Answered step by step

Verified Expert Solution

Question

1 Approved Answer

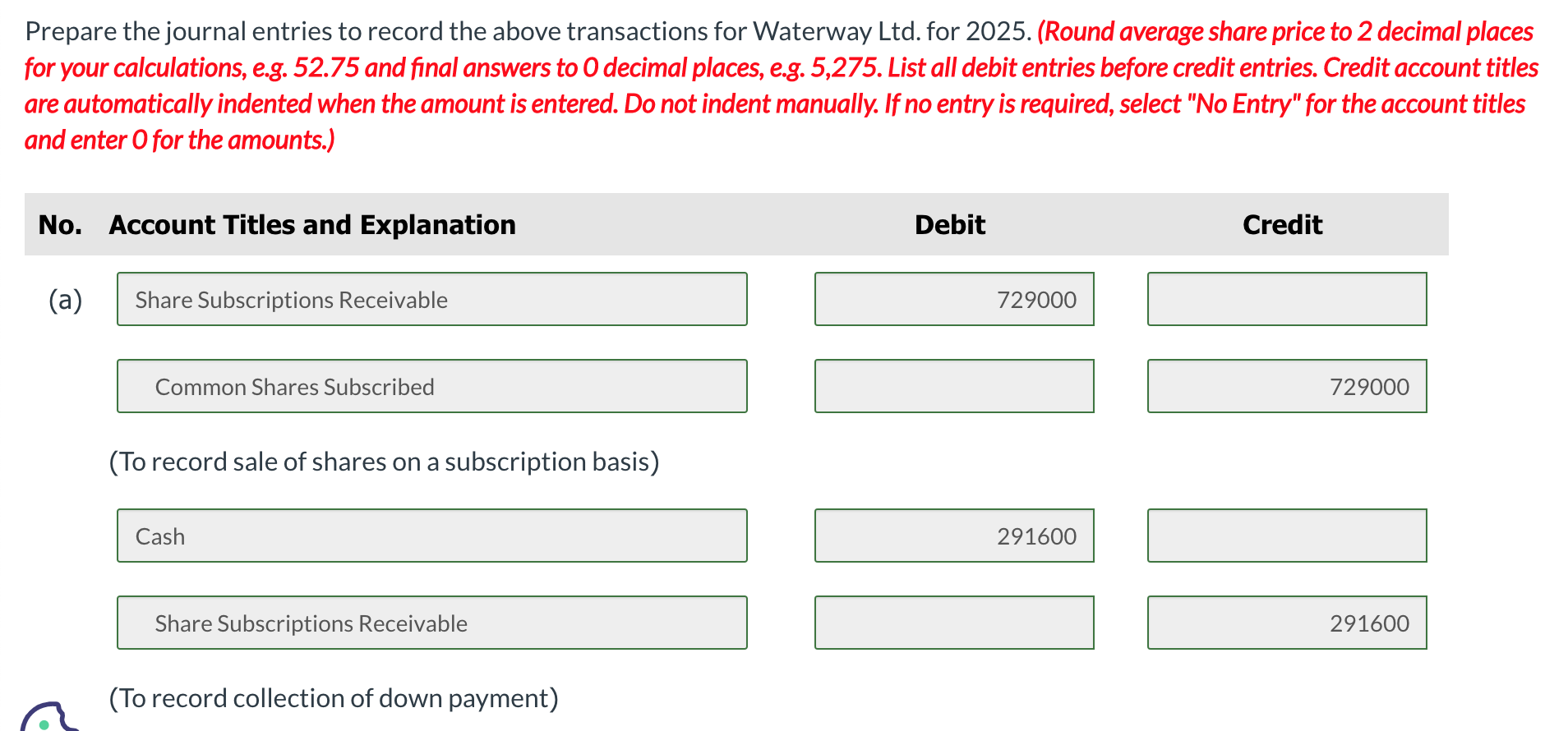

