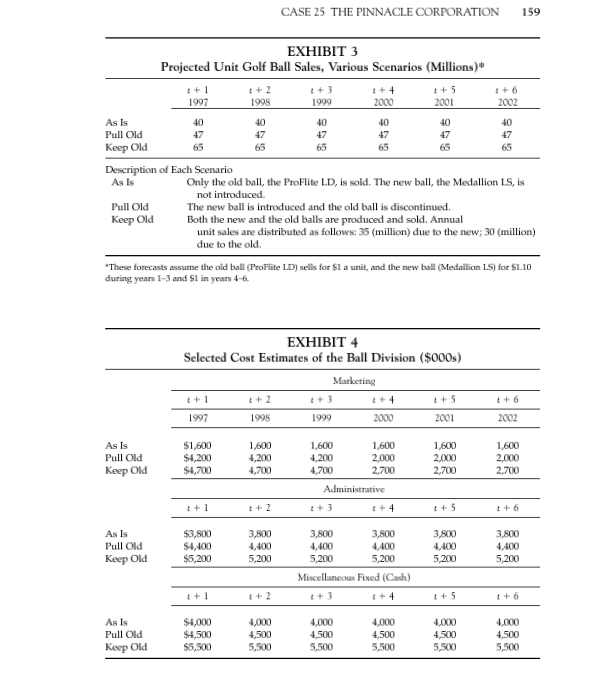

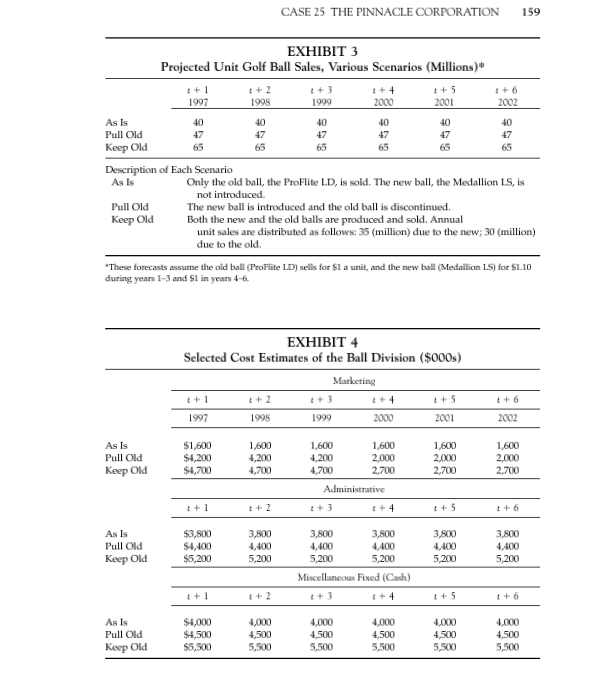

Here is information compiled by the ball division and considered relevant to the analysis.

