Answered step by step

Verified Expert Solution

Question

1 Approved Answer

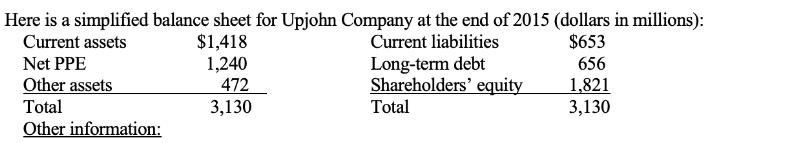

Here is a simplified balance sheet for Upjohn Company at the end of 2015 (dollars in millions): Current assets $1,418 $653 1,240 Current liabilities

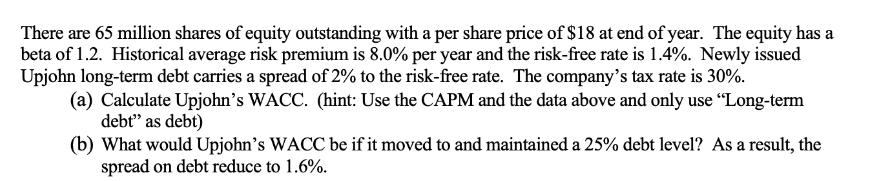

Here is a simplified balance sheet for Upjohn Company at the end of 2015 (dollars in millions): Current assets $1,418 $653 1,240 Current liabilities Long-term debt Shareholders' equity 472 3,130 Total Net PPE Other assets Total Other information: 656 1,821 3,130 There are 65 million shares of equity outstanding with a per share price of $18 at end of year. The equity has a beta of 1.2. Historical average risk premium is 8.0% per year and the risk-free rate is 1.4%. Newly issued Upjohn long-term debt carries a spread of 2% to the risk-free rate. The company's tax rate is 30%. (a) Calculate Upjohn's WACC. (hint: Use the CAPM and the data above and only use "Long-term debt" as debt) (b) What would Upjohn's WACC be if it moved to and maintained a 25% debt level? As a result, the spread on debt reduce to 1.6%.

Step by Step Solution

★★★★★

3.29 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a WACC Cost of Equity x Equity Cost of Debt x Debt x ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started