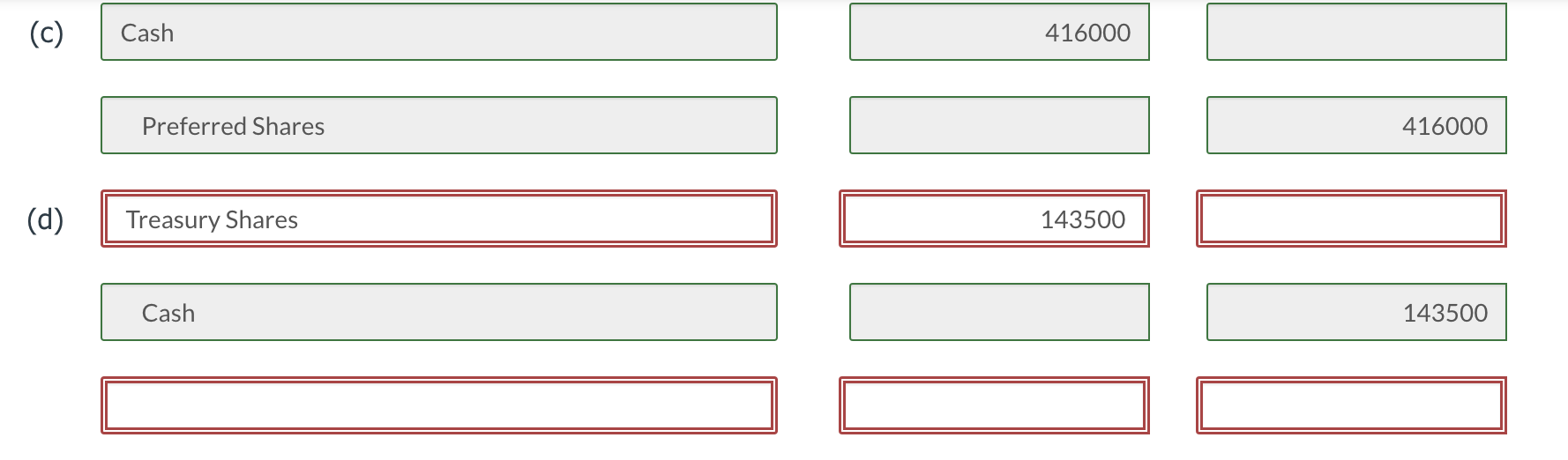

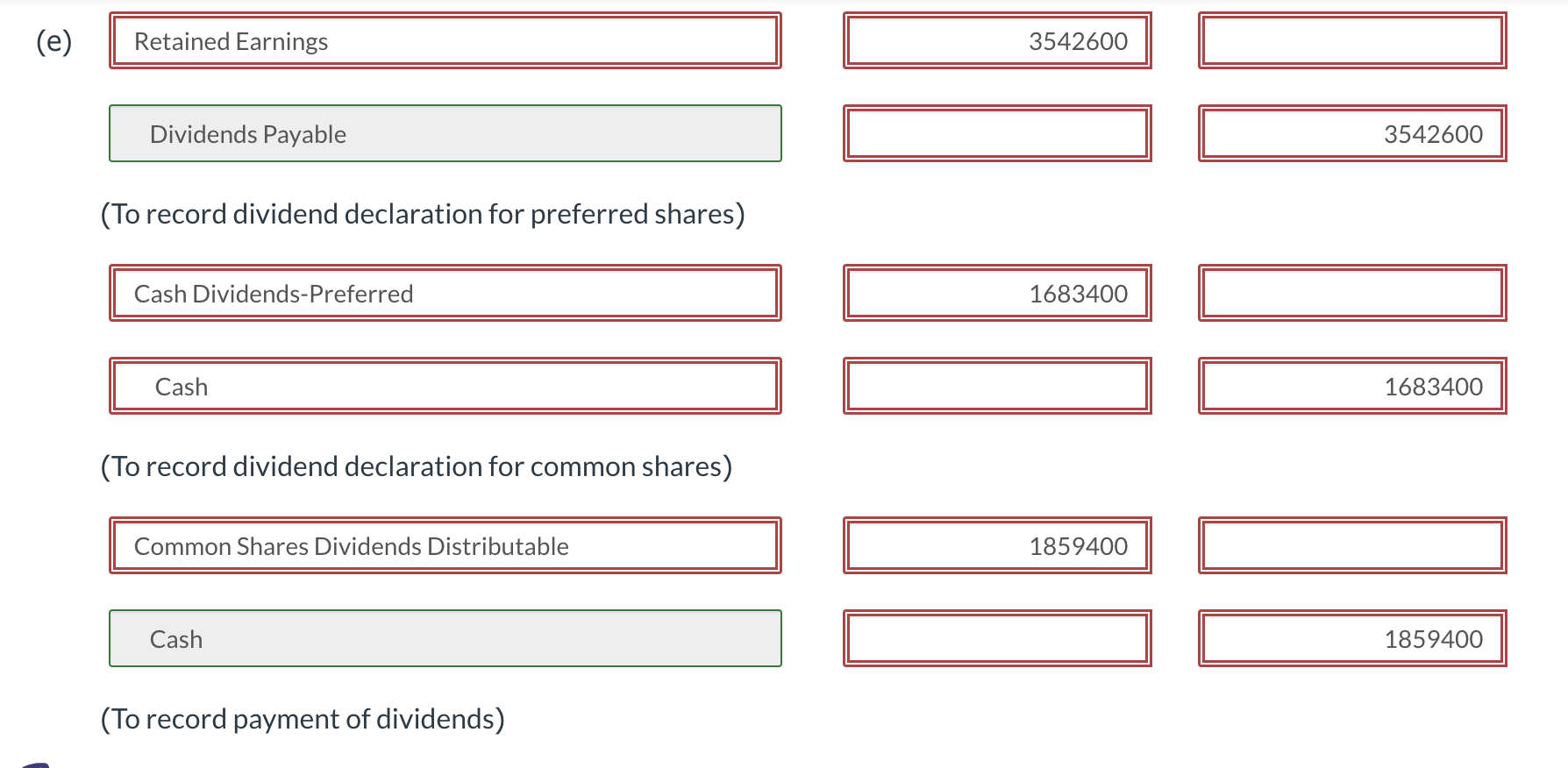

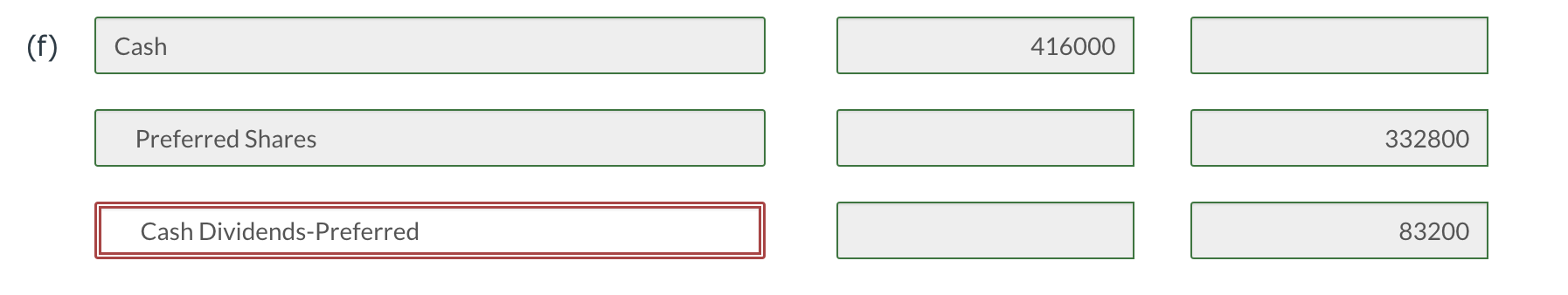

Here is a list of accounts that need to be used: Whatever in red is incorrect. And everything in green is correct. Waterway Ltd. showed