1. The relevant time horizon is six years.

2. Cost of goods sold will run 60 cents per ball for both the Medallion LS and the ProFlite LD.

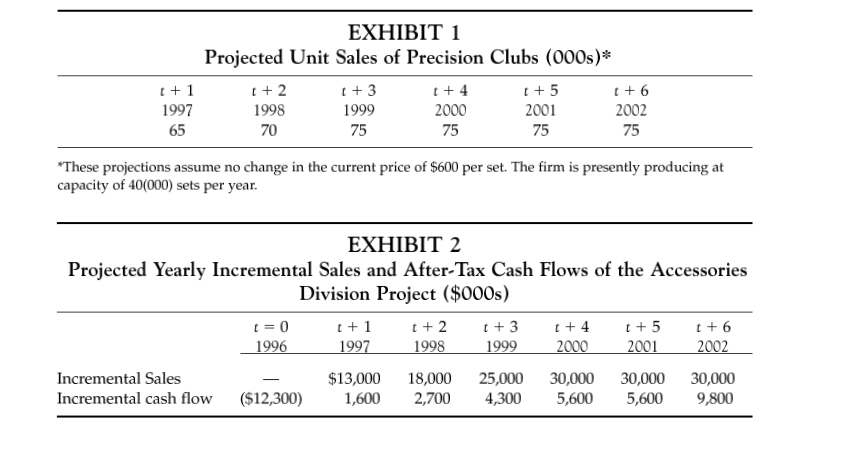

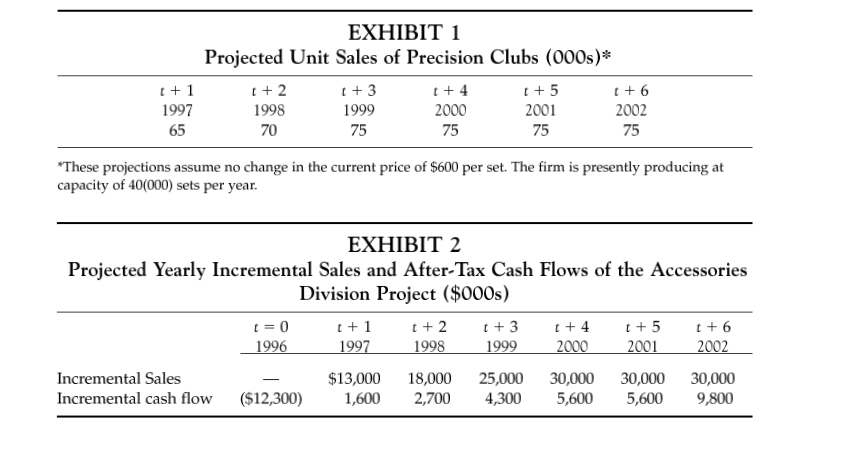

3. (a) The ProFlite LD will be sold for $1 apiece. Division managers believe and top management agreesthe Medallion LS is a "cut above" most balls. The LS, therefore, should sell at a premium until competitors develop a similar ball. A reasonable estimate is that the LS can be sold for $1.10 a unit in years 1-3 and $1 during years 4-6. (b) Annual unit sales of various LS/LD combinations are shown in Exhibit 3. These estimates assume the above prices.

4. Working capital requirements are $0.10 per ball.

5. The appropriate tax rate is 40 percent.

6. Exhibit 4 shows yearly marketing, administrative, and miscellaneous fixed cash expenses for the As Is, Keep Old, and Pull Old options.

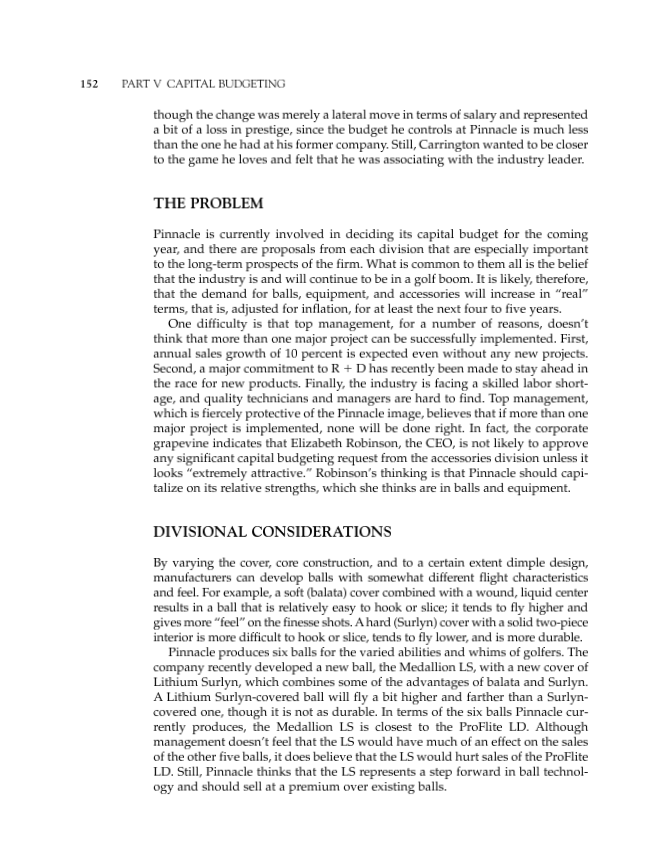

7. (a) The Pull Old alternative will require $4.8 million to redesign and expand existing manufacturing facilities and for the purchase of additional equipment. (b) The Keep Old option will require $15.9 million for new equipment and to expand the firm's manufacturing capacity. NOTE: For purposes of analysis, the expenditures in number 7 are assumed to occur "up front," that is, at time t = 0, and will be depreciated on a straight-line basis over six years, the relevant time horizon of each option.

8. The Keep Old and Pull Old options will require additional land whose mar- ket values are $200(000) and $25(000), respectively. (For tax purposes these amounts are not depreciable.)

9. The after-tax terminal value of Pull Old is $480(000) and Keep Old is $3,180(000). As Is has a negligible terminal value and can be ignored. These estimates do not consider the recapture of any working capital.

