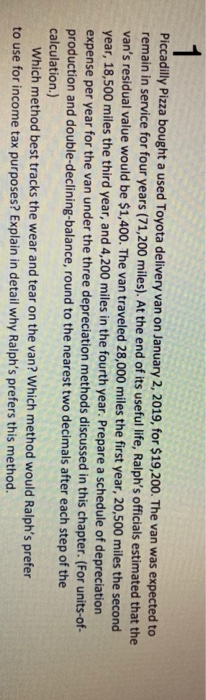

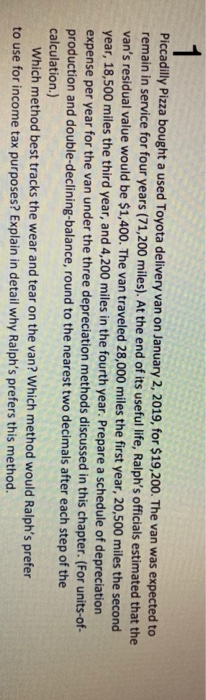

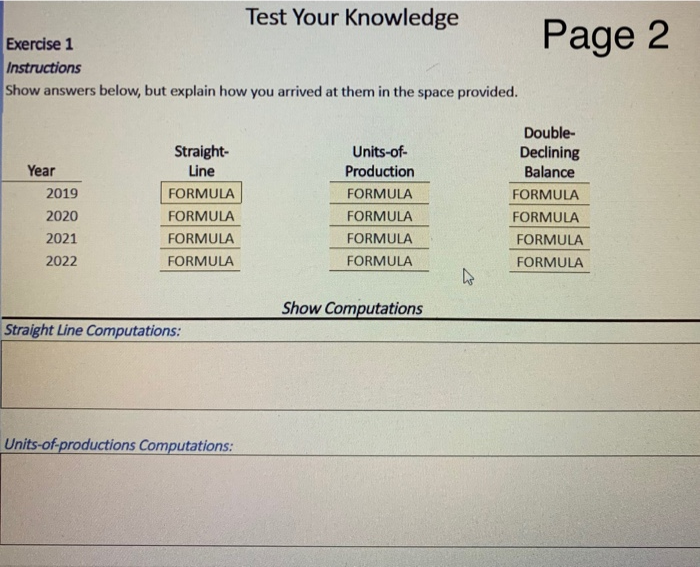

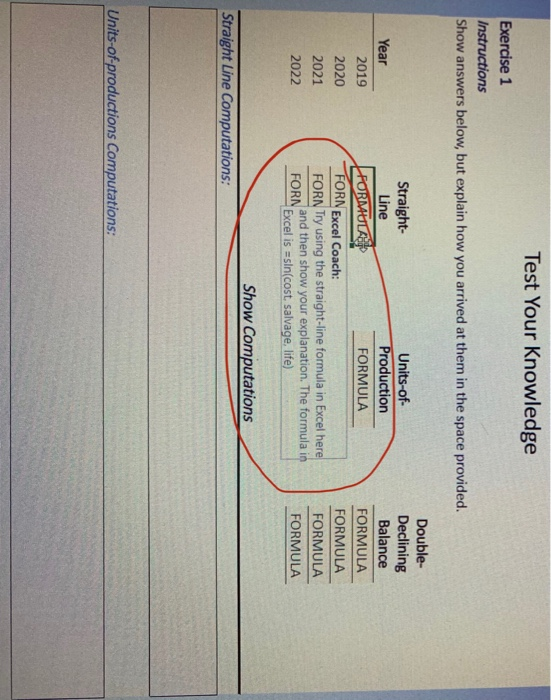

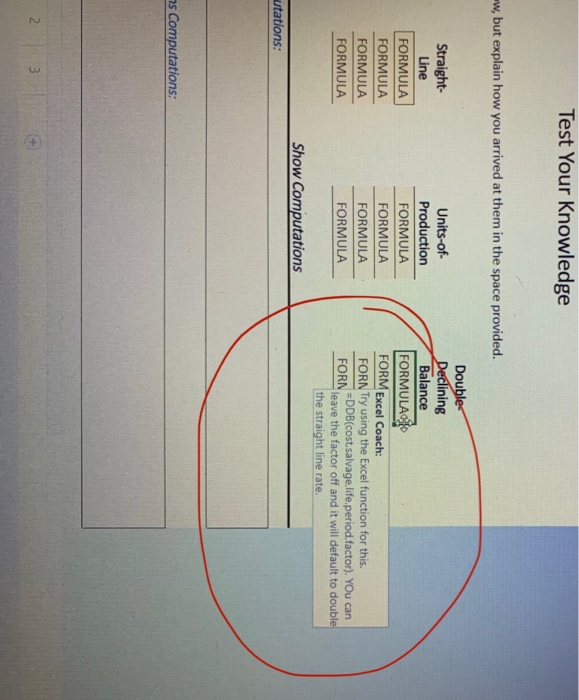

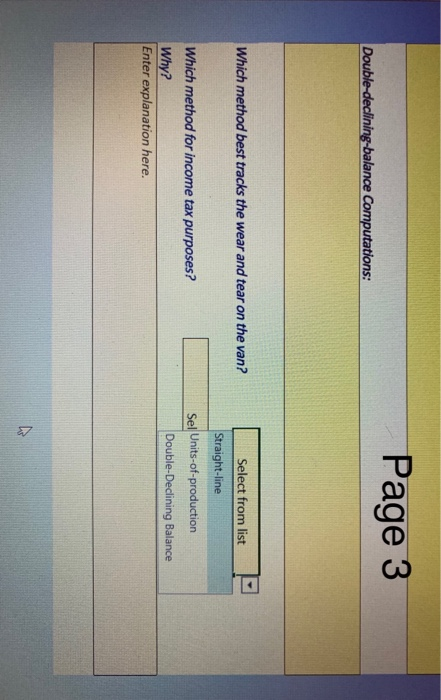

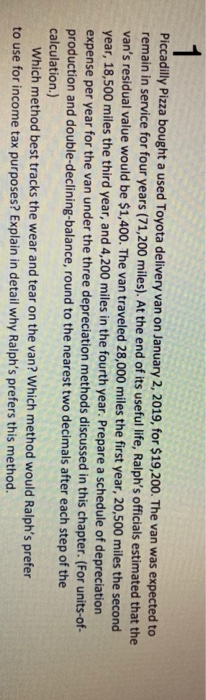

Piccadilly Pizza bought a used Toyota delivery van on January 2, 2019, for $19,200. The van was expected to remain in service for four years (71,200 miles). At the end of its useful life, Ralph's officials estimated that the van's residual value would be $1,400. The van traveled 28,000 miles the first year, 20,500 miles the second year, 18,500 miles the third year, and 4,200 miles in the fourth year. Prepare a schedule of depreciation expense per year for the van under the three depreciation methods discussed in this chapter. (For units-of- production and double-declining-balance, round to the nearest two decimals after each step of the calculation.) Which method best tracks the wear and tear on the van? Which method would Ralph's prefer to use for income tax purposes? Explain in detail why Ralph's prefers this method. Test Your Knowledge Page 2 Exercise 1 Instructions Show answers below, but explain how you arrived at them in the space provided. Double- Straight- Units-of- Declining Balance Year Production Line FORMULA 2019 FORMULA FORMULA 2020 FORMULA FORMULA FORMULA 2021 FORMULA FORMULA FORMULA 2022 FORMULA FORMULA FORMULA Show Computations Straight Line Computations: Units-of-productions Computations: Test Your Knowledge Exercise 1 Instructions Show answers below, but explain how you arrived at them in the space provided. Double- Units-of- Production Straight- Declining Balance Year Line FORMULA FORN FORN Try using the straight-line formula in Excel here 2019 FORMULA FORMULA 2020 Excel Coach: FORMULA 2021 FORMULA and then show your explanation. The formula in FORN Excel is =sln(cost, salvage, life) 2022 FORMULA Show Computations Straight Line Computations: Units-of-productions Computations: 2. Test Your Knowledge ww, but explain how you arrived at them in the space provided. Double Declining Balance FORMULA Units-of- Production Straight- Line FORMULA FORMULA FORMULA FORMULA FORM Excel Coach: FORMULA FORMULA FORN Try using the Excel function for this. =DDB(cost.salvage.life.period.factor). YOu can FORN leave the factor off and it will default to double FORMULA FORMULA the straight line rate. Show Computations utations: ns Computations: Page 3 Double-declining-balance Computations: Which method best tracks the wear and tear on the van? Select from list Straight-line Sel Units-of-production Which method for income tax purposes? Why? Enter explanation here. Double-Declining Balance Page 3 Double-declining-balance Computations: Which method best tracks the wear and tear on the van? Select from list Which method for income tax purposes? Select from list Why? Enter explanation here. Straight-line Units-of-production Double-Declining Balance