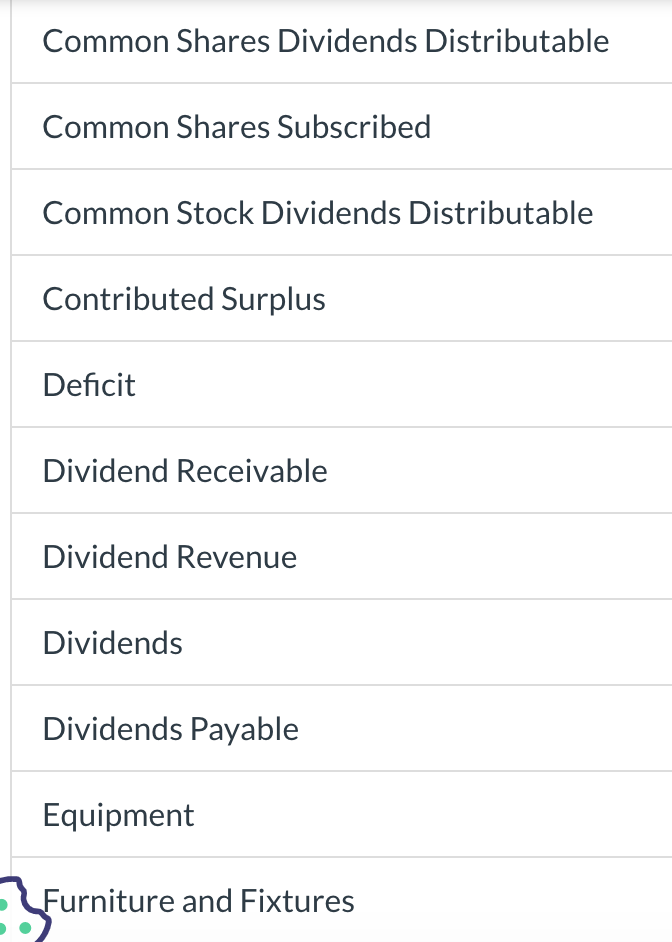

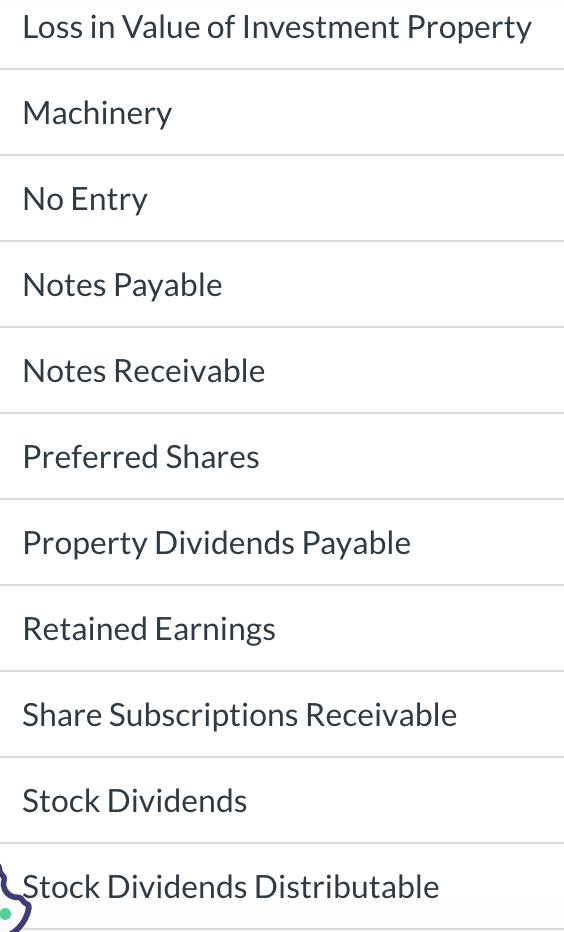

Here is a list of accounts that need to be used:

Whatever in red is incorrect. And everything in green is correct.