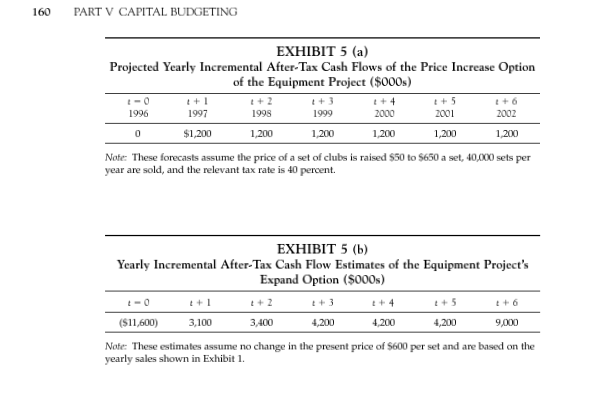

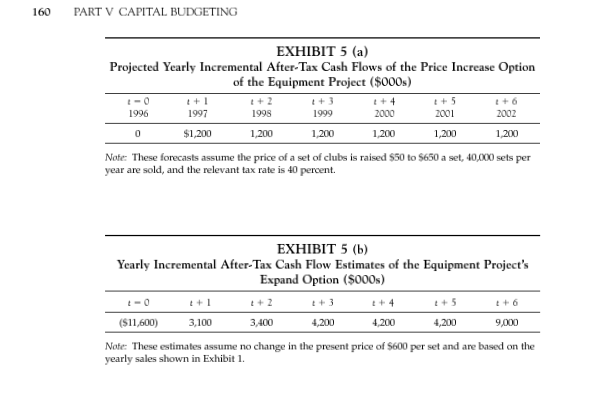

Management is considering two alternatives regarding the equipment deci- sion. One possibility, called Price Increase, is simply to raise the price of its Precision clubs in order to eliminate or at least reduce any excess demand. Management thinks that price can be raised from $600 to at least $650 a set without reducing sales below the present capacity of 40,000 per year. The other option, called Expand, involves leaving the price unchanged and building additional facilities to accommodate the expected demand. If Expand is chosen, then the firm would not pursue either the accessories project or the Keep Old alternative of the ball project. The equipment division has made cash flow esti- mates of Price Increase and Expand. Exhibit 5(a) shows the yearly incremental cash flow estimates for Price Increase assuming a $50 increase in the price CASE 25 THE PINNACLE CORPORATION 155 set of Precision clubs and annual sales of 40,000 sets per year. Exhibit 5(b) gives these estimates for Expand, assuming no change in unit price and the yearly sales shown in Exhibit 1. Management does not believe that projects in each division have the same degree of market risk. Equipment sales are considered to be relatively vulner- able to economic downturns because of their high unit price and because con- sumers can easily postpone their purchase and use their old equipment a little sales are of the lowest risk since they are a necessity for players. Management uses a required return (cost of capital of 11 percent for projects of the ball division, 12 percent for accessories, and 14 percent for equipment projects.

MANAGEMENT OPINION And there is no shortage of opinions among Pinnacle's executives about what should be done. Here is a sample of those views.

Paul McKinney, chemist and head of Pinnacle's research and development department. He favors introducing the new ball since "all the tests show that it really works," but he has no strong opinion about whether the old ball should be discontinued.

Lyle Snead, ex-touring pro and a member of the firm's advisory board. He doesn't have much faith in McKinney's scientific tests but has played the new ball and believes it works. Thinks it will sell.

Jane Sherry, director of communications. Wants either golf ball or equipment production to expand. She believes that any equipment price increase would give the firm "bad press" but could be avoided simply by expanding manu- facturing facilities. And not to introduce the LS "makes little sense if Pinnacle values its reputation as an industry pacesetter."

Warner Covington, senior vice president. Covington is sympathetic to Sherry's position and notes that "some type of expansion will never be cheaper." He points out that the firm has $1 million of excess working capi- tal and owns the land necessary for any expansion. "Thus," observes Covington, "if we expand now we save $1 million of working capital and the land costs us nothing."

Deborah Dresnik, chief of production. Dresnik is very concerned about the managerial and technical bottlenecks of the firm. She wonders (1) if doing any major expansion now would mean foregoing some profitable investment project in the future; and (2) if the accessories proposal represents too much of a shift in the firm's strategic policy. Notes that the Precision clubs are a "proven winner."

Elizabeth Robinson, CEO. She thinks Dresnik has made some good points. Her gut reaction is to increase the price of the Precision equipment and discontinue 156 PART V CAPITAL BUDGETING production of the ProFlite LD, replacing it with the Medallion LS, because these options leave room for possible future investments.

John Knudson, marketing director. He's the only senior manager sympa- thetic to the accessories expansion. He thinks that quality golf shirts and shoes would be "extremely popular," and he favors some option that allows this expansion. He notes that while the accessories division accounts for 5 percent of the firm's sales, it receives less than 2 percent of the advertising and marketing budget. Knudson, therefore, is very sympa- thetic to the theory that the sales of accessories have been hampered by a lack of promotion.

QUESTIONS:

1. (a) What is a firm's strategic policy? How, if at all, does it influence a firm's choice of capital budgeting projects? (b) What is an "unbiased cash flow forecast? Do you find it surprising that studies have found that the actual cash flows of "sales projects" tend to be well below the predicted amounts? Defend your answer.

2. Management uses an 11 percent required return (cost of capital) for projects of the Ball Division, 12 percent for Accessories', and 14 percent for Equipment's projects. Some of Pinnacle's plant managers feel that it is "unfair" to use three different rates. They argue that "we are all part of one firm so all projects should use the same rate." How would you respond to this objection?

