Question

Here is a simplified balance sheet for Locust Farming: Locust Farming Balance Sheet ($ in millions) Current assets Long-term assets Total Current liabilities Long-term

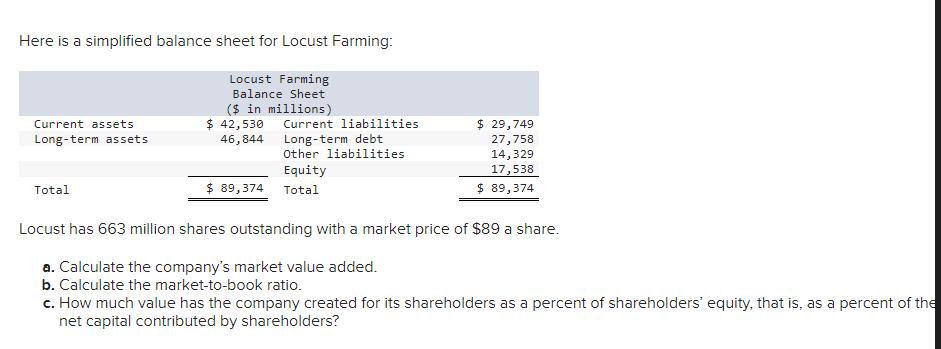

Here is a simplified balance sheet for Locust Farming: Locust Farming Balance Sheet ($ in millions) Current assets Long-term assets Total Current liabilities Long-term debt Other liabilities Equity $ 89,374 Total $ 42,530 46,844 $ 29,749 27,758 14,329 17,538 $ 89,374 Locust has 663 million shares outstanding with a market price of $89 a share. a. Calculate the company's market value added. b. Calculate the market-to-book ratio. c. How much value has the company created for its shareholders as a percent of shareholders' equity, that is, as a percent of the net capital contributed by shareholders?

Step by Step Solution

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a Market Value Added MVA Market Value of the Company Book Value of Equity Market Va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Corporate Finance

Authors: Richard Brealey, Stewart Myers, Alan Marcus

8th edition

77861620, 978-0077861629

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App