Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the following questions about cost of capital estimation: a. Suppose you are estimating the cost of capital for a company in Japan today,

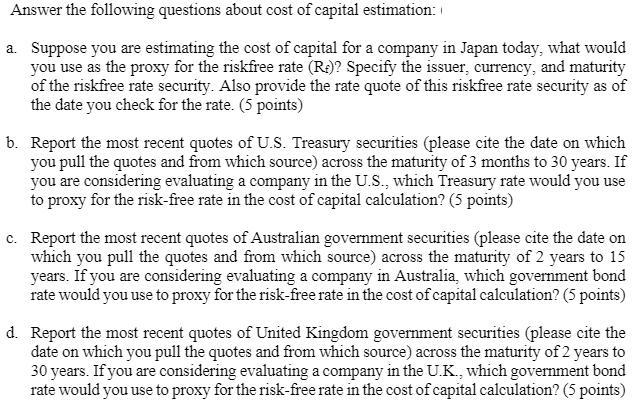

Answer the following questions about cost of capital estimation: a. Suppose you are estimating the cost of capital for a company in Japan today, what would you use as the proxy for the riskfree rate (Re)? Specify the issuer, currency, and maturity of the riskfree rate security. Also provide the rate quote of this riskfree rate security as of the date you check for the rate. (5 points) b. Report the most recent quotes of U.S. Treasury securities (please cite the date on which you pull the quotes and from which source) across the maturity of 3 months to 30 years. If you are considering evaluating a company in the U.S., which Treasury rate would you use to proxy for the risk-free rate in the cost of capital calculation? (5 points) c. Report the most recent quotes of Australian government securities (please cite the date on which you pull the quotes and from which source) across the maturity of 2 years to 15 years. If you are considering evaluating a company in Australia, which government bond rate would you use to proxy for the risk-free rate in the cost of capital calculation? (5 points) d. Report the most recent quotes of United Kingdom government securities (please cite the date on which you pull the quotes and from which source) across the maturity of 2 years to 30 years. If you are considering evaluating a company in the U.K., which government bond rate would you use to proxy for the risk-free rate in the cost of capital calculation? (5 points)

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a The riskfree rate used in the cost of capital calculation for a company in Japan would be the yield on the 10year Japanese government bond As of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started