3. The yearly cash flow estimates of the Price Increase option (see Exhibit 5a) on the equipment decision ignore any possible working capital require- ts. That is, these estimates assume that no additional working capital is necessary. Is this a reasonable assumption to make? Defend your answer. NOTE: "Working capital" is defined here as A/R + INV - A/P - Accruals.

4. Assuming a discount rate of 12 percent, the NPV of the proposal of the Accessories Division is $6,043(000) (see Exhibit 2 for the yearly cash flow estimates). Write out the equation used to determine this NPV.

5. Assuming a discount rate of 14 percent, the NPV of the Price Increase option of the Equipment Division is $4,666(000) (see Exhibit 5a for the cash flow estimates). Calculate the NPV of the Expand Option using a rate of 14 percent (See Exhibit 5b).

6. The Equipment Division really has another option, which is literally to "Do Nothing (a) It is not necessary to do an NPV to determine that Price Increase is superior to Do Nothing. Why? (b) What, then, is the advantage of doing an NPV on Price Increase?

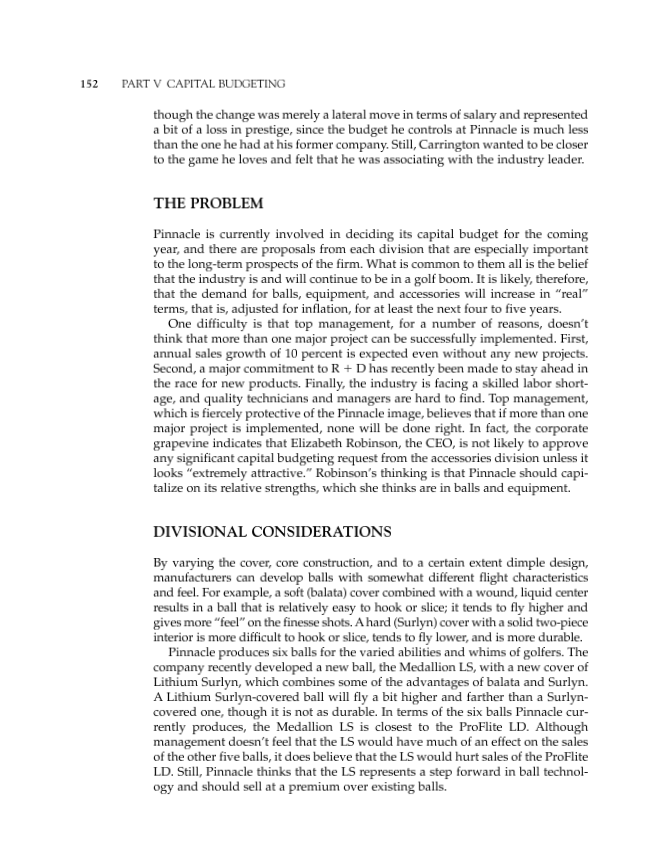

7. (a) Complete the table below, which shows the incremental yearly cash flows (5000s) of the Pull Old option of the Ball Division (use the As Is position as the base from which to calculate these incremental amounts). (b) Calculate the NPV of this project using a discount rate of 11 percent.

8. (a) Calculate the yearly incremental cash flows of the Keep Old alternative of the Ball Division using "As Is" as the base position. (b) Calculate the NPV using a discount rate of 11 percent.

9. Given the managerial and technical bottlenecks that Pinnacle faces, and its apparent desire for "orderly growth," list the firm's capital budgeting "choice set." That is, list the ball/equipment/accessories options open to management.

10. If a project's predicted NPV > 0, the implication is that the firm expects to make an economic profit from the project. (a) What are economic profits? (b) Under what circumstances, if any, can a firm expect to earn economic profits?

11. Play the role of a consultant. Based on your previous answers and other information in the case, how do you think management should proceed? Fully support your position.