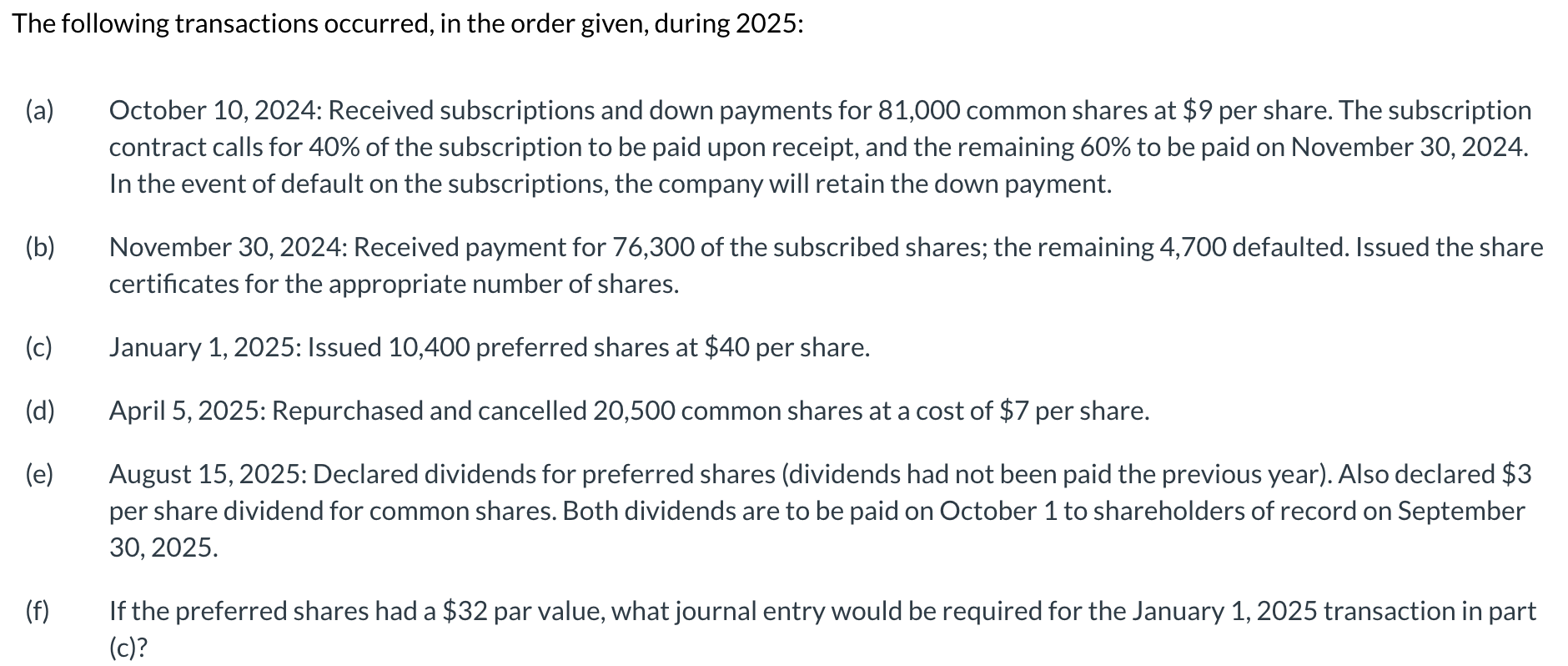

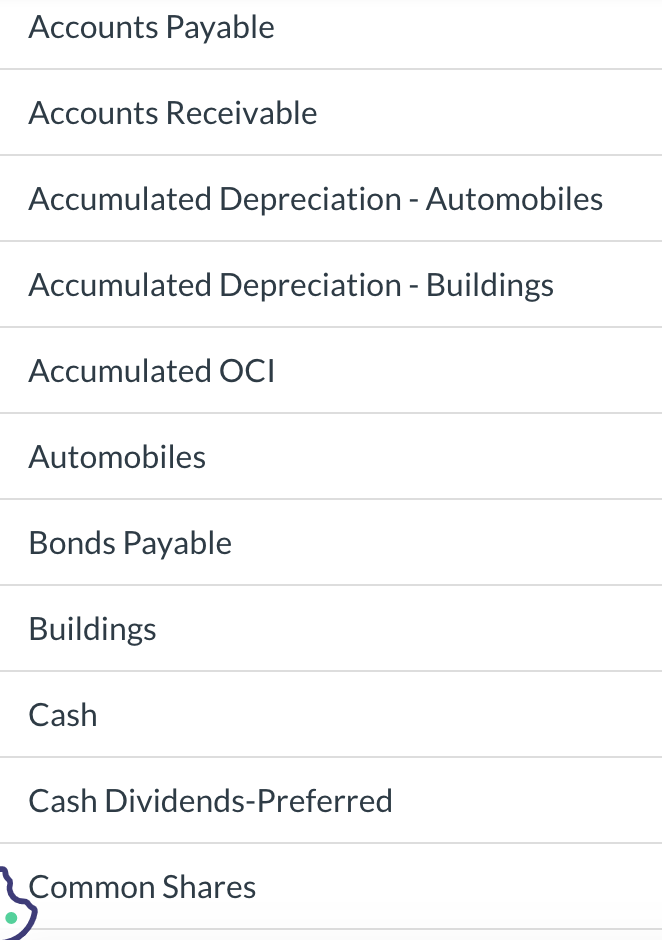

Waterway Ltd. showed the following information on its September 30, 2024 year-end financial statements: Preferred Shares, $8 cumulative, 500,000 shares authorized, 200,000 shares issued and outstanding $3,200,000 Common Shares, no par value, unlimited shares authorized, 564,000 shares issued and outstanding $4,512,000 The following transactions occurred, in the order given, during 2025: (a) October 10, 2024: Received subscriptions and down payments for 81,000 common shares at \$9 per share. The subscription contract calls for 40% of the subscription to be paid upon receipt, and the remaining 60\% to be paid on November 30,2024. In the event of default on the subscriptions, the company will retain the down payment. (b) November 30, 2024: Received payment for 76,300 of the subscribed shares; the remaining 4,700 defaulted. Issued the share certificates for the appropriate number of shares. (c) January 1, 2025: Issued 10,400 preferred shares at $40 per share. (d) April 5, 2025: Repurchased and cancelled 20,500 common shares at a cost of $7 per share. (e) August 15, 2025: Declared dividends for preferred shares (dividends had not been paid the previous year). Also declared $3 per share dividend for common shares. Both dividends are to be paid on October 1 to shareholders of record on September 30,2025. (f) If the preferred shares had a $32 par value, what journal entry would be required for the January 1, 2025 transaction in part (c)? Prepare the journal entries to record the above transactions for Waterway Ltd. for 2025 . (Round average share price to 2 decimal places for your calculations, e.g. 52.75 and final answers to 0 decimal places, e.g. 5,275. List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (b) \begin{tabular}{|c|} \hline