Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Here is 1 case study used in our program. We will utilize inputs from this case. Southview Health System: Southview Health System ( SHS )

Here is case study used in our program. We will utilize inputs from this case.

Southview Health System:

Southview Health System SHS is a notforprofit health system anchored by Southview

Hospital, an bed facility on the campus of Southview University in Philadelphia, PA The

University has the Southview School of Medicine and supports clinical training at its hospitals,

as well as supporting translational research. The system boasts additional hospitals that

have between beds in surrounding counties and states. Its member employee

base includes over ambulatory centers, including two medical groups of specialists

and family medicineprimary care specialists. The organization's IT platform shares one

electronic medical record.

Demographics

The primary service area is million with a diverse population: black, white,

Latinx, and Asian, and other.

The payor mix of the insured is

Medicare

commercial private insurance

Medicaid

selfpay majority cash

The uninsured rate for the area is typically

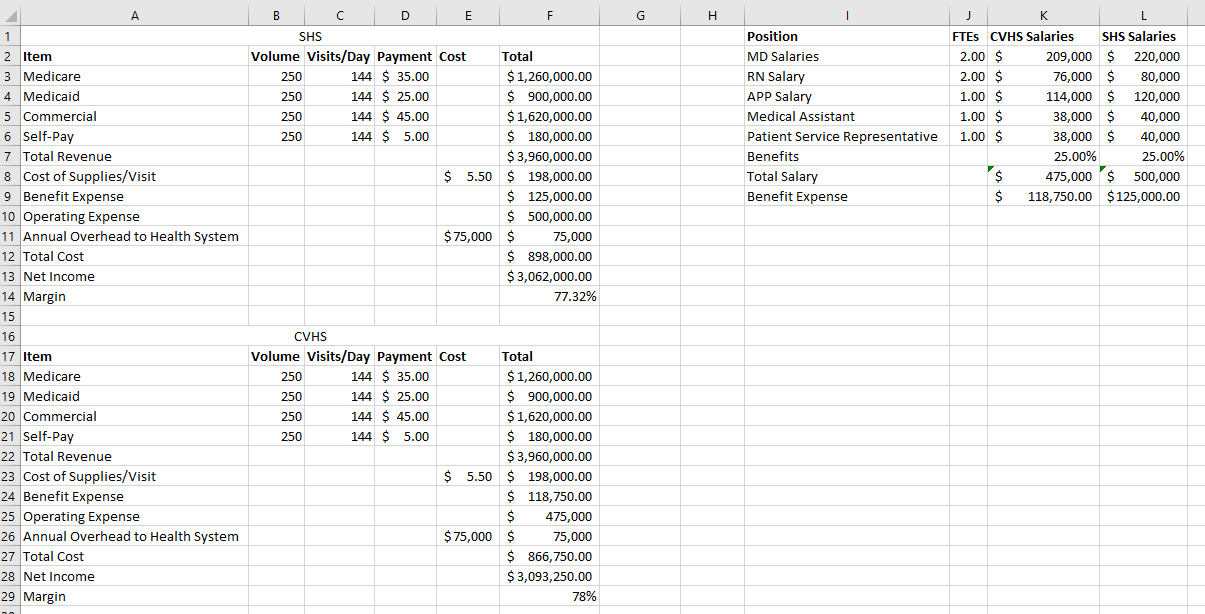

Question Create an Annual Proforma Income Statement in Excel for this health system, using inputs in the tables below

Question Does this system have a positive or negative margin?

Payer Payment

Medicare: $

Medicaid: $

Commercial: $

SelfPay $

Volume

Time Volume

Days

VisitsDay

Cost

Item Cost

SuppliesVisit $

Annual Overhead to Health System $

Position FTEs CVHS Salaries SHS Salaries

MD Salaries $ $

RN Salary $ $

APP Salary $ $

Medical Assistant $ $

Patient Service Representative $ $

Benefits

Could you please check my work on the image i sent. I feel the margins are too high.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started