CASE 2 5 THE PINNACLE CORPORATION CAPITAL BUDGETING The Pinnacle Corporation manufactures golf balls, clubs, and accessories like golf gloves, bags, shirts, and shoes. In an industry where image is quite impor- tant, the Pinnacle label is synonymous with excellence. Pinnacle was the first company to build a mechanical golfer, which dramatically improved the relia- bility of golf ball and equipment testing. Pinnacle introduced the Surlyn (hard- covered) golf ball and in the early 1970s developed a radically different dimple design, called the icosahedron pattern. It has also been a leader in metal equip- ment and in designing more "forgiving" clubs for the average player. In recent years Pinnacle entered the accessories market, partly to be known as a "full- service" golf manufacturer and partly to be in a position to capitalize on expected growth in this area. The firm is organized by product line and has separate ball, equipment, and accessories divisions. Sales during the most recent fiscal year (1995) were $391 million, broken down by division as follows: ball, $213 million; equipment $157 million; and accessories, $21 million. Thus, the first two areas account for nearly 95 percent of revenue and represent the divisions most consistent with the firm's strategic policy, since Pinnacle sees itself primarily as developing and manufacturing "tools" to assist golfers in their quest for lower scores. Although, it is unfair to say that Pinnacle entered the accessories market as an afterthought, it is appropriate to say that top management doesn't believe the firm has any particular advantage in this area. In fact, until three years ago, the accessories unit was not a separate division but simply a part of the equipment division. Top management felt, however, that this arrangement did not allow accessories to be properly represented in capital budgeting discussions and decisions. The accessories that Pinnacle has marketed, though, have been consistent with the firm's reputation. This has been due mainly to the efforts of George Carrington, an energetic and flamboyant divisional manager with ten years' experience in the clothing industry Carrington took the Pinnacle position even 152 PART V CAPITAL BUDGETING though the change was merely a lateral move in terms of salary and represented a bit of a loss in prestige, since the budget he controls at Pinnacle is much less than the one he had at his former company. Still, Carrington wanted to be closer to the game he loves and felt that he was associating with the industry leader. THE PROBLEM Pinnacle is currently involved in deciding its capital budget for the coming year, and there are proposals from each division that are especially important to the long-term prospects of the firm. What is common to them all is the belief that the industry is and will continue to be in a golf boom. It is likely, therefore, that the demand for balls, equipment, and accessories will increase in "real" terms, that is, adjusted for inflation, for at least the next four to five years. One difficulty is that top management, for a number of reasons, doesn't think that more than one major project can be successfully implemented. First, annual sales growth of 10 percent is expected even without any new projects. Second, a major commitment to R + D has recently been made to stay ahead in the race for new products. Finally, the industry is facing a skilled labor short- age, and quality technicians and managers are hard to find. Top management, which is fiercely protective of the Pinnacle image, believes that if more than one major project is implemented, none will be done right. In fact, the corporate grapevine indicates that Elizabeth Robinson, the CEO, is not likely to approve any significant capital budgeting request from the accessories division unless it looks "extremely attractive." Robinson's thinking is that Pinnacle should capi. talize on its relative strengths, which she thinks are in balls and equipment. DIVISIONAL CONSIDERATIONS By varying the cover, core construction, and to a certain extent dimple design, manufacturers can develop balls with somewhat different flight characteristics and feel. For example, a soft (balata) cover combined with a wound, liquid center results in a ball that is relatively easy to hook or slice; it tends to fly higher and gives more "feel" on the finesse shots. A hard (Surlyn) cover with a solid two-piece interior is more difficult to hook or slice, tends to fly lower, and is more durable. Pinnacle produces six balls for the varied abilities and whims of golfers. The company recently developed a new ball, the Medallion LS, with a new cover of Lithium Surlyn, which combines some of the advantages of balata and Surlyn. A Lithium Surlyn-covered ball will fly a bit higher and farther than a Surlyn- covered one, though it is not as durable. In terms of the six balls Pinnacle cur- rently produces, the Medallion LS is closest to the ProFlite LD. Although management doesn't feel that the LS would have much of an effect on the sales of the other five balls, it does believe that the LS would hurt sales of the ProFlite LD. Still, Pinnacle thinks that the LS represents a step forward in ball technol- ogy and should sell at a premium over existing balls. CASE 25 THE PINNACLE CORPORATION 153 Twelve months ago the firm began manufacturing its Precision line of clubs, which are machine-made from cast iron. Four factors account for their success. First, they have the largest "sweet spot" of