Cash \\ Common Shares \\ Share Subscriptions Receivable \\ \hline \end{tabular} 412020 (Collection of share subscriptions receivable) Common Shares Subscribed Share Subscriptions Receivable Common Shares (To record forfeit of payment from defaulting subscribers) Common Shares Subscribed Common Shares (To record issuance of shares) (c) Cash 416000 Preferred Shares (d) Treasury Shares Cash (e) \begin{tabular}{||l||} \hline Retained Earnings \\ \hline \end{tabular} Dividends Payable (To record dividend declaration for preferred shares) Cash Dividends-Preferred Cash (To record dividend declaration for common shares) Common Shares Dividends Distributable Cash (To record payment of dividends) (f) Cash Preferred Shares Cash Dividends-Preferred Accounts Payable Accounts Receivable Accumulated Depreciation - Automobiles Accumulated Depreciation - Buildings Accumulated OCl Automobiles Bonds Payable Buildings Cash Cash Dividends-Preferred Common Shares Common Shares Dividends Distributable Common Shares Subscribed Common Stock Dividends Distributable Contributed Surplus Deficit Dividend Receivable Dividend Revenue Dividends Dividends Payable Equipment Furniture and Fixtures FV-NI Investments FV-OCI Investments Gain on Appreciation of Capital Asset Gain on Disposal of Investments FV-OCl Gain on Sale of Investments Income Summary Inventory Investment Income or Loss Investment in Sinking Fund Land legal Expense Loss in Value of Investment Property Machinery No Entry Notes Payable Notes Receivable Preferred Shares Property Dividends Payable Retained Earnings Share Subscriptions Receivable Stock Dividends Stock Dividends Distributable Treasury Shares Unrealized Gain or Loss Unrealized Gain or Loss - OClStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started