any club produced. This means that the ball can be contacted considerably off center and still produce a respectable shot. This characteristic has made Precision clubs especially popular with below-average golfers. Second, the shaft is extremely lightweight, which helps get shots up in the air more easily. Third, though the clubs are machine-made, don't have an "assembly-line" look. Finally, a set sells for $600, about 10 percent under competitive brands. Pinnacle can produce 40,000 sets a year, but annual demand is running at about 65,000 sets. And management feels this demand will continue. Exhibit 1 shows future sales projections assuming no change in the current price of $600. The accessories division is proposing that the production of bags, gloves, shirts, and shoes be expanded. Though no real shortage exists for these items at the present time, divisional managers are convinced that sales have been hurt by the relatively low-key approach Pinnacle has taken in marketing these prod- ucts. Carrington strongly feels that additional promotion, coupled with the pro- jected golf boom, will cause the sales of accessories to more than double in three years and make an expansion of his division "highly attractive." He also argues that this project would result in Pinnacle achieving greater diversification in terms of product sales. Exhibit 2 shows the yearly incremental sales and cash flow estimates that Carrington has submitted to top management. THE OPTIONS The expansion of the accessories division is considered a major project and, for reasons stated, would rule out the Keep Old option of the ball project and the Expand alternative of the equipment project. (These are also considered major projects and are described later.) Pinnacle is considering three options with regard to the golf ball decision. One alternative is simply to continue as is and not introduce the Medallion LS. The second option, called Pull Old, involves producing the LS and taking the ProFlite LD off the market. A third possibility, Keep Old, is to produce both the LS and LD. Everyone involved finds the As Is option distasteful because the LS would not be introduced at all, and it is probably only a few years before a competitor develops a similar ball. Thus, if this option is chosen, Pinnacle would have lost its image as an industry pacesetter. If the ProFlite LD were discontinued (i.e., if Pull Old were selected), the firm's existing manufacturing facilities would have to be redesigned and addi- tional equipment would be required. Still, some increase in production facilities would be needed but not enough to preclude any necessary expansion of the equipment or accessories divisions. However, if Keep Old is selected, then the firm would lack sufficient managerial and technical expertise for any other major expansion. Year t + 5 t=0 1996 (4825) t +1 1997 1900 t + 2 1998 2600 t + 3 1999 2600 t + 4 2000 2001 t + 6 2002 2280 Inc. CF 1100 EXHIBIT 1 Projected Unit Sales of Precision Clubs (000s)* +2 t + 3 [ + 4 (+5 +6 1998 1999 2000 2001 2002 70 75 75 75 75 t + 1 1997 65 *These projections assume no change in the current price of $600 per set. The firm is presently producing at capacity of 40(000) sets per year. EXHIBIT 2 Projected Yearly Incremental Sales and After-Tax Cash Flows of the Accessories Division Project ($000s) [+1 +2 +3 +4 +5 + 6 1996 1997 1998 1999 2000 2001 2002 Incremental Sales - $13,000 18,000 25,000 30,000 30,000 30,000 Incremental cash flow ($12,300 1,600 2,700 4,300 5,600 5,600 9,800 t=0 CASE 25 THE PINNACLE CORPORATION 159 EXHIBIT 3 Projected Unit Golf Ball Sales, Various Scenarios (Millions)* +3 1000 +4 2000 +5 2001 + 6 2002 1902 1995 40 As Is Pull Old Keep Old Description of Each Scenario As Is Only the old ball, the ProFlite LD, is sold. The new ball, the Medallion LS, is not introduced. Pull Old The new ball is introduced and the old ball is discontinued. Keep Old Both the new and the old balls are produced and sold. Annual unit sales are distributed as follows: 35 million) due to the new; 30 million) due to the old. "These forecasts assume the old ball (ProFlute LD) sells for $1 a unit, and the new ball (Medallion 1.5) for $1.10 during years 1-3 and Slin years 4-6 EXHIBIT 4 Selected Cost Estimates of the Ball Division ($000s) +1 1997 +2 1998 Marketing +3 +4 1999 2000 +5 2001 +6 2002 As Is Pull Old Keep Old $1,600 $4,200 $4,700 1,600 4,200 4,700 1,600 4,200 4.700 1,600 2.000 2.700 1,600 2,000 2,700 1,600 2.000 2,700 Administrative +4 +5 ASIS Pull Old Keep Old $3,800 $4,400 $5,200 3,800 4.400 5,2005 3,800 4,400 ,200 3,800 4.400 5,200 3,800 4,400 5,200 3.800 4,400 5,200 Miscellaneous Fixed (Cash) + 4 + 5 +6 As Is Pull Old Keep Old $4,000 $4,500 $5,500 4,000 4,500 5,500 4,000 4,500 5.500 4,000 4,500 5,500 4.000 4,500 5,500 4.000 4,500 5.500 160 PART V CAPITAL BUDGETING EXHIBIT 5 (a) Projected Yearly Incremental After-Tax Cash Flows of the Price Increase Option of the Equipment Project ($000s) 1-0 +1 5 + 6 1996 1997 1998 1999 2000 2001 2002 0 $1,200 1,200 1,200 1,200 1,200 1 ,200 Note: These forecasts assume the price of a set of clubs is raised $50 to $650 a set, 40.000 sets per year are sold, and the relevant tax rate is 40 percent. EXHIBIT 5 (b) Yearly Incremental After-Tax Cash Flow Estimates of the Equipment Project's Expand Option (5000s) 1-0 + 1 + 2 +3 +4 +5 +6 ($11,600) 3,100 3,4004 ,2004 ,2004 ,200 9,000 Note: These estimates assume no change in the present price of $600 per set and are based on the yearly sales shown in Exhibit 1. CASE 2 5 THE PINNACLE CORPORATION CAPITAL BUDGETING The Pinnacle Corporation manufactures golf balls, clubs, and accessories like golf gloves, bags, shirts, and shoes. In an industry where image is quite impor- tant, the Pinnacle label is synonymous with excellence. Pinnacle was the first company to build a mechanical golfer, which dramatically improved the relia- bility of golf ball and equipment testing. Pinnacle introduced the Surlyn (hard- covered) golf ball and in the early 1970s developed a radically different dimple design, called the icosahedron pattern. It has also been a leader in metal equip- ment and in designing more "forgiving" clubs for the average player. In recent years Pinnacle entered the accessories market, partly to be known as a "full- service" golf manufacturer and partly to be in a position to capitalize on expected growth in this area. The firm is organized by product line and has separate ball, equipment, and accessories divisions. Sales during the most recent fiscal year (1995) were $391 million, broken down by division as follows: ball, $213 million; equipment $157 million; and accessories, $21 million. Thus, the first two areas account for nearly 95 percent of revenue and represent the divisions most consistent with the firm's strategic policy, since Pinnacle sees itself primarily as developing and manufacturing "tools" to assist golfers in their quest for lower scores. Although, it is unfair to say that Pinnacle entered the accessories market as an afterthought, it is appropriate to say that top management doesn't believe the firm has any particular advantage in this area. In fact, until three years ago, the accessories unit was not a separate division but simply a part of the equipment division. Top management felt, however, that this arrangement did not allow accessories to be properly represented in capital budgeting discussions and decisions. The accessories that Pinnacle has marketed, though, have been consistent with the firm's reputation. This has been due mainly to the efforts of George Carrington, an energetic and flamboyant divisional manager with ten years' experience in the clothing industry Carrington took the Pinnacle position even 152 PART V CAPITAL BUDGETING though the change was merely a lateral move in terms of salary and represented a bit of a loss in prestige, since the budget he controls at Pinnacle is much less than the one he had at his former company. Still, Carrington wanted to be closer to the game he loves and felt that he was associating with the industry leader. THE PROBLEM Pinnacle is currently involved in deciding its capital budget for the coming year, and there are proposals from each division that are especially important to the long-term prospects of the firm. What is common to them all is the belief that the industry is and will continue to be in a golf boom. It is likely, therefore, that the demand for balls, equipment, and accessories will increase in "real" terms, that is, adjusted for inflation, for at least the next four to five years. One difficulty is that top management, for a number of reasons, doesn't think that more than one major project can be successfully implemented. First, annual sales growth of 10 percent is expected even without any new projects. Second, a major commitment to R + D has recently been made to stay ahead in the race for new products. Finally, the industry is facing a skilled labor short- age, and quality technicians and managers are hard to find. Top management, which is fiercely protective of the Pinnacle image, believes that if more than one major project is implemented, none will be done right. In fact, the corporate grapevine indicates that Elizabeth Robinson, the CEO, is not likely to approve any significant capital budgeting request from the accessories division unless it looks "extremely attractive." Robinson's thinking is that Pinnacle should capi. talize on its relative strengths, which she thinks are in balls and equipment. DIVISIONAL CONSIDERATIONS By varying the cover, core construction, and to a certain extent dimple design, manufacturers can develop balls with somewhat different flight characteristics and feel. For example, a soft (balata) cover combined with a wound, liquid center results in a ball that is relatively easy to hook or slice; it tends to fly higher and gives more "feel" on the finesse shots. A hard (Surlyn) cover with a solid two-piece interior is more difficult to hook or slice, tends to fly lower, and is more durable. Pinnacle produces six balls for the varied abilities and whims of golfers. The company recently developed a new ball, the Medallion LS, with a new cover of Lithium Surlyn, which combines some of the advantages of balata and Surlyn. A Lithium Surlyn-covered ball will fly a bit higher and farther than a Surlyn- covered one, though it is not as durable. In terms of the six balls Pinnacle cur- rently produces, the Medallion LS is closest to the ProFlite LD. Although management doesn't feel that the LS would have much of an effect on the sales of the other five balls, it does believe that the LS would hurt sales of the ProFlite LD. Still, Pinnacle thinks that the LS represents a step forward in ball technol- ogy and should sell at a premium over existing balls. CASE 25 THE PINNACLE CORPORATION 153 Twelve months ago the firm began manufacturing its Precision line of clubs, which are machine-made from cast iron. Four factors account for their success. First, they have the largest "sweet spot" of any club produced. This means that the ball can be contacted considerably off center and still produce a respectable shot. This characteristic has made Precision clubs especially popular with below-average golfers. Second, the shaft is extremely lightweight, which helps get shots up in the air more easily. Third, though the clubs are machine-made, don't have an "assembly-line" look. Finally, a set sells for $600, about 10 percent under competitive brands. Pinnacle can produce 40,000 sets a year, but annual demand is running at about 65,000 sets. And management feels this demand will continue. Exhibit 1 shows future sales projections assuming no change in the current price of $600. The accessories division is proposing that the production of bags, gloves, shirts, and shoes be expanded. Though no real shortage exists for these items at the present time, divisional managers are convinced that sales have been hurt by the relatively low-key approach Pinnacle has taken in marketing these prod- ucts. Carrington strongly feels that additional promotion, coupled with the pro- jected golf boom, will cause the sales of accessories to more than double in three years and make an expansion of his division "highly attractive." He also argues that this project would result in Pinnacle achieving greater diversification in terms of product sales. Exhibit 2 shows the yearly incremental sales and cash flow estimates that Carrington has submitted to top management. THE OPTIONS The expansion of the accessories division is considered a major project and, for reasons stated, would rule out the Keep Old option of the ball project and the Expand alternative of the equipment project. (These are also considered major projects and are described later.) Pinnacle is considering three options with regard to the golf ball decision. One alternative is simply to continue as is and not introduce the Medallion LS. The second option, called Pull Old, involves producing the LS and taking the ProFlite LD off the market. A third possibility, Keep Old, is to produce both the LS and LD. Everyone involved finds the As Is option distasteful because the LS would not be introduced at all, and it is probably only a few years before a competitor develops a similar ball. Thus, if this option is chosen, Pinnacle would have lost its image as an industry pacesetter. If the ProFlite LD were discontinued (i.e., if Pull Old were selected), the firm's existing manufacturing facilities would have to be redesigned and addi- tional equipment would be required. Still, some increase in production facilities would be needed but not enough to preclude any necessary expansion of the equipment or accessories divisions. However, if Keep Old is selected, then the firm would lack sufficient managerial and technical expertise for any other major expansion. Year t + 5 t=0 1996 (4825) t +1 1997 1900 t + 2 1998 2600 t + 3 1999 2600 t + 4 2000 2001 t + 6 2002 2280 Inc. CF 1100 EXHIBIT 1 Projected Unit Sales of Precision Clubs (000s)* +2 t + 3 [ + 4 (+5 +6 1998 1999 2000 2001 2002 70 75 75 75 75 t + 1 1997 65 *These projections assume no change in the current price of $600 per set. The firm is presently producing at capacity of 40(000) sets per year. EXHIBIT 2 Projected Yearly Incremental Sales and After-Tax Cash Flows of the Accessories Division Project ($000s) [+1 +2 +3 +4 +5 + 6 1996 1997 1998 1999 2000 2001 2002 Incremental Sales - $13,000 18,000 25,000 30,000 30,000 30,000 Incremental cash flow ($12,300 1,600 2,700 4,300 5,600 5,600 9,800 t=0 CASE 25 THE PINNACLE CORPORATION 159 EXHIBIT 3 Projected Unit Golf Ball Sales, Various Scenarios (Millions)* +3 1000 +4 2000 +5 2001 + 6 2002 1902 1995 40 As Is Pull Old Keep Old Description of Each Scenario As Is Only the old ball, the ProFlite LD, is sold. The new ball, the Medallion LS, is not introduced. Pull Old The new ball is introduced and the old ball is discontinued. Keep Old Both the new and the old balls are produced and sold. Annual unit sales are distributed as follows: 35 million) due to the new; 30 million) due to the old. "These forecasts assume the old ball (ProFlute LD) sells for $1 a unit, and the new ball (Medallion 1.5) for $1.10 during years 1-3 and Slin years 4-6 EXHIBIT 4 Selected Cost Estimates of the Ball Division ($000s) +1 1997 +2 1998 Marketing +3 +4 1999 2000 +5 2001 +6 2002 As Is Pull Old Keep Old $1,600 $4,200 $4,700 1,600 4,200 4,700 1,600 4,200 4.700 1,600 2.000 2.700 1,600 2,000 2,700 1,600 2.000 2,700 Administrative +4 +5 ASIS Pull Old Keep Old $3,800 $4,400 $5,200 3,800 4.400 5,2005 3,800 4,400 ,200 3,800 4.400 5,200 3,800 4,400 5,200 3.800 4,400 5,200 Miscellaneous Fixed (Cash) + 4 + 5 +6 As Is Pull Old Keep Old $4,000 $4,500 $5,500 4,000 4,500 5,500 4,000 4,500 5.500 4,000 4,500 5,500 4.000 4,500 5,500 4.000 4,500 5.500 160 PART V CAPITAL BUDGETING EXHIBIT 5 (a) Projected Yearly Incremental After-Tax Cash Flows of the Price Increase Option of the Equipment Project ($000s) 1-0 +1 5 + 6 1996 1997 1998 1999 2000 2001 2002 0 $1,200 1,200 1,200 1,200 1,200 1 ,200 Note: These forecasts assume the price of a set of clubs is raised $50 to $650 a set, 40.000 sets per year are sold, and the relevant tax rate is 40 percent. EXHIBIT 5 (b) Yearly Incremental After-Tax Cash Flow Estimates of the Equipment Project's Expand Option (5000s) 1-0 + 1 + 2 +3 +4 +5 +6 ($11,600) 3,100 3,4004 ,2004 ,2004 ,200 9,000 Note: These estimates assume no change in the present price of $600 per set and are based on the yearly sales shown in Exhibit 1